Form Sa100 2020

What is the Form Sa100

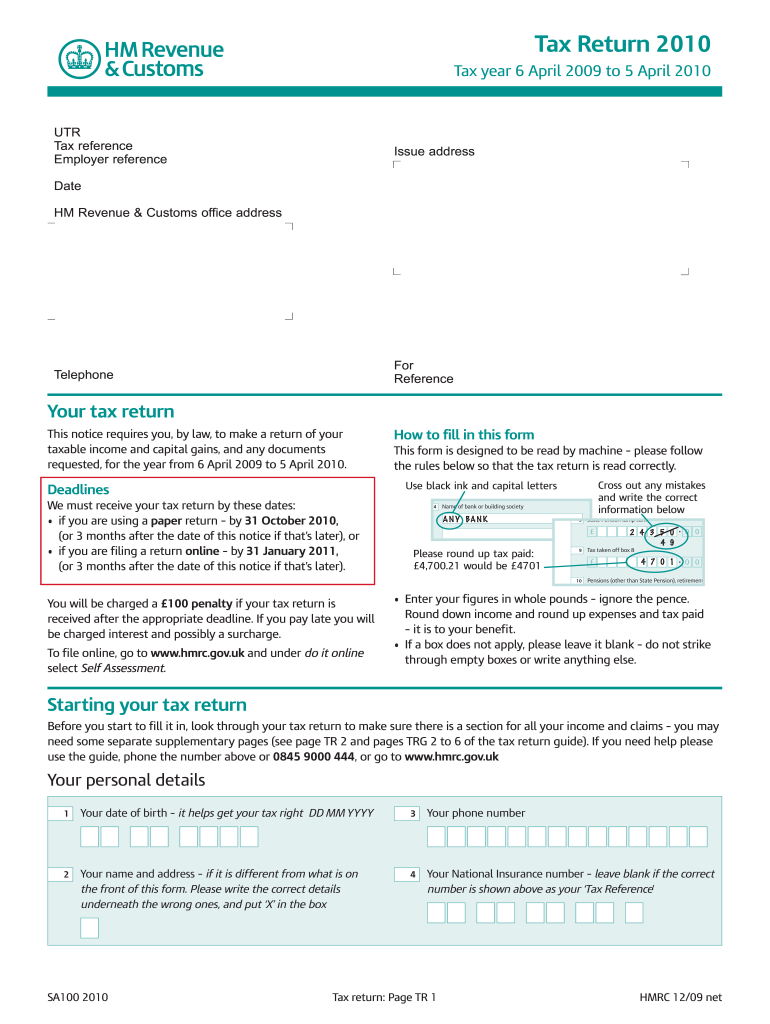

The Form Sa100 is a self-assessment tax return used by individuals in the United States to report their income and calculate their tax liability. This form is essential for those who are self-employed, have additional income sources, or need to declare specific deductions. By completing the Form Sa100, taxpayers ensure compliance with federal tax regulations and provide the IRS with a comprehensive overview of their financial situation for the tax year.

How to use the Form Sa100

Using the Form Sa100 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, expense receipts, and previous tax returns. Next, fill out the form with your personal information, income details, and any applicable deductions. It is crucial to review the completed form for accuracy before submission. Finally, submit the form electronically or by mail to the IRS, ensuring you meet all filing deadlines.

Steps to complete the Form Sa100

Completing the Form Sa100 requires careful attention to detail. Follow these steps:

- Gather all relevant financial records, such as W-2s, 1099s, and expense documentation.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any self-employment income.

- Claim any deductions you are eligible for, such as business expenses or educational credits.

- Calculate your total tax liability based on the provided income and deductions.

- Review the form for accuracy and completeness before submission.

Legal use of the Form Sa100

The Form Sa100 is legally recognized as a valid document for tax reporting purposes when completed accurately and submitted on time. It must adhere to IRS guidelines and regulations to ensure that the information provided is truthful and complete. Failure to comply with these legal requirements may result in penalties or audits by the IRS. Utilizing a reliable eSignature platform can enhance the legal validity of electronically submitted forms.

Filing Deadlines / Important Dates

Filing deadlines for the Form Sa100 are crucial for compliance. Typically, the deadline for submitting the form is April fifteenth of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may need to file, which can be requested through the IRS. Staying informed about these dates helps avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form Sa100 can be submitted using various methods to accommodate different preferences. Taxpayers can file online through the IRS e-filing system, which is often the fastest and most efficient option. Alternatively, the form can be mailed to the appropriate IRS address, depending on the taxpayer's location. In-person submissions are less common but may be available at certain IRS offices. Each method has its own processing times and requirements, so it's important to choose the one that best suits your needs.

Quick guide on how to complete 2010 form sa100

Complete Form Sa100 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form Sa100 on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric workflow today.

The easiest way to modify and electronically sign Form Sa100 without hassle

- Find Form Sa100 and then click Get Form to start.

- Utilize the features we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Sa100 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form sa100

Create this form in 5 minutes!

How to create an eSignature for the 2010 form sa100

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is Form Sa100?

Form Sa100 is the self-assessment tax return that individuals in the UK must submit to report their income and pay tax. With airSlate SignNow, you can easily eSign and send your Form Sa100 securely, ensuring that your tax documents are submitted promptly.

-

How can airSlate SignNow help with Form Sa100 submissions?

airSlate SignNow streamlines the process of filling out and signing your Form Sa100 by providing a user-friendly digital interface. This allows you to complete your form efficiently, reducing the chances of errors and ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form Sa100?

Yes, airSlate SignNow offers various pricing plans, making it affordable for individuals and businesses. Depending on your needs, you can choose a plan that best suits your budget while ensuring you have all the necessary features for handling Form Sa100 and other documents.

-

What features does airSlate SignNow offer for Form Sa100?

airSlate SignNow provides features like eSigning, document templates, and secure cloud storage that simplify the process of managing your Form Sa100. You can also track the status of your documents and set reminders, making it easier to stay organized during tax season.

-

Can I integrate airSlate SignNow with other applications for Form Sa100?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for Form Sa100. You can connect with accounting software and CRM systems to enhance document management and eSigning capabilities.

-

Are my Form Sa100 documents secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your Form Sa100 documents by employing advanced encryption and compliance measures. Your data will always be protected, ensuring that your sensitive tax information remains confidential.

-

How does airSlate SignNow improve efficiency when handling Form Sa100?

Using airSlate SignNow to manage your Form Sa100 increases efficiency due to its automated workflows and easy document sharing capabilities. This allows you to quickly send, sign, and receive your form without the delays that come with traditional paper methods.

Get more for Form Sa100

- Lesson 4 homework practice surface area of prisms form

- Absolute value worksheet pdf with answers form

- Cell phone repair form pdf

- Dpp food journal form

- Load tender template form

- Nis guyana online form

- X x x x factor x x 1 x 4 4 x 1 meaning means 21176639 form

- Fill fillable mis equipment move request form pdf form

Find out other Form Sa100

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document