Wisconsin Real Estate Transfer Return Form Pe 500a

What is the Wisconsin Real Estate Transfer Return Form PE-500A

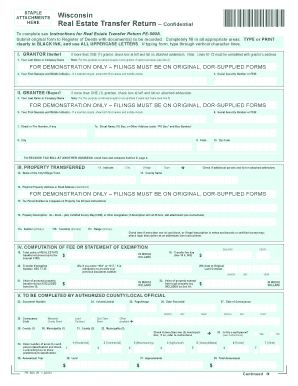

The Wisconsin Real Estate Transfer Return Form PE-500A is a crucial document used in real estate transactions within the state of Wisconsin. This form is required when transferring property ownership and serves to report the sale or transfer of real estate to the state. It collects essential information about the transaction, including the names of the parties involved, the property description, and the sale price. Completing this form accurately is vital for ensuring compliance with state regulations and for the proper assessment of transfer taxes.

How to use the Wisconsin Real Estate Transfer Return Form PE-500A

Using the Wisconsin Real Estate Transfer Return Form PE-500A involves several steps. First, gather all necessary information about the property and the parties involved in the transaction. This includes the legal description of the property, the sale price, and the names and addresses of both the buyer and seller. Next, fill out the form with this information, ensuring that all sections are completed accurately. Once completed, the form must be submitted to the appropriate county register of deeds office, along with any required fees. Utilizing digital tools can simplify this process, allowing for easy completion and submission.

Steps to complete the Wisconsin Real Estate Transfer Return Form PE-500A

Completing the Wisconsin Real Estate Transfer Return Form PE-500A involves a systematic approach:

- Gather necessary information: Collect details about the property, including its legal description and sale price.

- Fill out the form: Enter the required information accurately, ensuring all fields are completed.

- Review the form: Double-check for any errors or omissions to avoid delays in processing.

- Submit the form: Deliver the completed form to the county register of deeds office, either in person or electronically.

By following these steps, individuals can ensure that their real estate transactions are properly documented and compliant with state laws.

Key elements of the Wisconsin Real Estate Transfer Return Form PE-500A

The Wisconsin Real Estate Transfer Return Form PE-500A includes several key elements that are essential for its validity:

- Property Information: This section requires the legal description of the property being transferred.

- Parties Involved: Names and addresses of both the buyer and seller must be clearly stated.

- Sale Price: The total sale price of the property is a critical component for tax assessment.

- Signature: Both parties must sign the form to validate the transaction.

Understanding these elements is important for ensuring the form is filled out correctly and meets all legal requirements.

Form Submission Methods for the Wisconsin Real Estate Transfer Return Form PE-500A

The Wisconsin Real Estate Transfer Return Form PE-500A can be submitted through various methods, providing flexibility for users:

- Online Submission: Many counties allow electronic submission of the form through their official websites.

- Mail Submission: The completed form can be mailed to the appropriate county register of deeds office.

- In-Person Submission: Individuals may choose to deliver the form in person at the county office.

Choosing the right submission method can help streamline the process and ensure timely processing of the transfer.

Quick guide on how to complete wisconsin real estate transfer return form pe 500a

Effortlessly Complete Wisconsin Real Estate Transfer Return Form Pe 500a on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, amend, and eSign your documents rapidly without any hold-ups. Manage Wisconsin Real Estate Transfer Return Form Pe 500a on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Wisconsin Real Estate Transfer Return Form Pe 500a with Ease

- Find Wisconsin Real Estate Transfer Return Form Pe 500a and click Get Form to get started.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your edits.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Wisconsin Real Estate Transfer Return Form Pe 500a to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin real estate transfer return form pe 500a

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Wisconsin real estate transfer return form PE 500A?

The Wisconsin real estate transfer return form PE 500A is a document required for the transfer of real estate ownership in Wisconsin. It is essential for recording property sales and helps ensure that all necessary information is provided to the Wisconsin Department of Revenue for tax purposes.

-

How can airSlate SignNow help with the Wisconsin real estate transfer return form PE 500A?

airSlate SignNow allows users to eSign and manage their Wisconsin real estate transfer return form PE 500A efficiently. You can prepare, send, and track the form seamlessly, ensuring quick completion and compliance with state regulations.

-

Is eSigning the Wisconsin real estate transfer return form PE 500A legally binding?

Yes, eSigning your Wisconsin real estate transfer return form PE 500A through airSlate SignNow is legally binding. Our platform complies with the ESIGN Act and UETA, ensuring that your digital signatures hold the same legal weight as traditional handwritten signatures.

-

What features does airSlate SignNow offer for managing the Wisconsin real estate transfer return form PE 500A?

airSlate SignNow offers features such as customizable templates, real-time tracking, automated workflows, and secure storage. These tools streamline the process of preparing and signing the Wisconsin real estate transfer return form PE 500A, making it easier for users.

-

What are the pricing plans for using airSlate SignNow for the Wisconsin real estate transfer return form PE 500A?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring that you can handle the Wisconsin real estate transfer return form PE 500A and various other documents efficiently.

-

Can airSlate SignNow integrate with other applications for handling the Wisconsin real estate transfer return form PE 500A?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and many others. This allows you to easily access and manage the Wisconsin real estate transfer return form PE 500A alongside your other documents across various platforms.

-

What are the benefits of using airSlate SignNow for my Wisconsin real estate transfer return form PE 500A?

Using airSlate SignNow for your Wisconsin real estate transfer return form PE 500A offers benefits such as enhanced efficiency, reduced turnaround time, and improved document security. The platform also provides access to templates and tools that simplify the overall process.

Get more for Wisconsin Real Estate Transfer Return Form Pe 500a

- Cold war crossword puzzle pdf form

- Scholarship recipient form lifeshare lifeshare

- Ion formation worksheet

- Deletion form

- End of activity coach evaluation form eagle river high school

- Contract for success current studentsdocx rsu form

- Rogers state university educational talent search student rsu form

- Mjc educational plan form

Find out other Wisconsin Real Estate Transfer Return Form Pe 500a

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple