Official Receipt Form

What is the Official Receipt

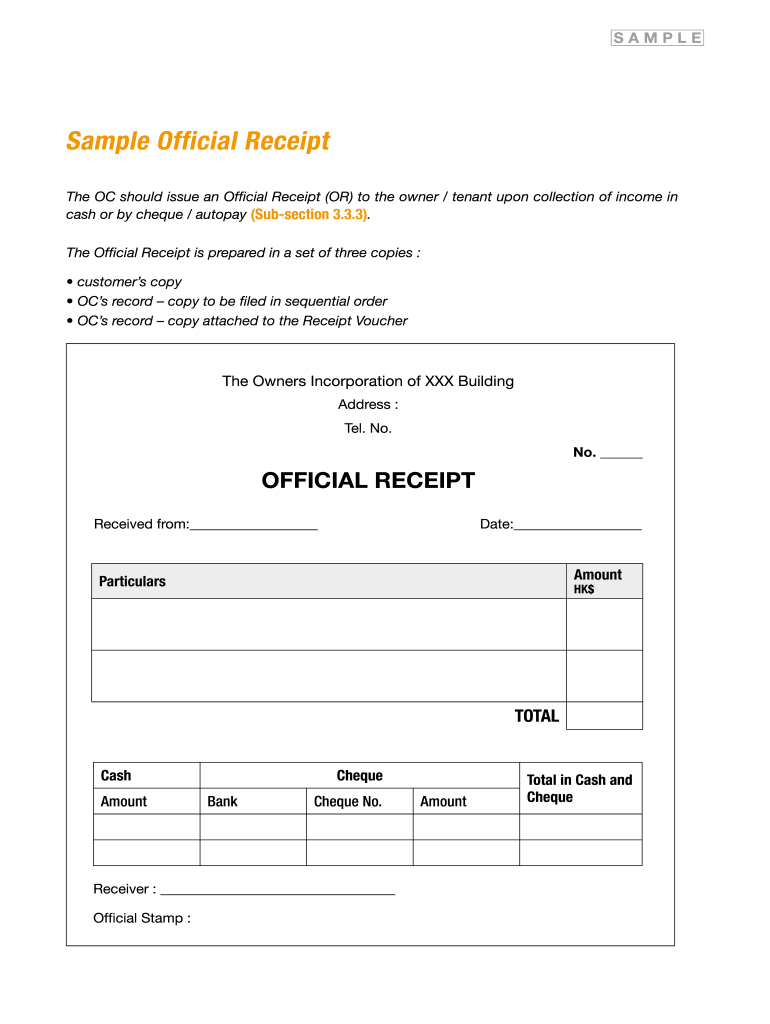

An official receipt is a document that serves as proof of a transaction between a buyer and a seller. It typically includes essential details such as the date of the transaction, the items or services purchased, the total amount paid, and the names of both parties involved. This document is crucial for record-keeping and can be required for tax purposes or warranty claims. In the United States, official receipts must meet specific legal standards to be considered valid.

Key Elements of the Official Receipt

To ensure that an official receipt is legally valid, it should contain several key elements:

- Date: The date when the transaction occurred.

- Seller Information: Name, address, and contact details of the seller.

- Buyer Information: Name and contact details of the buyer, if applicable.

- Description of Goods or Services: Detailed information about what was purchased.

- Total Amount Paid: The total cost of the transaction, including taxes if applicable.

- Payment Method: Indication of how the payment was made (cash, credit card, etc.).

- Signature or Stamp: A signature or official stamp from the seller to authenticate the receipt.

Steps to Complete the Official Receipt

Completing an official receipt involves several straightforward steps:

- Gather all necessary information, including transaction details and buyer/seller information.

- Fill in the date of the transaction at the top of the receipt.

- Provide detailed descriptions of the goods or services sold.

- Calculate the total amount paid, including any applicable taxes.

- Indicate the payment method used for the transaction.

- Sign or stamp the receipt to authenticate it.

Legal Use of the Official Receipt

The legal use of an official receipt is vital for both buyers and sellers. In the United States, receipts can serve as evidence in disputes, tax audits, or warranty claims. They must comply with local and federal regulations, such as the Internal Revenue Service (IRS) guidelines for record-keeping. Properly issued receipts help prevent issues related to tax compliance and provide a clear record of transactions.

How to Obtain the Official Receipt

Obtaining an official receipt is typically straightforward. When making a purchase, request a receipt from the seller. If the seller does not provide one, you can ask them to issue an official receipt. In some cases, businesses may have specific procedures for issuing receipts, especially for larger transactions. It is essential to ensure that the receipt includes all required elements to maintain its validity.

Examples of Using the Official Receipt

Official receipts can be used in various scenarios, including:

- Documenting purchases for personal or business expenses.

- Providing proof of payment for warranty claims on products.

- Serving as evidence in case of disputes over transactions.

- Facilitating tax preparation by serving as proof of deductible expenses.

Quick guide on how to complete official receipt

Effortlessly Prepare Official Receipt on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without any holds. Handle Official Receipt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Official Receipt effortlessly

- Obtain Official Receipt and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, and the need to reprint new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Official Receipt and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the official receipt

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is receiving copy in airSlate SignNow?

Receiving copy refers to the process of obtaining signed documents through airSlate SignNow. Once your recipients have eSigned a document, you will receive a copy of it in your designated account, ensuring you always have access to important agreements.

-

How does airSlate SignNow ensure secure receiving copy?

airSlate SignNow takes security seriously, utilizing encryption and secure storage to protect your documents. When receiving copy of signed documents, rest assured that your data is safeguarded against unauthorized access and bsignNowes.

-

Are there any costs associated with receiving copy of signed documents?

Receiving copy of signed documents in airSlate SignNow is included in the subscription plan you choose. There are no hidden fees for receiving copies, allowing you to budget effectively for your document management needs.

-

Can I customize the notifications for receiving copy?

Yes, airSlate SignNow allows you to customize notifications for receiving copy of signed documents. You can select how and when you receive alerts, ensuring you stay informed about your document status and transactions.

-

What features support the receiving copy process in airSlate SignNow?

Features enhancing the receiving copy process include automatic notifications, document tracking, and seamless integration with other tools. You can easily manage your workflow and ensure no signed document goes unaccounted for.

-

Can I integrate airSlate SignNow with other applications for managing receiving copy?

Absolutely! airSlate SignNow integrates with a variety of applications like Google Drive, Dropbox, and more. This allows you to streamline your workflow and easily access your receiving copy alongside other documents.

-

What benefits does receiving copy offer for businesses?

Receiving copy of signed documents enhances accountability and organization within your business. With a clear record of agreements, you can easily refer back to contracts and improve compliance in your operations.

Get more for Official Receipt

Find out other Official Receipt

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure