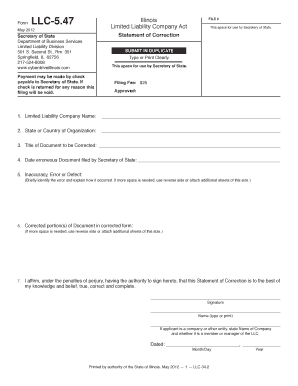

Llc 547 Form 2012

What is the LLC 547 Form

The LLC 547 Form is a tax document used by limited liability companies (LLCs) to report certain information to the Internal Revenue Service (IRS). This form is particularly relevant for LLCs that have chosen to be taxed as a corporation. It provides essential details about the company's financial activities, ownership structure, and tax obligations. Understanding this form is crucial for compliance with federal tax regulations and for maintaining the legal status of the LLC.

Steps to Complete the LLC 547 Form

Completing the LLC 547 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documentation, including income statements and balance sheets. Next, fill in the required sections of the form, providing detailed information about the LLC's income, deductions, and credits. It is important to double-check all entries for accuracy, as errors can lead to delays or penalties. Once completed, the form should be reviewed by a tax professional if possible, before submission to the IRS.

How to Obtain the LLC 547 Form

The LLC 547 Form can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, tax software programs may include the form within their filing tools, allowing for electronic completion and submission. It is advisable to ensure that you are using the most current version of the form, as tax regulations can change annually. If assistance is needed, consulting a tax advisor can provide guidance on obtaining and completing the form correctly.

Legal Use of the LLC 547 Form

The legal use of the LLC 547 Form is essential for compliance with IRS regulations. This form must be filed accurately and on time to avoid penalties. It serves as a formal declaration of the LLC's tax status and financial activities, which can be scrutinized by the IRS during audits. Properly completing and submitting this form helps protect the LLC's legal standing and ensures that all tax obligations are met according to federal law.

Filing Deadlines / Important Dates

Filing deadlines for the LLC 547 Form are crucial to avoid penalties. Generally, the form must be submitted by the 15th day of the third month following the end of the LLC's tax year. For example, if the tax year ends on December 31, the form would be due on March 15 of the following year. It is important to keep track of these dates, as late submissions can result in fines and interest on unpaid taxes. Marking these deadlines on a calendar can help ensure timely filing.

Penalties for Non-Compliance

Failing to file the LLC 547 Form on time or submitting incorrect information can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate quickly. Additionally, improper reporting can trigger audits, resulting in further scrutiny of the LLC's financial records. To mitigate these risks, it is advisable to file the form accurately and on time, and to seek professional assistance if needed.

Quick guide on how to complete llc 547 form

Effortlessly Prepare Llc 547 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary format and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Llc 547 Form from any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

Steps to Modify and eSign Llc 547 Form with Ease

- Obtain Llc 547 Form and then click Get Form to commence.

- Make use of the tools we provide to complete your document.

- Emphasize specific segments of your documents or obscure confidential details with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature utilizing the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all aspects of document management in just a few clicks from any device of your preference. Modify and eSign Llc 547 Form to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct llc 547 form

Create this form in 5 minutes!

How to create an eSignature for the llc 547 form

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the LLC 547 Form used for?

The LLC 547 Form is used for reporting the income, deductions, and credits of a Limited Liability Company treated as a partnership. This form is essential for LLCs to accurately inform the IRS about financial activity and ensure compliance with federal tax regulations.

-

How can airSlate SignNow help with the LLC 547 Form?

airSlate SignNow offers an efficient way to prepare, manage, and eSign your LLC 547 Form electronically. Our platform simplifies the process, allowing you to fill out forms easily, store them securely, and share them with partners or accountants seamlessly.

-

What features does airSlate SignNow provide for managing documents like the LLC 547 Form?

With airSlate SignNow, you get features such as customizable templates, cloud storage, and real-time collaboration tools. These features make it easier to manage documents like the LLC 547 Form and provide a more streamlined workflow for your business.

-

Is airSlate SignNow affordable for small businesses needing the LLC 547 Form?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses. Our flexible subscription options ensure that you can access essential eSigning features for managing documents like the LLC 547 Form without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the LLC 547 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the LLC 547 Form alongside other business processes. This integration capability allows for better data synchronization and a more unified operational workflow.

-

What are the benefits of using airSlate SignNow for the LLC 547 Form?

Using airSlate SignNow for the LLC 547 Form offers several benefits, including enhanced security, time savings, and improved accuracy. The electronic signing process eliminates paper clutter and reduces the likelihood of errors that can occur with manual handling.

-

How secure is airSlate SignNow when handling sensitive documents like the LLC 547 Form?

airSlate SignNow prioritizes security through advanced encryption and secure access protocols. This ensures that your LLC 547 Form and other sensitive documents are safeguarded from unauthorized access and potential data bsignNowes.

Get more for Llc 547 Form

Find out other Llc 547 Form

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter