Oklahoma Seller Financing Form

What is the Oklahoma Seller Financing

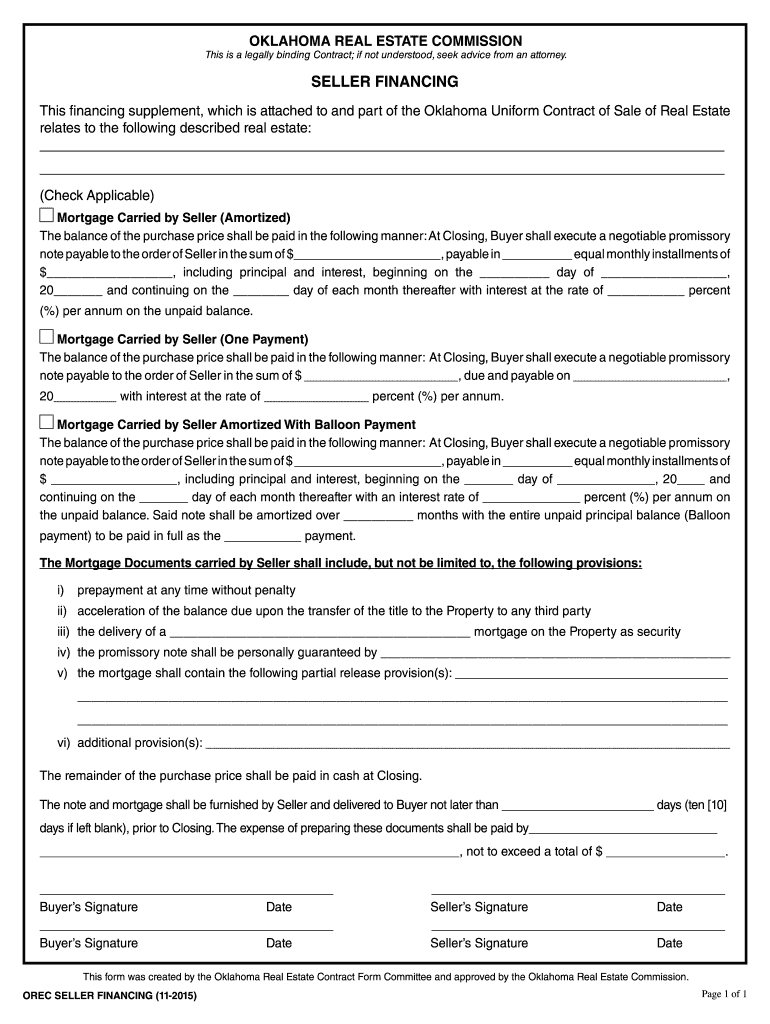

The Oklahoma seller financing arrangement allows property sellers to provide financing directly to buyers, enabling them to purchase real estate without relying on traditional lenders. This method can be beneficial for both parties, as it often results in more flexible terms and quicker transactions. In this arrangement, the seller acts as the lender, and the buyer agrees to repay the loan over a specified period, typically with interest. Understanding the specifics of Oklahoma seller financing is essential for both buyers and sellers to ensure compliance with state regulations and to protect their interests.

How to use the Oklahoma Seller Financing

Using Oklahoma seller financing involves several steps that both the seller and buyer must follow to ensure a smooth transaction. First, the seller and buyer should agree on the terms of the financing, including the purchase price, interest rate, repayment schedule, and any other conditions. Next, it is advisable to draft a seller financing agreement, which outlines all agreed-upon terms and protects both parties legally. This document should be signed by both parties and can be facilitated through electronic signature solutions for convenience. It is also important to record the agreement with the local county clerk to establish legal rights to the property.

Key elements of the Oklahoma Seller Financing

When entering into a seller financing agreement in Oklahoma, several key elements must be included to ensure clarity and legal validity. These elements typically include:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount paid upfront by the buyer.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Repayment Schedule: The timeline for payments, detailing when they are due and the amount of each payment.

- Default Terms: Conditions under which the seller can take action if the buyer fails to make payments.

Including these elements in the seller financing agreement helps protect both the seller's and buyer's interests and ensures compliance with Oklahoma laws.

Steps to complete the Oklahoma Seller Financing

Completing the Oklahoma seller financing process involves several essential steps. First, both parties should negotiate and agree on the financing terms. Once an agreement is reached, the next step is to draft a comprehensive seller financing agreement that includes all key elements. After the agreement is prepared, both parties should review it carefully to ensure it meets their expectations and complies with legal requirements. Once finalized, the agreement should be signed electronically or in person, and it is advisable to have it notarized for added legal protection. Finally, the agreement should be recorded with the appropriate county office to establish the seller's lien on the property.

Legal use of the Oklahoma Seller Financing

The legal use of seller financing in Oklahoma requires adherence to state laws and regulations. Sellers must ensure that their financing agreements comply with the Oklahoma Uniform Commercial Code and any specific real estate laws applicable in the state. Additionally, sellers should be aware of any disclosure requirements, such as providing buyers with information about the terms and conditions of the financing. It is also crucial to understand the implications of the Truth in Lending Act, which may apply to certain seller financing arrangements. Consulting with a legal professional can help ensure that the agreement is legally sound and protects the interests of both parties.

Required Documents

To facilitate the Oklahoma seller financing process, several documents are typically required. These include:

- Seller Financing Agreement: A detailed document outlining the terms of the financing arrangement.

- Property Deed: The official document that transfers ownership of the property from the seller to the buyer.

- Promissory Note: A legal document in which the buyer promises to repay the loan under the agreed terms.

- Disclosure Statements: Documents that provide necessary information about the financing terms and conditions.

Having these documents prepared and organized helps ensure a smooth transaction and protects both parties' rights throughout the seller financing process.

Quick guide on how to complete oklahoma seller financing

Complete Oklahoma Seller Financing seamlessly on any gadget

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the proper form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly and without delays. Handle Oklahoma Seller Financing on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and eSign Oklahoma Seller Financing without any hassle

- Locate Oklahoma Seller Financing and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with instruments that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and bears the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Oklahoma Seller Financing and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma seller financing

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an orec seller?

An orec seller refers to a seller using the airSlate SignNow platform to streamline their document signing process. With airSlate SignNow, orec sellers can easily manage contracts, agreements, and other vital documents electronically, enhancing efficiency and compliance.

-

How can airSlate SignNow benefit an orec seller?

AirSlate SignNow offers orec sellers a user-friendly solution to send and eSign documents quickly. This not only saves time but also reduces costs associated with printing and mailing, enabling orec sellers to focus on closing deals efficiently.

-

What are the pricing options for orec sellers using airSlate SignNow?

AirSlate SignNow provides flexible pricing plans tailored for orec sellers, ensuring affordability while accessing robust features. Depending on requirements, orec sellers can choose from various plans, including a free trial to explore capabilities before committing.

-

What features does airSlate SignNow offer to orec sellers?

For orec sellers, airSlate SignNow includes features such as custom templates, mobile access, and advanced signing options. These functionalities help enhance the signing process, allowing orec sellers to send documents anytime and from anywhere.

-

Are there integrations available for orec sellers using airSlate SignNow?

Yes, airSlate SignNow offers numerous integrations specifically designed for orec sellers. This allows them to seamlessly connect with popular tools like CRMs, cloud storage, and productivity apps, facilitating a more streamlined workflow.

-

Is airSlate SignNow secure for orec sellers?

Absolutely, airSlate SignNow ensures high-level security for orec sellers by employing encryption and compliance with data protection regulations. Orec sellers can trust that their sensitive documents are kept safe during the signing process.

-

Can orec sellers track their documents with airSlate SignNow?

Yes, airSlate SignNow provides a comprehensive tracking feature that allows orec sellers to monitor the status of their documents. This real-time tracking ensures that orec sellers remain informed about when documents are viewed and signed.

Get more for Oklahoma Seller Financing

Find out other Oklahoma Seller Financing

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form