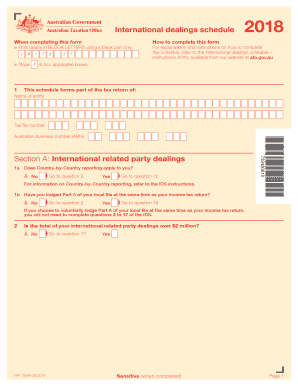

International Dealings Schedule Section a International 2018

What is the International Dealings Schedule Section A International

The International Dealings Schedule Section A International is a specific form used for reporting international transactions and dealings. This form is essential for U.S. taxpayers who engage in transactions with foreign entities or individuals. It provides detailed information about the nature of these dealings, ensuring compliance with U.S. tax laws. By accurately completing this form, taxpayers can report their international financial activities, which may include sales, purchases, or other financial arrangements with foreign parties.

How to use the International Dealings Schedule Section A International

To effectively use the International Dealings Schedule Section A International, begin by gathering all relevant financial documents related to your international transactions. This may include contracts, invoices, and receipts. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the descriptions of the transactions and the involved parties. Once the form is completed, it should be submitted along with your tax return, following the specific filing guidelines provided by the IRS.

Steps to complete the International Dealings Schedule Section A International

Completing the International Dealings Schedule Section A International involves several key steps:

- Gather necessary documentation, such as contracts and financial statements.

- Fill out the identifying information, including your name, taxpayer identification number, and address.

- Detail each international transaction, specifying the type, amount, and parties involved.

- Review the completed form for accuracy and completeness.

- Submit the form with your annual tax return, ensuring it is filed by the deadline.

Legal use of the International Dealings Schedule Section A International

The legal use of the International Dealings Schedule Section A International is governed by U.S. tax regulations. It is crucial for taxpayers to understand that failure to accurately report international transactions can lead to penalties. The form must be completed in accordance with IRS guidelines to ensure that all international dealings are properly disclosed. This compliance helps protect taxpayers from potential legal issues and ensures transparency in international financial activities.

Filing Deadlines / Important Dates

Filing deadlines for the International Dealings Schedule Section A International align with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of each year. However, if you file for an extension, the deadline may be extended to October 15. It is vital to be aware of these dates to avoid late filing penalties and ensure compliance with IRS regulations.

Examples of using the International Dealings Schedule Section A International

Examples of using the International Dealings Schedule Section A International include various scenarios where U.S. taxpayers engage in international transactions. For instance, a business that imports goods from a foreign supplier would need to report these transactions on the form. Similarly, an individual who receives income from a foreign investment or property rental must also disclose these dealings. Each example highlights the importance of accurate reporting to maintain compliance with U.S. tax laws.

Quick guide on how to complete international dealings schedule 2018 section a international

Prepare International Dealings Schedule Section A International seamlessly on any device

Online document management has gained traction with enterprises and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without any delays. Manage International Dealings Schedule Section A International across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign International Dealings Schedule Section A International effortlessly

- Find International Dealings Schedule Section A International and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to preserve your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign International Dealings Schedule Section A International and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct international dealings schedule 2018 section a international

Create this form in 5 minutes!

How to create an eSignature for the international dealings schedule 2018 section a international

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the International Dealings Schedule Section A International?

The International Dealings Schedule Section A International is a component that helps businesses accurately report their international transactions. By utilizing this schedule, companies can ensure compliance with regulatory requirements and enhance their financial reporting related to international dealings.

-

How can airSlate SignNow assist with the International Dealings Schedule Section A International?

airSlate SignNow provides a user-friendly platform that streamlines the document management process, making it easier to prepare and submit the International Dealings Schedule Section A International. The solution allows for real-time collaboration and secure electronic signatures, ensuring that all parties can efficiently handle necessary paperwork.

-

What are the pricing options for airSlate SignNow when dealing with the International Dealings Schedule Section A International?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs, including those focused on the International Dealings Schedule Section A International. Potential users can choose from various tiers based on features, user limits, and specific functionalities that best suit their operations.

-

Are there any key features of airSlate SignNow relevant to the International Dealings Schedule Section A International?

Yes, key features of airSlate SignNow relevant to the International Dealings Schedule Section A International include document templates, robust security protocols, and customizable workflows. These features enhance user efficiency and ensure that all transactions meet international standards.

-

What benefits can businesses expect from using airSlate SignNow for the International Dealings Schedule Section A International?

Businesses can expect numerous benefits from using airSlate SignNow for the International Dealings Schedule Section A International, including reduced processing time and elimination of paperwork errors. The platform also facilitates compliance and helps businesses maintain accurate records of their international dealings.

-

Can airSlate SignNow integrate with other systems for the International Dealings Schedule Section A International?

Yes, airSlate SignNow offers integration capabilities with various software systems, allowing for seamless handling of the International Dealings Schedule Section A International. This feature helps businesses sync data across platforms, improving overall efficiency and data accuracy.

-

Is airSlate SignNow secure for managing the International Dealings Schedule Section A International?

Absolutely, airSlate SignNow employs advanced security measures, including data encryption and secure access controls, to safeguard the International Dealings Schedule Section A International. This ensures that sensitive business information is protected throughout the document signing process.

Get more for International Dealings Schedule Section A International

- 16 bhp oh provider adjust form 2015 7 15indd

- Missouri medicaid pharmacy help desk 2015 2019 form

- 4501 dhsr hcpr form 2014 2019

- Dss 2435r dhhs nc department of health and human services form

- Blackafrican american native hawaiianother pacic islander form

- Ccap review north dakota 2016 2019 form

- Sfn 960 2015 2019 form

- Cm 011 confidential cover sheet false claims action judicial council forms

Find out other International Dealings Schedule Section A International

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself