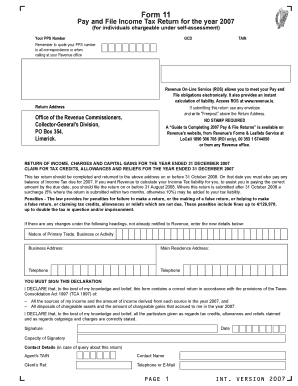

Revenue Form 11 2007

What is the Revenue Form 11

The Revenue Form 11 is a tax return form used by individuals and businesses in the United States to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and is typically required for various types of tax filings. Understanding the purpose and requirements of the Revenue Form 11 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Revenue Form 11

Using the Revenue Form 11 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense receipts, and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided by the IRS for each section of the form. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements for your tax situation.

Steps to complete the Revenue Form 11

Completing the Revenue Form 11 can be streamlined by following these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Review the form's instructions to understand the requirements for each section.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income, ensuring that all sources are accurately reflected.

- Detail any deductions or credits you are eligible for to reduce your taxable income.

- Double-check all entries for accuracy before submitting the form.

Legal use of the Revenue Form 11

The legal use of the Revenue Form 11 is governed by IRS regulations, which stipulate that the information provided must be truthful and accurate. Filing this form is a legal obligation for taxpayers who meet specific income thresholds or have certain tax situations. Failure to file or providing false information can result in penalties, including fines or legal action. It is essential to ensure that all data entered on the form complies with applicable tax laws to maintain its validity.

Filing Deadlines / Important Dates

Filing deadlines for the Revenue Form 11 vary based on the tax year and the taxpayer's situation. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines announced by the IRS, as these can affect when you need to file your form to avoid penalties.

Required Documents

To complete the Revenue Form 11 accurately, several documents are typically required. These include:

- W-2 forms from employers detailing wages earned.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or business-related costs.

- Prior year tax returns for reference.

Having these documents readily available can facilitate a smoother filing process and help ensure that all necessary information is included.

Quick guide on how to complete revenue form 11

Effortlessly Prepare Revenue Form 11 on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Manage Revenue Form 11 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Revenue Form 11 with Ease

- Obtain Revenue Form 11 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal status as a traditional wet signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Revenue Form 11 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue form 11

Create this form in 5 minutes!

How to create an eSignature for the revenue form 11

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is revenue form 11 and how can airSlate SignNow help?

Revenue form 11 is essential for reporting income details to tax authorities. airSlate SignNow simplifies the completion and submission of this form by allowing you to eSign documents securely, ensuring compliance and ease of use.

-

How much does it cost to use airSlate SignNow for managing revenue form 11?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. By choosing our platform, you can efficiently manage revenue form 11 submissions without excessive costs, maximizing your ROI.

-

What features does airSlate SignNow include for revenue form 11?

AirSlate SignNow includes features like template creation, bulk sending, and secure storage tailored for revenue form 11. These tools enhance document management efficiency and streamline the eSigning process.

-

Can airSlate SignNow integrate with other software to handle revenue form 11?

Yes, airSlate SignNow supports integrations with popular software, such as accounting and CRM systems, to facilitate seamless handling of revenue form 11. This ensures that your processes remain interconnected and efficient.

-

Is it safe to use airSlate SignNow for sending my revenue form 11?

Absolutely! AirSlate SignNow prioritizes data security and compliance, implementing strong encryption protocols to protect your revenue form 11 and other sensitive documents during transmission and storage.

-

How does eSigning with airSlate SignNow improve the revenue form 11 submission process?

Using airSlate SignNow for eSigning your revenue form 11 speeds up the entire process, allowing for quicker approvals and submissions. This eliminates delays caused by physical signatures and enhances overall productivity.

-

Can I track the status of my revenue form 11 submissions in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your revenue form 11 submissions. You can easily monitor the status of documents, ensuring that you stay informed about any actions taken or required.

Get more for Revenue Form 11

- Excavation contractor package north dakota form

- Renovation contractor package north dakota form

- Concrete mason contractor package north dakota form

- Demolition contractor package north dakota form

- Security contractor package north dakota form

- Insulation contractor package north dakota form

- Paving contractor package north dakota form

- Site work contractor package north dakota form

Find out other Revenue Form 11

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online