5 advantages of electronic signature software for accounting & bookkeeping

The article primarily highlights the advantages of SignNow, an intuitive eSignature solution that seamlessly integrates with your accounting workflows. The solution:

- enables accountants and bookkeepers to digitize their workflows, reducing manual document handling and turnaround times.

- streamlines document creation, signing, tracking, and archiving: all in a single, secure platform.

- lets you have peace of mind, because its digital signatures ensure compliance with laws such as ESIGN, UETA, SOX, and GDPR through encryption, audit logs, and role-based access.

- has a cloud-based storage and audit-ready archives simplify recordkeeping and make audit responses faster and more accurate.

- offers industry-specific features like multi-signature routing, branded templates, and SOC 2 Type II compliance.

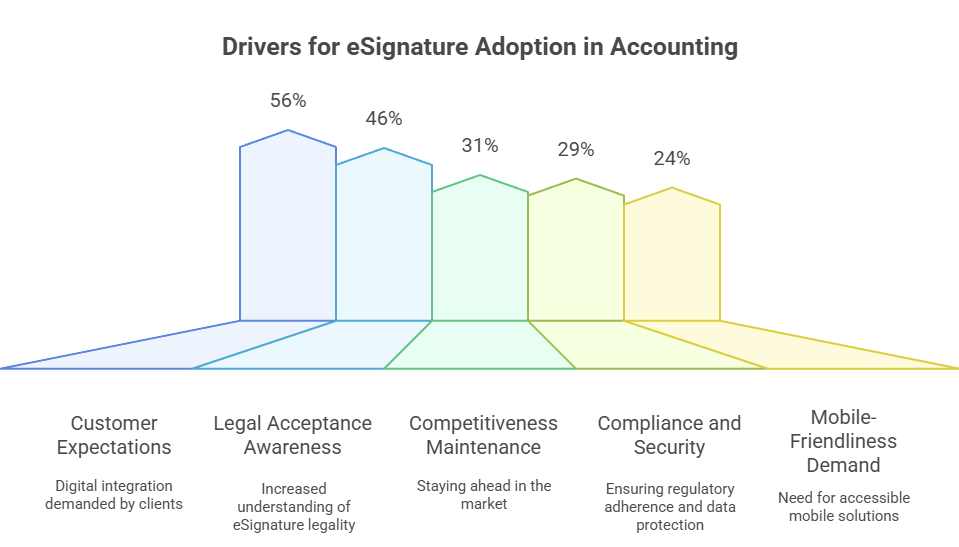

Why accountants are adopting eSignatures

The accounting and bookkeeping industry is increasingly built for scale rather than just manual, localized processes. Cloud-based platforms, automation, and real-time data access have become standard expectations: for example, the U.S. accounting software market was estimated at over USD 6 billion in 2024 and is projected to grow at a compound annual growth rate of 6.3% through 2030.

This shift enables firms to serve more clients or handle larger transaction volumes without a linear increase in staffing or infrastructure. As practices grow, they need tools that support remote collaboration, flexible workflows, and scalable document management.

In that context, eSignature software becomes a critical enabler of scalability: when dozens or hundreds of clients need contracts, engagement letters, authorization forms or audit documents signed, firms cannot rely on paper or manual signatures.

Secure, integrated electronic-signature tools help accelerate onboarding, reduce delays, maintain audit trails, and support mobile/remote work. According to industry commentary, such tools are now considered almost essential for accounting firms handling high document volumes.

The exact reasons for implementing eSignature solutions may differ among businesses, but they are primarily focused on speeding up the document turnaround process and enhancing the customer experience.

Example: A CPA managing multiple clients during tax season can send 50+ signature requests simultaneously via SignNow, track progress in real-time, and receive completed forms without leaving their dashboard.

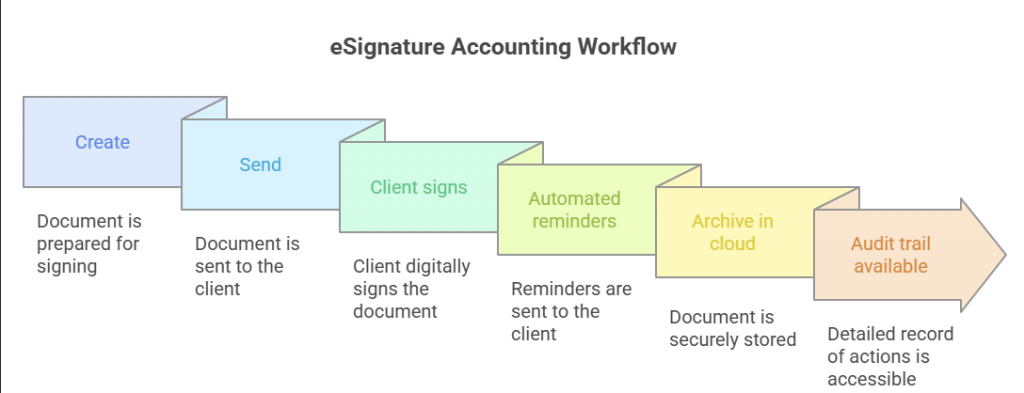

How electronic signature software simplifies accounting workflows

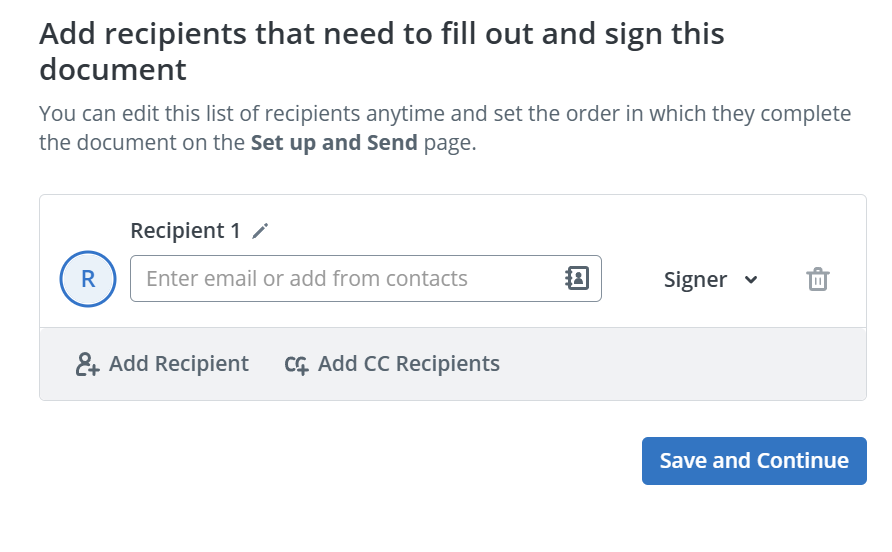

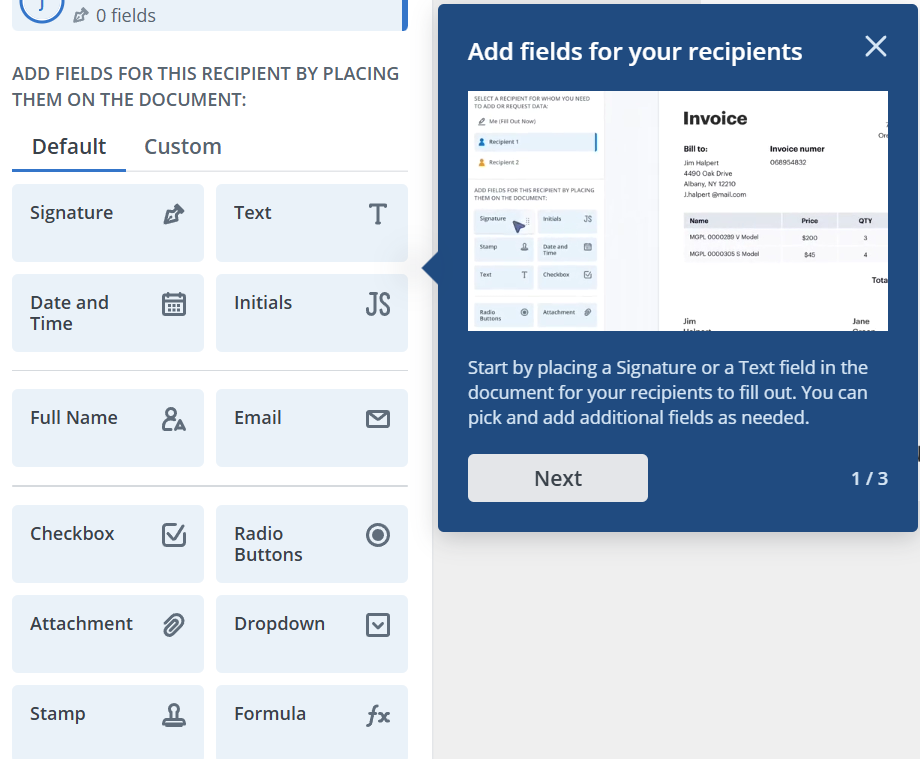

eSignature solutions simplify every stage of document management within an accounting firm. They enable accountants to create, send, sign, and archive critical forms, from engagement letters to IRS authorizations, in a single, streamlined workflow.

Instead of juggling between email threads and document folders, accountants can automate signature collection, significantly reducing follow-ups. This centralized approach enhances both accuracy and visibility across client transactions, which is why it is implemented in financial services and other industries that involve real-time customer interactions.

Key workflow simplifications include:

- Automated reminders for pending signatures

- Template reuse for recurring client forms

- Instant cloud storage for signed documents

- Audit trails for legal and compliance verification

By utilizing SignNow’s templates, role-based signature invitations, payment collection, and other essential features, accountants gain complete control over the document flow while ensuring compliance with financial and legal regulations.

1. Faster client approvals and document turnaround

One of the biggest advantages of adopting eSignature software is the ability to accelerate approval cycles. Accounting professionals often depend on client sign-offs for filings, tax returns, and financial statements. Delays in receiving signatures can hinder project progress and impact compliance timelines.

With eSignature platforms, clients can review and sign documents instantly from any device, eliminating delays caused by scheduling conflicts or the need for physical mail.

Practical Benefits:

- Reduced waiting time: Approvals happen in minutes instead of days.

- Instant notifications: Accountants receive alerts when a document is signed.

- Customizable documents: Add fillable fields to your documents along with the signature field.

This speed enhances both efficiency and client satisfaction, particularly during critical deadlines such as tax season.

2. Improved security and compliance with digital signatures

For accountants handling sensitive financial data, security is non-negotiable. eSignature solutions like SignNow provide advanced encryption and audit trails to ensure document integrity and prevent unauthorized access.

Unlike scanned paper signatures, digital signatures are legally binding under ESIGN and UETA laws, offering verifiable proof of consent and authorship.

Core Security Measures:

- Encrypted storage: All documents are encrypted during transmission and at rest.

- Audit logs: Each signature action is recorded with a timestamp and IP address.

- Access controls: Role-based permissions limit who can view or edit files.

These built-in protections ensure that accountants remain compliant with federal data regulations such as SOX and GDPR, reinforcing client trust in their digital workflows.

3. Streamlined recordkeeping and audit readiness

Accountants need to maintain precise and accessible records to meet audit and retention requirements. eSignature platforms simplify this process by automatically storing all signed documents in organized, searchable repositories.

Instead of maintaining physical filing systems, firms can implement cloud-based storage that allows immediate access to any signed agreement.

Audit-Ready Features:

- Indexed document storage with keyword search

- Downloadable signature certificates

- Version tracking for document updates

- Centralized archives for multi-client records

This approach not only supports compliance but also enables accountants to respond quickly to audit requests, significantly reducing preparation time.

4. Enhanced client experience and remote collaboration

eSignatures enhance the client experience by making document interactions fast, secure, and intuitive. Clients no longer need to print or scan anything. They can review and sign directly from their computer or smartphone.

For accounting firms, this translates into higher client satisfaction and better retention. Remote signing capabilities also allow firms to expand services beyond their local market, accommodating clients across states or countries.

Client collaboration advantages:

- Seamless remote signing for clients anywhere

- Real-time progress tracking and notifications

- Embedded instructions or checklists within documents

- Reduced friction during onboarding and renewals

By leveraging digital signatures, firms project a modern, client-centric image that strengthens their reputation for professionalism and efficiency.

5. Cost and time savings for accounting teams

Paper-based processes come with hidden costs: printing, shipping, filing, and physical storage. eSignature software virtually eliminates these expenses while reclaiming countless administrative hours.

Over time, these savings translate directly into higher profitability and operational scalability.

Cost-saving metrics: traditional document processing vs SignNow

| Process | Traditional | With SignNow | Savings |

| Document delivery | 2–3 days | Instant | 90% time saved |

| Printing & storage | $2–3 per doc | $0 | 100% cost reduction |

| Client follow-ups | Manual emails | Automated reminders | At least 75% effort saved |

By cutting repetitive manual tasks, accountants can focus on delivering advisory services that generate real value.

Integrating eSignatures into accounting software

Integration plays a crucial role in maximizing the value of eSignature software. SignNow offers APIs and native connectors for popular accounting tools. If you want to integrate SignNow into your app, contact the team and get started.

The integration enables seamless data synchronization between accounting entries and signed documents, reducing duplication and improving reporting accuracy.

Integration Possibilities:

- Automatically attach signed engagement letters to client profiles

- Sync invoice approvals with billing systems

- Embed signing workflows directly into client portals

Integrated digital workflows not only improve efficiency but also ensure that accountants maintain a single source of truth across their financial ecosystem.

Why SignNow fits accounting professionals best

SignNow is designed with simplicity and scalability in mind, making it ideal for accounting firms of any size. Its intuitive interface, compliance certifications, and flexible API support a range of use cases, from tax form authorization to audit confirmations.

Unlike generic eSignature tools, SignNow provides granular user controls, reusable templates, and team-based analytics tailored for business operations.

Highlights for Accountants:

- ESIGN and SOC 2 Type II compliant

- Multi-signature routing with automated reminders

- Cloud storage and integration with accounting suites

- Branded templates for consistent client communication

The result is a solution that combines security, efficiency, and professional polish, essential for modern accounting practices.

The future of digital workflows in accounting

The accounting industry is undergoing a decisive shift toward full digital transformation. eSignatures are just one part of a broader trend that includes AI-powered auditing, automated reporting, and secure cloud collaboration.

Companies adopting these tools early gain a competitive edge, both in service delivery and client retention.

Predicted Trends:

- Greater use of blockchain for verification

- Expansion of mobile-first accounting workflows

- Integration of eSignatures into tax and compliance platforms

- Shift toward paperless audits and digital attestations

In the future, digital signatures will not just be a convenience. They’ll be a compliance necessity. For forward-thinking accountants, now is the time to standardize on a reliable platform.

Sign up for a SignNow free trial to future-proof your document management and client experience!

Glossary

- eSignature (Electronic Signature): A legally binding digital mark indicating a person’s consent to a document, replacing handwritten signatures.

- Digital Transformation: The adoption of digital technologies to improve business processes, enhance customer experiences, and streamline operations.

- Audit Trail: A chronological record showing who signed a document, when, and from where—essential for compliance and verification.

- Encryption: The process of converting data into code to protect it from unauthorized access during transmission and storage.

- ESIGN & UETA: U.S. laws that establish the legal validity of electronic signatures and records.

- SOC 2 Type II Compliance: A certification verifying that a service provider securely manages customer data according to strict standards.

- API (Application Programming Interface): A set of protocols that allow different software systems to communicate and share data seamlessly.

- Cloud Storage: Digital storage accessible via the internet, allowing users to securely save and retrieve documents from anywhere.

FAQ

1. Are electronic signatures legally valid for accounting documents?

Yes, they are. eSignatures are legally recognized under ESIGN and UETA acts in the U.S. SignNow provides verifiable proof of identity, consent, and document integrity. So the signatures are suitable for tax forms, contracts, and client authorizations.

2. How does SignNow improve audit readiness?

It automatically organizes and stores all signed documents in searchable, cloud-based repositories. Accountants can instantly access timestamped records and audit logs, drastically reducing audit preparation time.

3. Can small accounting firms benefit from eSignatures?

Even small practices can save substantial time and costs by eliminating paper handling, printing, and mailing. For example, SignNow offers different pricing plans for different business sizes and scales easily as the firm grows.

4. How secure is client data when using eSignature tools?

Modern platforms like SignNow use encryption, role-based access, and detailed audit trails to protect data. These security features comply with strict regulations such as GDPR and SOC 2 standards.

5. How can eSignature software integrate with existing accounting tools?

eSignature platforms offer APIs and pre-built integrations for QuickBooks, Xero, and FreshBooks. This allows automatic syncing of signed documents with financial records, ensuring accuracy and consistency across systems.

- Why accountants are adopting eSignatures

- How electronic signature software simplifies accounting workflows

- 1. Faster client approvals and document turnaround

- 2. Improved security and compliance with digital signatures

- 3. Streamlined recordkeeping and audit readiness

- 4. Enhanced client experience and remote collaboration

- 5. Cost and time savings for accounting teams

- Integrating eSignatures into accounting software

- Why SignNow fits accounting professionals best

- The future of digital workflows in accounting

- Glossary

- FAQ