Simple Ira Contribution Form' Keyword Found Websites Listing 2018

What is the Simple IRA Contribution Form?

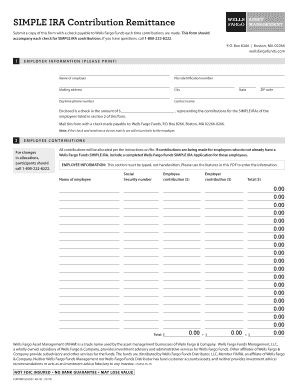

The Simple IRA Contribution Form is a document used by employers and employees to facilitate contributions to a Simple Individual Retirement Account (IRA). This form outlines the specifics of the contribution, including the amount and frequency, and is essential for ensuring compliance with IRS regulations. It is designed to simplify the process of retirement savings for small businesses and their employees, allowing for tax-deferred growth of retirement funds.

How to Use the Simple IRA Contribution Form

Using the Simple IRA Contribution Form involves several straightforward steps. First, gather all necessary information, including the employee's personal details and the contribution amounts. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, submit it to the financial institution managing the Simple IRA. This submission can typically be done online, by mail, or in person, depending on the institution's requirements.

Steps to Complete the Simple IRA Contribution Form

Completing the Simple IRA Contribution Form requires careful attention to detail. Follow these steps:

- Begin by entering the employee's name and contact information.

- Specify the contribution amount, ensuring it aligns with IRS limits.

- Indicate the frequency of contributions, such as monthly or annually.

- Review the form for accuracy, checking all entries.

- Sign and date the form to validate it.

Legal Use of the Simple IRA Contribution Form

The Simple IRA Contribution Form is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, the form must be signed by the employee and submitted to the financial institution managing the Simple IRA. Compliance with IRS regulations is crucial, as improper use of the form can lead to penalties or disqualification of the retirement plan.

IRS Guidelines

The IRS provides specific guidelines regarding contributions to Simple IRAs. These guidelines include annual contribution limits, eligibility criteria for employees, and deadlines for contributions. Employers must ensure that all contributions are made within the specified limits to maintain the tax-advantaged status of the account. Regularly checking IRS publications can help keep employers informed about any changes to these guidelines.

Eligibility Criteria

Eligibility to use the Simple IRA Contribution Form is primarily based on the employee's employment status and the employer's plan. Generally, employees who earned at least $5,000 in any two preceding years and expect to earn at least that amount in the current year are eligible. Employers must also meet certain criteria, such as having a maximum of one hundred employees, to offer a Simple IRA plan.

Form Submission Methods

The Simple IRA Contribution Form can be submitted through various methods, depending on the financial institution's preferences. Common submission methods include:

- Online submission via the institution's secure portal.

- Mailing the completed form to the designated address.

- In-person delivery at a local branch of the financial institution.

Quick guide on how to complete simple ira contribution formquot keyword found websites listing

Effortlessly Prepare Simple Ira Contribution Form' Keyword Found Websites Listing on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Simple Ira Contribution Form' Keyword Found Websites Listing on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Simple Ira Contribution Form' Keyword Found Websites Listing with Ease

- Locate Simple Ira Contribution Form' Keyword Found Websites Listing and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key portions of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Simple Ira Contribution Form' Keyword Found Websites Listing and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct simple ira contribution formquot keyword found websites listing

Create this form in 5 minutes!

How to create an eSignature for the simple ira contribution formquot keyword found websites listing

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Simple Ira Contribution Form and how does it work?

The Simple Ira Contribution Form is a crucial document that allows individuals to contribute to their SIMPLE IRA accounts. This form streamlines the process of making contributions, helping users to efficiently manage their retirement savings. By using airSlate SignNow, you can easily fill out and eSign this form for fast compliance with IRS regulations.

-

What are the pricing options for using the Simple Ira Contribution Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By utilizing the Simple Ira Contribution Form, you can save on administrative costs and enhance your document management process. Check our website for detailed pricing options tailored to your needs.

-

What features does the airSlate SignNow platform provide for the Simple Ira Contribution Form?

The airSlate SignNow platform includes essential features such as customizable templates, electronic signatures, and automated workflows specifically for the Simple Ira Contribution Form. These features help ensure that your documentation is efficient and compliant, allowing for quick processing and approval. Additionally, there's robust tracking functionality to monitor form completion.

-

How can the Simple Ira Contribution Form benefit my business?

Utilizing the Simple Ira Contribution Form can signNowly reduce manual paperwork and streamline your contributions to retirement plans. This not only enhances productivity but also ensures that compliance standards are met efficiently. By integrating with airSlate SignNow, businesses can focus more on growth and less on administrative tasks.

-

Are there any integrations available with the Simple Ira Contribution Form?

Yes, airSlate SignNow offers various integrations with popular tools and software to facilitate seamless use of the Simple Ira Contribution Form. You can integrate with CRMs, accounting software, and storage services to enhance your document management strategy. This flexibility allows for a more cohesive workflow across your business operations.

-

Is it secure to use the Simple Ira Contribution Form on airSlate SignNow?

Absolutely! Security is a top priority at airSlate SignNow. All transactions involving the Simple Ira Contribution Form are encrypted and comply with industry-standard security protocols, ensuring your sensitive information remains protected and confidential throughout the process.

-

Can I track the status of my Simple Ira Contribution Form submissions?

Yes, airSlate SignNow allows you to easily track the status of your Simple Ira Contribution Form submissions in real time. You can see whether the form has been viewed, signed, or completed, giving you peace of mind and letting you follow up efficiently. This feature simplifies communication and enhances accountability.

Get more for Simple Ira Contribution Form' Keyword Found Websites Listing

- Name change in alabamaform to change nameus legal

- Name reservation for domestic entities alabama secretary form

- State of alabama probate court jefferson form

- In re alan l king in his official capacity as judge of probate form

- The alabama historical quarterlyampampquot pdffiller form

- Fill out in black ink only form

- Fillable online alabama request to change name form ps 12

- Page 1 of 2 in the probate court of houston form

Find out other Simple Ira Contribution Form' Keyword Found Websites Listing

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple