Vat 72 2019-2026

What is the VAT 72?

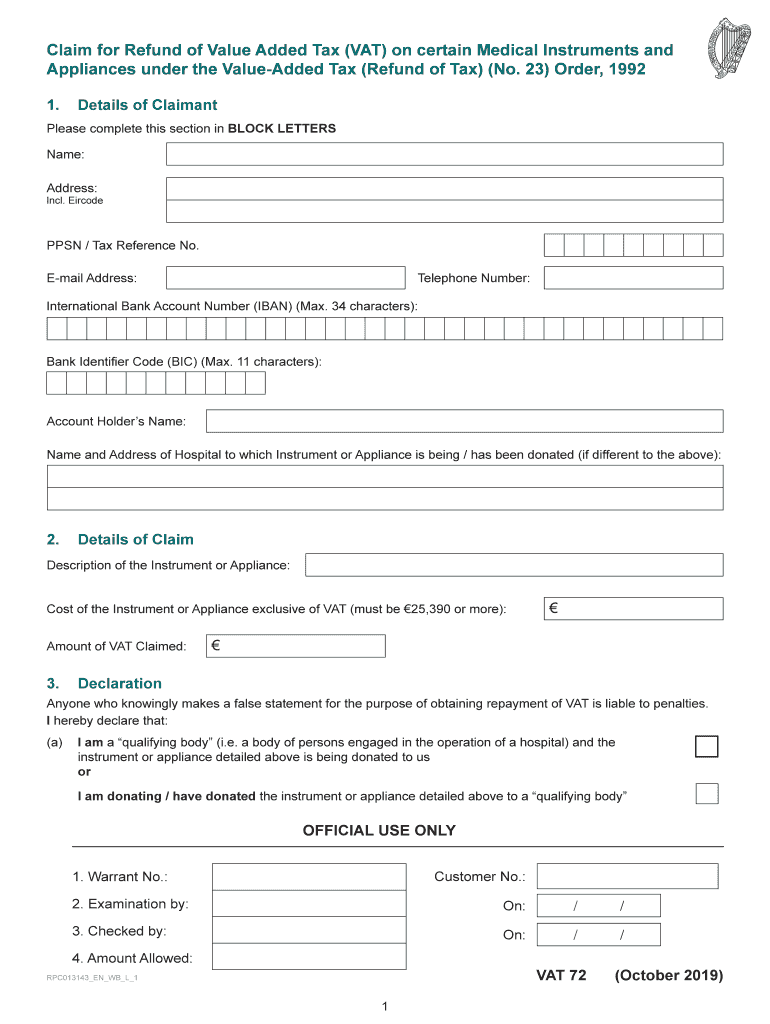

The VAT 72 form, also known as the Ireland Revenue VAT 72, is a document used for reclaiming VAT on goods and services purchased within the European Union. This form is particularly relevant for businesses that are not established in Ireland but have incurred VAT expenses during their operations. The VAT 72 allows these businesses to apply for a refund of the VAT they paid, provided they meet specific eligibility criteria set by the Ireland Revenue.

Steps to Complete the VAT 72

Completing the VAT 72 form involves several important steps to ensure accuracy and compliance. The following steps outline the process:

- Gather necessary documentation, including invoices and proof of payment for VAT incurred.

- Fill out the VAT 72 form with accurate details, including your business information and VAT amounts.

- Submit the completed form along with supporting documents to the Ireland Revenue.

- Keep copies of all submitted documents for your records.

Legal Use of the VAT 72

The VAT 72 form must be used in accordance with the legal guidelines established by the Ireland Revenue. This includes ensuring that all information provided is truthful and that the VAT being reclaimed was legitimately incurred for business purposes. The form is legally binding, and any discrepancies or fraudulent claims can result in penalties or legal action.

Eligibility Criteria

To qualify for a VAT refund using the VAT 72 form, businesses must meet certain eligibility criteria. These criteria typically include:

- The business must not be registered for VAT in Ireland.

- The VAT must have been incurred on goods or services used for business purposes.

- The claim must be made within a specific timeframe, usually within six months of the end of the VAT period.

Required Documents

When submitting the VAT 72 form, it is essential to include all required documents to support your claim. Commonly required documents include:

- Invoices detailing the VAT paid.

- Proof of payment for the goods or services.

- Any additional documentation requested by the Ireland Revenue.

Form Submission Methods

The VAT 72 form can be submitted through various methods, ensuring convenience for businesses. The available submission methods include:

- Online submission through the Ireland Revenue's official website.

- Mailing a hard copy of the completed form and supporting documents.

- In-person submission at designated Ireland Revenue offices.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the VAT 72 form. Typically, claims must be submitted within six months following the end of the VAT period in which the VAT was incurred. Keeping track of these important dates can help ensure timely submissions and avoid penalties.

Quick guide on how to complete vat 72

Effortlessly Prepare Vat 72 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Vat 72 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Vat 72 with Ease

- Obtain Vat 72 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vat 72 and guarantee outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat 72

Create this form in 5 minutes!

How to create an eSignature for the vat 72

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is Ireland VAT72 VAT?

Ireland VAT72 VAT refers to a specific VAT scheme for businesses operating in Ireland. This scheme allows eligible companies to reclaim VAT paid on purchases related to their business activities. Understanding how Ireland VAT72 VAT applies can help businesses optimize their tax strategies.

-

How can airSlate SignNow help with Ireland VAT72 VAT compliance?

airSlate SignNow provides an efficient solution for managing documents related to Ireland VAT72 VAT compliance. By enabling seamless electronic signatures and document tracking, businesses can ensure that all necessary paperwork is handled promptly and securely, thus reducing the risk of compliance issues.

-

What features does airSlate SignNow offer for VAT document management?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure storage that are essential for managing VAT-related documents effectively. These features help streamline the process of preparing and signing documents related to Ireland VAT72 VAT, making it easier for businesses to stay organized and compliant.

-

How much does airSlate SignNow cost for services related to Ireland VAT72 VAT?

The pricing for airSlate SignNow varies based on the subscription plan chosen by the business. However, it provides a cost-effective solution for document management, especially for those dealing with Ireland VAT72 VAT processes. Companies can select the plan that best fits their operational needs and budget.

-

Can airSlate SignNow integrate with accounting software for VAT reporting?

Yes, airSlate SignNow can integrate with various accounting software systems, enhancing its functionality for VAT reporting. This integration allows businesses to easily manage documentation required for Ireland VAT72 VAT while ensuring that all financial records are easily accessible and up-to-date.

-

Is airSlate SignNow secure for handling VAT-related documents?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect VAT-related documents. This level of security is critical for businesses managing sensitive Ireland VAT72 VAT information and ensures peace of mind for users.

-

How quickly can I get started with airSlate SignNow for Ireland VAT72 VAT?

Getting started with airSlate SignNow is quick and easy. After signing up, users can access the platform within minutes, set up their document workflows, and begin preparing and signing documents related to Ireland VAT72 VAT. The user-friendly interface ensures a smooth onboarding experience.

Get more for Vat 72

- Siding contractor package north dakota form

- Refrigeration contractor package north dakota form

- Drainage contractor package north dakota form

- Tax free exchange package north dakota form

- North dakota tenant 497317818 form

- Buy sell agreement package north dakota form

- Option to purchase package north dakota form

- Amendment of lease package north dakota form

Find out other Vat 72

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast