C1202 Form

What is the C1202?

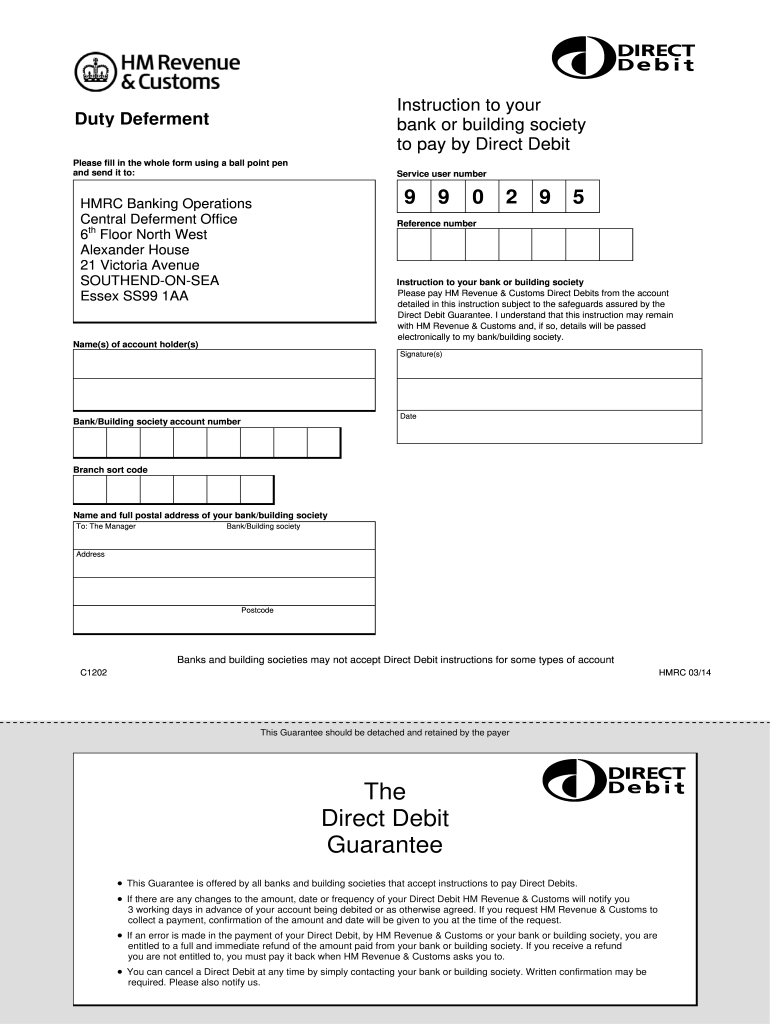

The C1202 form, also known as the C1202 form HMRC, is a document used in the United Kingdom for the deferment of payment of sums due to the Commissioners of HM Revenue and Customs (HMRC). This form is essential for businesses that need to manage their tax liabilities effectively. By submitting the C1202, businesses can request a deferment, allowing them to postpone payment for a specified period, which can help with cash flow management.

How to use the C1202

Using the C1202 form involves several steps to ensure compliance with HMRC regulations. Businesses must fill out the form accurately, providing necessary details such as the type of deferment requested and the reasons for the request. Once completed, the form should be submitted through the appropriate channels, either online or via mail. It is crucial to retain a copy of the submitted form for record-keeping and future reference.

Steps to complete the C1202

Completing the C1202 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business details and tax reference numbers.

- Clearly indicate the deferment period you are requesting.

- Provide a concise explanation for the deferment request.

- Review the form for accuracy before submission.

- Submit the completed form to HMRC through the designated method.

Legal use of the C1202

The C1202 form is legally binding when completed and submitted according to HMRC guidelines. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal repercussions. Businesses should familiarize themselves with the relevant laws governing tax deferment to ensure compliance and avoid issues with HMRC.

Key elements of the C1202

Several key elements are essential for the successful completion of the C1202 form:

- Business Information: Accurate details about the business, including name, address, and tax reference.

- Deferment Request: Clearly stated reasons for requesting the deferment and the specific period requested.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods

The C1202 form can be submitted through various methods, depending on the preferences of the business and the requirements set by HMRC. The available submission methods include:

- Online Submission: Many businesses prefer to submit the C1202 electronically through HMRC's online services.

- Mail: Alternatively, the form can be printed and sent via postal mail to the appropriate HMRC address.

- In-Person Submission: In some cases, businesses may choose to deliver the form in person at designated HMRC offices.

Quick guide on how to complete c1202

Complete C1202 effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle C1202 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The easiest way to modify and eSign C1202 without hassle

- Locate C1202 and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign C1202 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c1202

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the c1202 form pdf and how is it used?

The c1202 form pdf is a specific document required for certain administrative processes. It is typically used for reporting or submitting important information to relevant authorities. Using airSlate SignNow, you can easily create, edit, and eSign the c1202 form pdf securely in just a few clicks.

-

How can I download the c1202 form pdf?

To download the c1202 form pdf, simply access the form through our platform and select the download option. airSlate SignNow provides an easy-to-use interface that ensures you can obtain the c1202 form pdf quickly and efficiently without hassle.

-

Is there a cost associated with using the c1202 form pdf feature?

AirSlate SignNow offers a cost-effective solution for managing your documents, including the c1202 form pdf. Pricing plans vary based on features and user needs, so you can select an option that best fits your budget while still benefiting from all functionalities related to handling the c1202 form pdf.

-

What features does airSlate SignNow offer for managing the c1202 form pdf?

AirSlate SignNow provides several powerful features for managing the c1202 form pdf, including eSigning, document editing, and sharing capabilities. You can also track changes and progress in real-time, ensuring that your process is efficient and streamlined.

-

Can I integrate airSlate SignNow with other applications for the c1202 form pdf?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing your ability to manage the c1202 form pdf. Whether you are using CRM systems or project management tools, these integrations help facilitate a cohesive workflow.

-

How secure is the c1202 form pdf when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The c1202 form pdf, like all documents processed through our platform, is protected with advanced encryption protocols, ensuring that your sensitive information remains confidential and secure during signing and sharing.

-

Can I send the c1202 form pdf to multiple recipients for signature?

Absolutely! With airSlate SignNow, you can easily send the c1202 form pdf to multiple recipients for signature. This simplifies the signing process for teams and ensures that everyone involved can complete their necessary actions in an organized manner.

Get more for C1202

- Resident inventory sheet adult family home 2017 2019 form

- Cowlitz county std case report 2016 2019 form

- Wi form waiver 2015 2019

- Wv application lieap 2016 2019 form

- Solo 401k distribution form pdf use this form to request a distribution from a participant s solo 401k account we recommend

- Borrower assistance application rushmore loan management 471665346 form

- Wells fargo beneficiary form 2019

- Wells fargo beneficiary form 2017

Find out other C1202

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation