Xpress Credit Loan Application Form PDF 2005-2026

What is the Xpress Credit Loan Application Form PDF

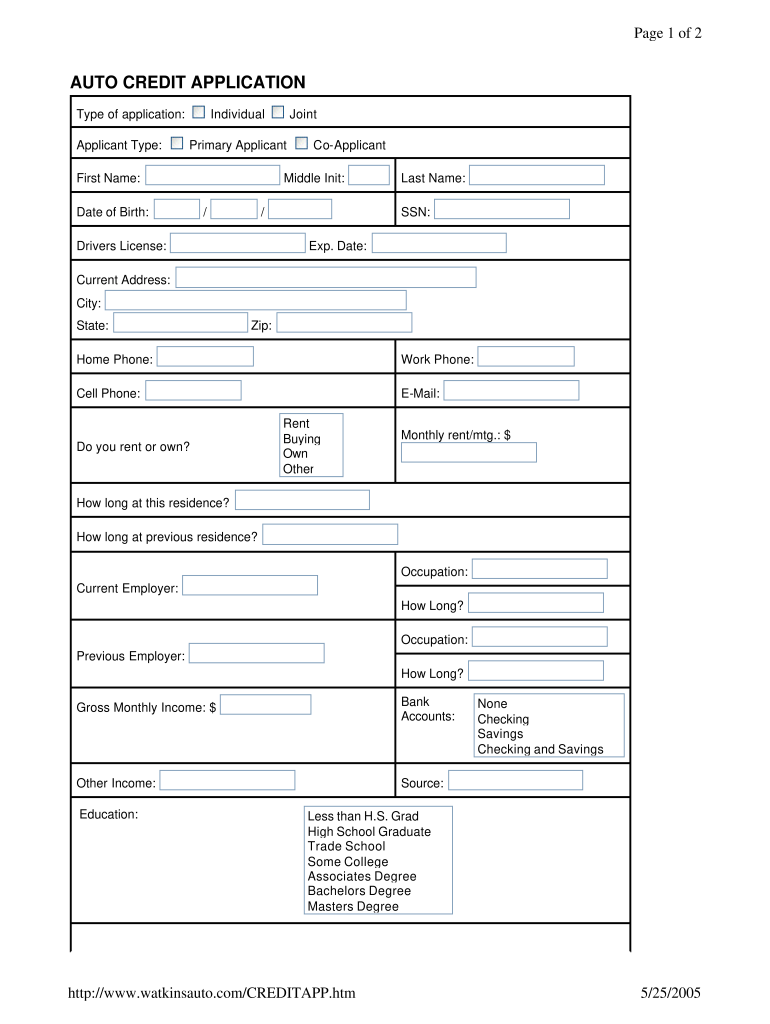

The Xpress Credit Loan Application Form PDF is a standardized document used by individuals seeking to apply for a car loan. This form collects essential information from applicants, including personal details, employment history, financial status, and the specifics of the vehicle being financed. By using this form, lenders can assess the creditworthiness of applicants and determine the terms of the loan. The PDF format ensures that the document is easily accessible and can be filled out digitally or printed for manual completion.

Steps to Complete the Xpress Credit Loan Application Form PDF

Completing the Xpress Credit Loan Application Form involves several straightforward steps:

- Gather necessary information: Collect personal identification, income details, and information about the vehicle you wish to finance.

- Fill out the form: Input your personal details accurately, including your name, address, and Social Security number.

- Provide financial information: Include your employment details, income, and any existing debts to give lenders a complete picture of your financial situation.

- Review the application: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the application: Follow the submission guidelines provided, whether submitting online or by mail.

Key Elements of the Xpress Credit Loan Application Form PDF

The Xpress Credit Loan Application Form PDF includes several key elements that are crucial for the loan approval process:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Monthly income, existing debts, and credit history.

- Vehicle Information: Make, model, year, and purchase price of the vehicle.

- Consent and Signature: A section for the applicant's signature, indicating consent to the terms and conditions of the loan.

Legal Use of the Xpress Credit Loan Application Form PDF

The Xpress Credit Loan Application Form PDF is legally binding once signed by the applicant. It is essential for both the lender and the borrower to understand that the information provided must be truthful and accurate. Misrepresentation or falsification of information can lead to legal consequences, including denial of the loan or potential criminal charges. Lenders are required to comply with federal regulations, ensuring that the application process is fair and transparent.

Form Submission Methods

The Xpress Credit Loan Application can be submitted through various methods, depending on the lender's requirements:

- Online Submission: Many lenders offer a digital platform where applicants can fill out and submit the form electronically.

- Mail Submission: Applicants can print the completed form and send it via postal mail to the lender's designated address.

- In-Person Submission: Some applicants may prefer to submit the form in person at a local branch of the lending institution.

Eligibility Criteria

To qualify for a car loan using the Xpress Credit Loan Application Form, applicants typically need to meet certain eligibility criteria, which may include:

- Age: Applicants must be at least eighteen years old.

- Residency: Proof of U.S. residency is often required.

- Income: A stable source of income to demonstrate the ability to repay the loan.

- Credit History: A satisfactory credit history may be necessary, although some lenders offer options for those with less-than-perfect credit.

Quick guide on how to complete sbi xpress credit loan application form

The simplest method to obtain and endorse Xpress Credit Loan Application Form Pdf

On the scale of a complete organization, ineffective procedures surrounding paper approval can consume considerable work time. Endorsing documents like Xpress Credit Loan Application Form Pdf is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the company’s overall performance. With airSlate SignNow, endorsing your Xpress Credit Loan Application Form Pdf is as straightforward and quick as it can be. You’ll discover on this platform the latest version of almost any form. Even better, you may endorse it right away without needing to install external software on your computer or printing anything as hard copies.

