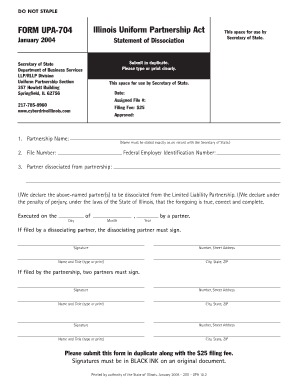

State of Illinois Uniform Partnership Act Tax Forms 2004

What are the State Of Illinois Uniform Partnership Act Tax Forms?

The State Of Illinois Uniform Partnership Act Tax Forms are essential documents used by partnerships operating within Illinois to report their income, deductions, and other relevant tax information. These forms ensure compliance with state tax laws and facilitate accurate tax reporting. Partnerships must file these forms annually to inform the state of their financial activities, which helps determine tax liabilities.

How to use the State Of Illinois Uniform Partnership Act Tax Forms

Using the State Of Illinois Uniform Partnership Act Tax Forms involves several key steps. First, partnerships must gather all necessary financial information, including income, expenses, and deductions. Next, they should accurately fill out the forms, ensuring that all entries are complete and correct. Once the forms are filled out, partnerships can submit them either electronically or via traditional mail. It is crucial to keep copies of submitted forms for record-keeping purposes.

Steps to complete the State Of Illinois Uniform Partnership Act Tax Forms

Completing the State Of Illinois Uniform Partnership Act Tax Forms requires a systematic approach:

- Gather financial records, including income statements and expense reports.

- Obtain the correct version of the tax forms from the Illinois Department of Revenue.

- Carefully fill out each section of the form, ensuring accuracy in reporting all financial data.

- Review the completed forms for any errors or omissions.

- Submit the forms by the designated deadline, either electronically or by mail.

Legal use of the State Of Illinois Uniform Partnership Act Tax Forms

The legal use of the State Of Illinois Uniform Partnership Act Tax Forms is crucial for partnerships to comply with state tax regulations. These forms must be filled out accurately and submitted on time to avoid penalties. Additionally, the information provided in these forms is used by the state to assess tax liabilities and ensure that partnerships are adhering to applicable laws. Proper use of these forms also protects partnerships from potential audits or legal issues related to tax compliance.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines to ensure compliance with state tax laws. Typically, the deadline for submitting the State Of Illinois Uniform Partnership Act Tax Forms aligns with the federal tax filing deadline, which is usually April fifteenth. Partnerships should be aware of any extensions that may apply and ensure that they file their forms timely to avoid late fees or penalties.

Required Documents

To complete the State Of Illinois Uniform Partnership Act Tax Forms, partnerships need to prepare several documents:

- Financial statements, including profit and loss statements.

- Records of all income and expenses incurred during the tax year.

- Previous year’s tax returns for reference.

- Partnership agreements that outline the distribution of profits and responsibilities.

Who Issues the Form

The State Of Illinois Uniform Partnership Act Tax Forms are issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Illinois. Partnerships can access the forms through the department's official website or by contacting their office directly for assistance.

Quick guide on how to complete state of illinois uniform partnership act tax forms 2004

Complete State Of Illinois Uniform Partnership Act Tax Forms seamlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without any hold-ups. Manage State Of Illinois Uniform Partnership Act Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign State Of Illinois Uniform Partnership Act Tax Forms effortlessly

- Obtain State Of Illinois Uniform Partnership Act Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign State Of Illinois Uniform Partnership Act Tax Forms and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of illinois uniform partnership act tax forms 2004

Create this form in 5 minutes!

How to create an eSignature for the state of illinois uniform partnership act tax forms 2004

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What are the State Of Illinois Uniform Partnership Act Tax Forms?

The State Of Illinois Uniform Partnership Act Tax Forms are essential documents required for partnership businesses operating in Illinois. These forms ensure compliance with state tax laws and are used to report income, losses, and distributions from partnerships. Properly completing these forms is crucial for maintaining good standing with the Illinois tax authorities.

-

How can airSlate SignNow assist with the State Of Illinois Uniform Partnership Act Tax Forms?

airSlate SignNow provides a seamless platform for completing and eSigning the State Of Illinois Uniform Partnership Act Tax Forms. With our user-friendly interface, you can quickly fill out, review, and sign these important documents online. This not only saves time but also ensures that your forms are submitted promptly and accurately.

-

Are there any additional fees associated with using airSlate SignNow for the State Of Illinois Uniform Partnership Act Tax Forms?

airSlate SignNow offers transparent pricing with no hidden fees, making it a cost-effective option for managing the State Of Illinois Uniform Partnership Act Tax Forms. You can choose from various subscription plans that fit your business needs. Our pricing covers all necessary features to eSign and store your documents securely.

-

What features does airSlate SignNow offer for eSigning State Of Illinois Uniform Partnership Act Tax Forms?

Our platform offers features such as customizable templates, automated reminders, and secure cloud storage for your State Of Illinois Uniform Partnership Act Tax Forms. You can also track the signing process in real-time, ensuring that all parties are informed and engaged. Additionally, we prioritize security to protect your sensitive information.

-

Is airSlate SignNow compatible with other software for handling State Of Illinois Uniform Partnership Act Tax Forms?

Yes, airSlate SignNow fully integrates with various accounting and document management systems, enhancing your workflow for handling State Of Illinois Uniform Partnership Act Tax Forms. This interoperability allows for easier data transfer and document synchronization across platforms. You can streamline your business processes by connecting the tools you already use.

-

What are the benefits of using airSlate SignNow for State Of Illinois Uniform Partnership Act Tax Forms?

Using airSlate SignNow for your State Of Illinois Uniform Partnership Act Tax Forms offers numerous benefits, including time savings, improved accuracy, and enhanced document security. Our platform reduces the risk of errors by providing a clear, structured environment for form completion. Plus, the electronic nature of the eSigning process speeds up approvals and submissions.

-

Can I access my State Of Illinois Uniform Partnership Act Tax Forms from any device?

Absolutely! airSlate SignNow is designed to be accessible from any device—whether it's a computer, tablet, or smartphone. This flexibility allows you to manage your State Of Illinois Uniform Partnership Act Tax Forms on the go. You can complete, sign, and send documents anytime, ensuring that you never miss an important deadline.

Get more for State Of Illinois Uniform Partnership Act Tax Forms

- Blue cross blue shield il employer login form

- Consent for procedures and transfusions university of kentucky uky form

- Fax signed forms to aetna better health of kentucky at 1 855 799 2550

- Map 351 assessment form

- Large group employee and individual application and enrollment form the offering companyies listed below severally or

- Map 10 kentucky cabinet for health and family services form

- Abc employee enrollment bformb agent link

- Progress payment form

Find out other State Of Illinois Uniform Partnership Act Tax Forms

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate