Daas 101 Form

What is the Daas 101 Form

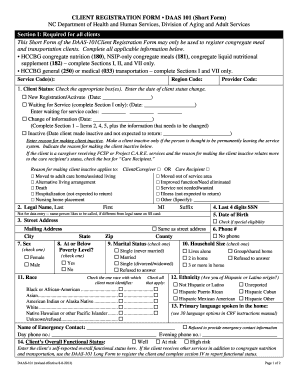

The Daas 101 Form is a specific document used primarily for tax-related purposes in the United States. It is essential for individuals and businesses to accurately report certain financial information to the Internal Revenue Service (IRS). This form may also be utilized for various compliance and regulatory needs, depending on the context in which it is applied. Understanding its purpose is crucial for ensuring proper filing and adherence to tax obligations.

How to use the Daas 101 Form

Using the Daas 101 Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the form. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before submitting it to the appropriate authority. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the Daas 101 Form

Completing the Daas 101 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather required documents, such as identification and financial records.

- Access the form through an authorized source or digital platform.

- Fill in personal information, including name, address, and taxpayer identification number.

- Provide necessary financial details, ensuring accuracy in reporting income and deductions.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or via mail, depending on the submission guidelines.

Legal use of the Daas 101 Form

The legal use of the Daas 101 Form is governed by IRS regulations and guidelines. For the form to be considered valid, it must be filled out accurately and submitted within the designated deadlines. Compliance with federal and state laws is essential to avoid penalties. Additionally, using a reliable eSignature solution can enhance the legal standing of the form, ensuring that it meets all necessary requirements for electronic submissions.

Key elements of the Daas 101 Form

Several key elements must be included in the Daas 101 Form for it to be considered complete and valid. These elements typically include:

- Taxpayer identification information, such as Social Security number or Employer Identification Number.

- Accurate reporting of income and deductions.

- Signature of the taxpayer or authorized representative.

- Date of submission to establish compliance with filing deadlines.

Form Submission Methods

The Daas 101 Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the IRS. Common submission methods include:

- Online submission through authorized e-filing platforms.

- Mailing a physical copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete daas 101 form

Complete Daas 101 Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Daas 101 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Daas 101 Form with ease

- Find Daas 101 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Daas 101 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the daas 101 form

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Daas 101 Form and how does it work?

A Daas 101 Form is a digital document template designed to simplify the data acquisition and signature process. With airSlate SignNow, users can easily create, edit, and send Daas 101 Forms for eSignature, ensuring a smooth workflow. This tool allows businesses to streamline their processes and manage documents efficiently.

-

How can I create a Daas 101 Form using airSlate SignNow?

Creating a Daas 101 Form with airSlate SignNow is simple and intuitive. Users can start by choosing a template, customizing it with necessary fields, and adding signature requests. Once set up, the form can be sent to recipients via email for quick eSigning.

-

What are the pricing options for using airSlate SignNow for Daas 101 Forms?

airSlate SignNow offers several pricing plans, catering to different business needs for managing Daas 101 Forms. You can choose from various packages that include essential features for eSigning and document management. A free trial is also available to explore the platform's capabilities before making a commitment.

-

What features does airSlate SignNow offer for managing Daas 101 Forms?

airSlate SignNow provides a range of features for Daas 101 Forms, including customizable templates, automatic reminders, and real-time tracking. Users can also integrate document workflows and securely store signed forms in the cloud, enhancing overall productivity and security.

-

What are the benefits of using airSlate SignNow for Daas 101 Forms?

Using airSlate SignNow for Daas 101 Forms offers signNow benefits such as increased efficiency, reduced turnaround time, and improved document accuracy. The platform’s user-friendly interface allows for quick adoption by all team members. Additionally, it enhances compliance with legally binding eSignatures.

-

Can I integrate other apps with airSlate SignNow for Daas 101 Forms?

Yes, airSlate SignNow supports integrations with numerous third-party applications. You can seamlessly connect with CRM systems, cloud storage services, and other business tools to enhance the functionality of your Daas 101 Forms. This interoperability helps streamline workflows across different platforms.

-

Is it secure to use airSlate SignNow for eSigning Daas 101 Forms?

Absolutely! airSlate SignNow employs advanced security measures such as encryption and secure storage to protect your Daas 101 Forms. All eSignatures are legally compliant and authenticated, ensuring that your documents remain confidential and safe throughout the signing process.

Get more for Daas 101 Form

Find out other Daas 101 Form

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online