Steps to obtain and endorse your Xpress Credit Loan Application Form Pdf

- Browse our collection by category or utilize the search function to locate the form you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Xpress Credit Loan Application Form Pdf.

- Select the signing option that is most suitable for you: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents effectively. You can find, fill out, amend, and even send your Xpress Credit Loan Application Form Pdf in a single tab with no difficulty. Optimize your workflows with one smart eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it mandatory to take SBI life insurance for taking an SBI Xpress credit loan?

It is not mandatory. Some branches insist on insurance. You can always apply at a different branch that doesn't insist on taking the insurance.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

Can I apply for the SBI PO, if the results of my final year is not yet out?

YES you can, provided when called for interview you have your graduation certificate dated 30.08.2018 or before.

-

How do I fill out the SBI PO form?

How to apply: The online registration starts from the 2nd April and the last date for online registration is 22nd April 2019. Before applying online candidates should arrange all the valid documents such as scanned photo, signature, and valid degree certificate, etc. Candidates should also read the official advertisement for proper guidelines. Simple Online Registration Steps are:First of all, go to the official website of SBI i.e. State Bank of IndiaThen go to the latest announcement section > click on the link “SBI PO recruitment 2019 apply online”.Now, candidates will find then “click here for new registration” if you are a new user option.Now you have to Enter the required details to register online and obtain the Registration ID / Login Access details.Upload the scanned documents and also pay the application fee.Verify the details submitted by candidate and download the application form at finally for future reference.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill in an SBI cheque?

The cheques issued by all commercial banks have the same format as stipulated by Indian Banks AssociationSee the following specimen of one chequeThe cheque has front page and back page. The back page is kept blank enabling the payee and other parties to sign the cheque for the purpose of transfer or for getting payment from the bankerThe name of the bank, branch, address, IFSC code, Account number, cheque number, MICR code etc are already printed in the cheque in the front page.There are pre printed provisions with some open spaces and the drawer has to use such open spaces for filling up the following detailsDate of the cheque - the date on which the cheque is writtenName of the payee - Always write the name close to the printed version - “Pay to” so that fraudsters cannot insert any name or misutilise the cheque in case the cheque comes into their handsAmount in words - Write the amount of the cheque close to the printed version - RupeesAmount in figures - Mention the amount through numerical characters and write the amount close to the rupee symbolEnsure that the amount mentioned in words and figures are one and the same and there is no differenceSign the cheque at the bottom right hand portion of the cheque above the printed name of the drawer (in case printed) and ensure that you sign the cheque as per the signature lodged with the bank at the time of opening bank accounts or subsequentlyNow you had filled up the cheque and the cheque is ready to move in the hands of the payeeEnsure that the details are noted in the acknowledgment portion as provided in your cheque book for your future reference. Otherwise, you may lose track as to whom you had issued the cheque.The cheque is valid for three months and you should keep funds in your account so that the cheque gets paid on presentation and the cheque can be presented at any time during the three months period

Create this form in 5 minutes!

How to create an eSignature for the sbi xpress credit loan application form

How to make an electronic signature for the Sbi Xpress Credit Loan Application Form online

How to make an electronic signature for your Sbi Xpress Credit Loan Application Form in Chrome

How to generate an electronic signature for signing the Sbi Xpress Credit Loan Application Form in Gmail

How to generate an electronic signature for the Sbi Xpress Credit Loan Application Form straight from your mobile device

How to generate an eSignature for the Sbi Xpress Credit Loan Application Form on iOS

How to make an eSignature for the Sbi Xpress Credit Loan Application Form on Android devices

People also ask

-

What is a car loan application in the context of airSlate SignNow?

A car loan application is a document that can be sent and signed electronically using airSlate SignNow. This feature simplifies the process, allowing lenders and buyers to complete the application quickly and securely. With airSlate SignNow, you can easily track and manage your car loan applications throughout the signing process.

-

How does airSlate SignNow enhance the car loan application process?

AirSlate SignNow streamlines the car loan application process by offering an intuitive eSigning platform. Users can fill out and sign documents from any device, minimizing the need for physical paperwork. This efficiency not only speeds up the approval process but also improves customer satisfaction.

-

What are the pricing options for using airSlate SignNow for car loan applications?

AirSlate SignNow offers various pricing plans to suit different business needs when managing car loan applications. Pricing typically varies based on the number of users and features required. It's advisable to visit the airSlate SignNow website to find a plan that aligns with your budget and requirements.

-

Can airSlate SignNow be integrated with other software for car loan applications?

Yes, airSlate SignNow offers integrations with many popular CRM and financial software tools, making it easy to incorporate it into your existing workflows. This allows for a seamless car loan application process that retains data across platforms. Ensure to check the integration options available on the airSlate SignNow site for compatibility.

-

What security features does airSlate SignNow offer for car loan applications?

AirSlate SignNow prioritizes security by utilizing advanced encryption and authentication measures for all car loan applications. Your documents are stored securely, and access can be adjusted based on user roles, ensuring sensitive information is protected. This gives both lenders and borrowers peace of mind during the application process.

-

How can airSlate SignNow help reduce paperwork in the car loan application process?

With airSlate SignNow, you can eliminate the excess paperwork associated with car loan applications by going completely digital. The platform allows for easy document creation, sending, and signing online. This not only saves time but also contributes to a more environmentally friendly approach.

-

What benefits does eSigning offer for car loan applications?

eSigning with airSlate SignNow offers numerous benefits for car loan applications, including faster approvals and improved accuracy. Customers can quickly sign documents from anywhere, which reduces delays caused by mailing physical documents. Overall, eSigning enhances the user experience by providing convenience and efficiency.

Get more for Xpress Credit Loan Application Form Pdf

Find out other Xpress Credit Loan Application Form Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors