Bc Ifta Form 2018

What is the BC IFTA Form

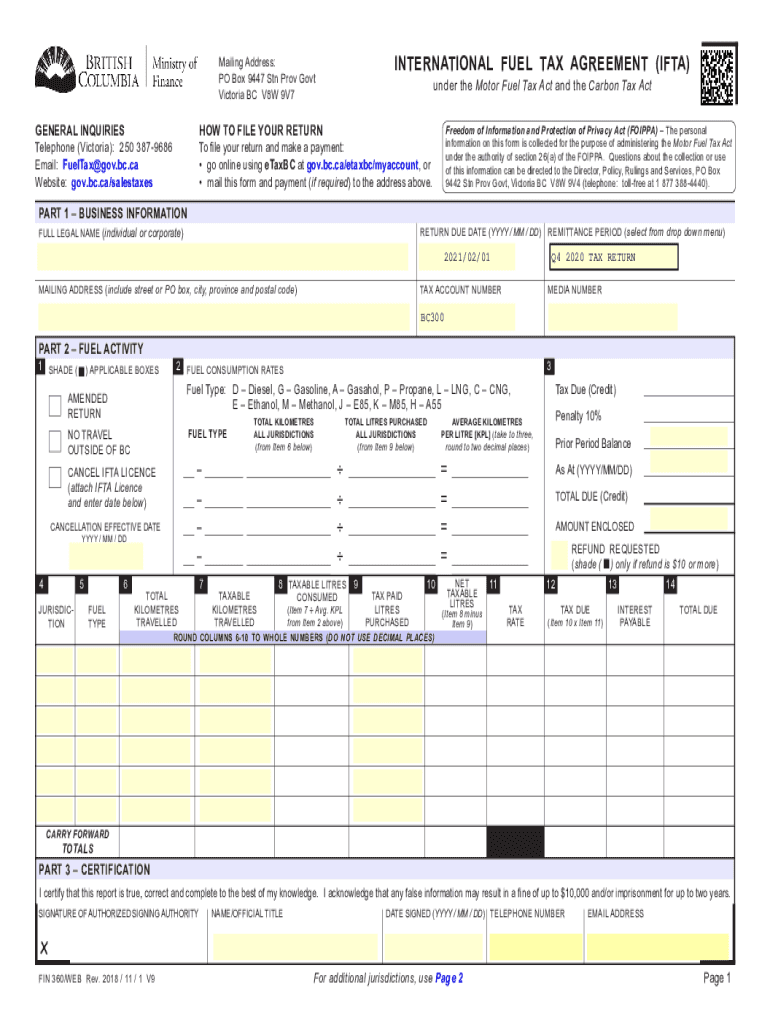

The BC IFTA form, also known as the British Columbia International Fuel Tax Agreement form, is a crucial document for commercial vehicle operators who travel across multiple jurisdictions in Canada and the United States. This form is used to report fuel consumption and calculate the taxes owed to various jurisdictions based on the miles driven and fuel purchased. The IFTA framework simplifies the process of fuel tax reporting for interstate and international travel, ensuring compliance with tax regulations while promoting fair taxation among provinces and states.

How to Use the BC IFTA Form

Using the BC IFTA form involves several steps to ensure accurate reporting of fuel usage and mileage. First, gather all relevant data, including the total miles driven in each jurisdiction and the amount of fuel purchased. Next, complete the form by entering the required information in the designated fields, ensuring that all calculations are accurate. After filling out the form, review it for completeness and accuracy before submission. The form can be submitted online or via mail, depending on the preferred method of filing.

Steps to Complete the BC IFTA Form

Completing the BC IFTA form involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Gather necessary documents, including fuel purchase receipts and mileage logs.

- Calculate the total miles driven in each jurisdiction and the total fuel consumed.

- Fill out the form, entering the calculated figures in the appropriate sections.

- Double-check all entries for accuracy, ensuring that calculations are correct.

- Submit the completed form by the specified deadline, either online or by mail.

Legal Use of the BC IFTA Form

The legal use of the BC IFTA form is governed by the International Fuel Tax Agreement, which establishes the framework for fuel tax reporting across participating jurisdictions. To ensure that the form is legally valid, it must be completed accurately and submitted on time. Non-compliance with IFTA regulations can result in penalties, including fines and audits. Therefore, it is essential for operators to understand their obligations under the agreement and maintain accurate records of fuel purchases and mileage.

Filing Deadlines / Important Dates

Filing deadlines for the BC IFTA form are critical for maintaining compliance and avoiding penalties. Typically, the form must be filed quarterly, with specific due dates for each quarter. Operators should keep track of these deadlines to ensure timely submissions. Missing a deadline can lead to fines and additional scrutiny from tax authorities, so it is advisable to set reminders and prepare the form well in advance of the due date.

Required Documents

To complete the BC IFTA form accurately, certain documents are required. These include:

- Fuel purchase receipts detailing the amount and type of fuel bought.

- Mileage logs that record the distance traveled in each jurisdiction.

- Previous IFTA filings for reference and accuracy in reporting.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure compliance with IFTA regulations.

Quick guide on how to complete bc ifta form

Complete Bc Ifta Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Bc Ifta Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Bc Ifta Form effortlessly

- Find Bc Ifta Form and click Get Form to begin.

- Make use of the features we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to share your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Modify and eSign Bc Ifta Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bc ifta form

Create this form in 5 minutes!

How to create an eSignature for the bc ifta form

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the bc fin 360 form and how does it work with airSlate SignNow?

The bc fin 360 form is a crucial document used for business financing in British Columbia. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining the process of obtaining necessary approvals. Our platform simplifies documentation, ensuring that your bc fin 360 form is securely processed and easily accessible.

-

How can I send a bc fin 360 form through airSlate SignNow?

To send a bc fin 360 form using airSlate SignNow, simply upload the document to your account, add the necessary recipients, and customize the signing order. After you finalize the settings, click 'Send,' and your recipients will receive an email notification to eSign the document. This process ensures a smooth and efficient workflow.

-

Are there any costs associated with using airSlate SignNow for the bc fin 360 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including plans specifically designed for handling documents like the bc fin 360 form. Pricing is based on features, storage, and the number of users. We recommend reviewing our pricing page to find the best option for your business.

-

What features does airSlate SignNow offer for managing the bc fin 360 form?

AirSlate SignNow provides numerous features to manage your bc fin 360 form efficiently, such as customizable templates, bulk sending, real-time tracking, and automated reminders. Additionally, you can integrate signature fields and add comments to streamline collaboration. These features enhance user experience and document management.

-

What are the benefits of using airSlate SignNow for the bc fin 360 form?

Using airSlate SignNow for the bc fin 360 form allows for faster processing and enhanced security. The platform ensures your documents are protected with encryption while offering an intuitive interface for all users. Additionally, our eSigning capabilities reduce the turnaround time signNowly compared to traditional methods.

-

Can I integrate airSlate SignNow with other applications for the bc fin 360 form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications such as Google Drive, Salesforce, and Microsoft Office. This integration allows you to manage your workflows involving the bc fin 360 form more efficiently. By connecting your tools, you can reduce redundancy and enhance productivity.

-

Is customer support available for issues related to the bc fin 360 form?

Absolutely! AirSlate SignNow offers dedicated customer support to help resolve any issues related to your bc fin 360 form or general usage of the platform. Support is available via email, live chat, and phone, ensuring you have the assistance you need to manage your documents effectively.

Get more for Bc Ifta Form

- Publication 5428 5 2020 fact sheet for spec partners form

- Publication 5411 rev 7 2020 retirement plans reporting and disclosure requirements form

- Publication 5257 en sp rev 8 2020 you may need to renew your expiring itin form

- Form 886 h hoh sp rev 10 2019 supporting documents to prove head of household filing status spanish version

- Publication 4591 rev 10 2018 internal revenue service form

- Publication 963 rev 7 2020 federal state reference guide form

- Publication 5433 sp 7 2020 internal revenue service form

- Form 8971 january 2016 information regarding beneficiariesacquiring property from a decedent

Find out other Bc Ifta Form

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure