Vat1614d 2008

What is the Vat1614d

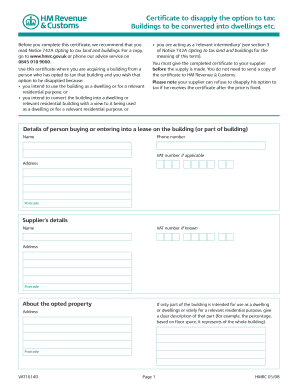

The Vat1614d is a specific form used in the context of value-added tax (VAT) in the United Kingdom. It serves as a declaration for businesses that are reclaiming VAT on goods or services purchased. The form is essential for ensuring that businesses comply with tax regulations and accurately report their VAT claims to the HM Revenue and Customs (HMRC). Understanding the purpose and requirements of the Vat1614d is crucial for businesses to maintain compliance and avoid potential penalties.

How to use the Vat1614d

Using the Vat1614d involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to your VAT transactions, including invoices and receipts. Next, fill out the form with the required details, such as your business information and the specific VAT amounts you wish to reclaim. Once completed, review the form for accuracy and ensure all supporting documents are attached. Finally, submit the form to HMRC through the appropriate channels, which may include online submission or mailing a physical copy.

Steps to complete the Vat1614d

Completing the Vat1614d requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant invoices and receipts that detail your VAT transactions.

- Access the Vat1614d form, either online or in a physical format.

- Fill in your business name, address, and VAT registration number.

- Detail the amounts of VAT you are claiming back, ensuring accuracy.

- Attach all necessary supporting documents to validate your claim.

- Review the completed form for any errors or omissions.

- Submit the form to HMRC via the preferred method.

Legal use of the Vat1614d

The legal use of the Vat1614d is governed by specific regulations set forth by HMRC. To ensure that your submission is legally binding, it is essential to comply with the requirements outlined in the VAT Act. This includes providing accurate information, maintaining proper records, and adhering to deadlines for submission. Failure to comply with these legal standards may result in penalties or rejection of your VAT claim.

Key elements of the Vat1614d

Several key elements are critical when completing the Vat1614d. These include:

- Business Information: Accurate details about your business, including name and VAT registration number.

- Claim Amounts: Clearly stated amounts of VAT being reclaimed, supported by documentation.

- Supporting Documents: Invoices and receipts that validate your VAT claims.

- Signature: A signature or declaration confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when dealing with the Vat1614d. Typically, businesses must submit their VAT returns and claims within specific timeframes set by HMRC. It is advisable to regularly check the HMRC website or consult with a tax professional to stay updated on important dates, as missing a deadline can lead to penalties or delays in processing your claim.

Quick guide on how to complete vat1614d

Finalize Vat1614d effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without delays. Handle Vat1614d on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Vat1614d with ease

- Find Vat1614d and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight signNow parts of the documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Vat1614d to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat1614d

Create this form in 5 minutes!

How to create an eSignature for the vat1614d

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is vat1614d and how does it relate to airSlate SignNow?

Vat1614d is a document management requirement for businesses that need to comply with specific VAT regulations. AirSlate SignNow simplifies the process of managing vat1614d documents by providing a seamless way to send and eSign them efficiently.

-

How does airSlate SignNow handle vat1614d document security?

AirSlate SignNow prioritizes the security of your vat1614d documents through advanced encryption and secure storage. This ensures that all your sensitive information stays protected while you manage your documents online.

-

What features does airSlate SignNow offer for managing vat1614d documents?

AirSlate SignNow offers a range of features for managing vat1614d documents, including customizable templates, automated workflows, and real-time tracking of signatures. These features streamline the process and make it easier for you to stay compliant.

-

Is there a free trial available for airSlate SignNow to handle vat1614d documents?

Yes, airSlate SignNow provides a free trial that allows you to explore its capabilities for handling vat1614d documents. During the trial, you can test features like eSigning, document sharing, and integrations without any commitment.

-

How can airSlate SignNow integrate with existing software for vat1614d compliance?

AirSlate SignNow offers integrations with various software tools that businesses commonly use, enhancing the efficiency of handling vat1614d documents. This interoperability helps you maintain a smooth workflow and meet compliance requirements effortlessly.

-

What are the pricing options for airSlate SignNow concerning vat1614d document management?

AirSlate SignNow provides flexible pricing plans tailored to meet the needs of different businesses handling vat1614d documents. The pricing is competitive and includes various features that can scale up as your business grows.

-

How can airSlate SignNow help improve the efficiency of handling vat1614d documents?

By using airSlate SignNow for vat1614d documents, businesses can automate their document workflows, signNowly reducing the time spent on manual processes. This efficiency not only saves time but also minimizes the risk of errors in document management.

Get more for Vat1614d

- Httpsapi6ilovepdfcomv1download anyrun form

- Application checklist medical device establishment licence form

- Employer incident investigation report form

- Guide 5218 request to amend valid temporary resident form

- Pdf imm 1444 e application for criminal rehabilitation form

- Undertaking for an application for a work permit exempted form

- D0688 medical grade footwear prescription dva form

- Form 110 spent conviction fill online printable fillable

Find out other Vat1614d

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast