Invesco Distribution Form 2017-2026

What is the Invesco Distribution Form

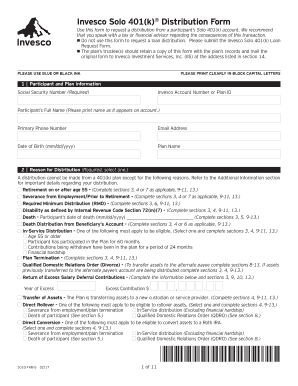

The Invesco Distribution Form is a crucial document used by individuals participating in Invesco's retirement plans, such as the solo 401k. This form facilitates the withdrawal of funds from the retirement account, allowing account holders to access their investments as needed. It is essential for ensuring compliance with IRS regulations and for maintaining accurate records of distributions made from the retirement account.

How to use the Invesco Distribution Form

Using the Invesco Distribution Form involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, fill out the required fields, including personal information and details about the distribution amount. Be sure to specify the type of distribution you are requesting, whether it is a regular withdrawal, hardship distribution, or rollover. Once completed, review the form for accuracy before submitting it according to the instructions provided.

Steps to complete the Invesco Distribution Form

Completing the Invesco Distribution Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from Invesco's official website or customer service.

- Fill in your personal information, including your name, address, and account number.

- Indicate the type of distribution you are requesting.

- Specify the amount you wish to withdraw and provide any necessary documentation supporting your request.

- Sign and date the form to validate your request.

- Submit the form via the specified method, whether online, by mail, or in person.

Legal use of the Invesco Distribution Form

To ensure the legal validity of the Invesco Distribution Form, it is important to adhere to IRS guidelines governing retirement account distributions. This includes understanding the tax implications of withdrawals and ensuring that the form is completed accurately. Using an electronic signature solution like signNow can enhance the security and legality of the submission process, as it complies with relevant regulations such as ESIGN and UETA.

Required Documents

When completing the Invesco Distribution Form, certain documents may be required to support your request. These can include:

- Proof of identity, such as a government-issued ID.

- Documentation of the reason for the distribution, if applicable (e.g., hardship documentation).

- Previous account statements or records, if necessary, to verify account status.

Form Submission Methods

The Invesco Distribution Form can typically be submitted through various methods. Options may include:

- Online submission via Invesco's secure portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at a local Invesco office or authorized representative.

Quick guide on how to complete solo 401k distribution form pdf use this form to request a distribution from a participant s solo 401k account we recommend

The optimal method to obtain and sign Invesco Distribution Form

At the level of an entire organization, ineffective protocols regarding paper approvals can take up a signNow amount of work hours. Endorsing documents like Invesco Distribution Form is a standard component of operations across various sectors, which is why the efficacy of each contract's lifecycle is crucial to the overall performance of the company. With airSlate SignNow, endorsing your Invesco Distribution Form is as straightforward and quick as possible. This platform offers the latest version of virtually any form. Even better, you can sign it right away without needing to install additional software on your computer or printing hard copies.

How to obtain and sign your Invesco Distribution Form

- Browse our collection by category or utilize the search feature to locate the document you require.

- View the form preview by selecting Learn more to ensure it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign tool to endorse your Invesco Distribution Form.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if necessary.

With airSlate SignNow, you possess everything required to handle your paperwork efficiently. You can find, complete, edit, and even transmit your Invesco Distribution Form in a single tab without any complications. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct solo 401k distribution form pdf use this form to request a distribution from a participant s solo 401k account we recommend

Create this form in 5 minutes!

How to create an eSignature for the solo 401k distribution form pdf use this form to request a distribution from a participant s solo 401k account we recommend

How to make an eSignature for the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend online

How to make an electronic signature for the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend in Google Chrome

How to create an electronic signature for putting it on the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend in Gmail

How to make an eSignature for the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend from your mobile device

How to generate an electronic signature for the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend on iOS devices

How to make an eSignature for the Solo 401k Distribution Form Pdf Use This Form To Request A Distribution From A Participant S Solo 401k Account We Recommend on Android

People also ask

-

What is an Invesco Solo 401k and how does it work?

The Invesco Solo 401k is a retirement savings plan designed for self-employed individuals and small business owners. It allows participants to make signNow tax-deferred contributions, grow their investments, and enjoy flexible withdrawal options in retirement. With the Invesco Solo 401k, you can manage your own investments and take charge of your financial future.

-

What are the benefits of using an Invesco Solo 401k?

One of the primary benefits of the Invesco Solo 401k is the high contribution limits, allowing you to save more for retirement compared to traditional IRAs. Additionally, it offers tax advantages, including tax-deferred growth and potential tax deductions. You also gain control over your investment choices, which can include stocks, bonds, and mutual funds.

-

How much does an Invesco Solo 401k cost?

The costs associated with an Invesco Solo 401k can vary depending on the level of service and investment options you choose. Generally, there may be setup fees, maintenance fees, and trading costs associated with managing your account. It's essential to review the fee structure provided by Invesco to understand your total investment expenses.

-

Can the Invesco Solo 401k be integrated with other financial tools?

Yes, the Invesco Solo 401k can be integrated with various financial planning and accounting tools, making it easier for you to manage your retirement savings alongside your business finances. Integration with software applications can streamline contributions, track performance, and simplify tax reporting. Ensure compatibility with your current tools when choosing investment options.

-

What types of investments can I hold in my Invesco Solo 401k?

The Invesco Solo 401k offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. Additionally, you may have the opportunity to invest in alternative assets like real estate or private equity, depending on plan specifications. This flexibility allows you to diversify your portfolio and tailor your investments to your specific financial goals.

-

Is there an age limit to set up an Invesco Solo 401k?

There is no minimum age requirement to set up an Invesco Solo 401k, but you must have earned income from self-employment or a business. Whether you are a young entrepreneur or nearing retirement age, you can take advantage of the benefits offered by this retirement plan. Just be sure to adhere to contribution limits based on your age and income.

-

What happens if I want to withdraw funds from my Invesco Solo 401k?

Withdrawals from an Invesco Solo 401k are subject to specific rules and tax implications. Generally, you can take distributions after signNowing age 59½ without penalties, while early withdrawals may incur taxes and penalties. It's important to consult a financial advisor to understand the consequences and plan your retirement strategy accordingly.

Get more for Invesco Distribution Form

- Public record request form borough of beachwood

- Dyno liability release form

- Schedule d 702367391 form

- Ssvf renewal application u s department of veterans affairs va form

- Wholesale food agreement template form

- Wholesale distribution agreement template form

- Wholesale agreement template form

- Wholesale pricing agreement template form

Find out other Invesco Distribution Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online