Food and Beverage Tax Return City of Alton Form

What is the Food And Beverage Tax Return City Of Alton

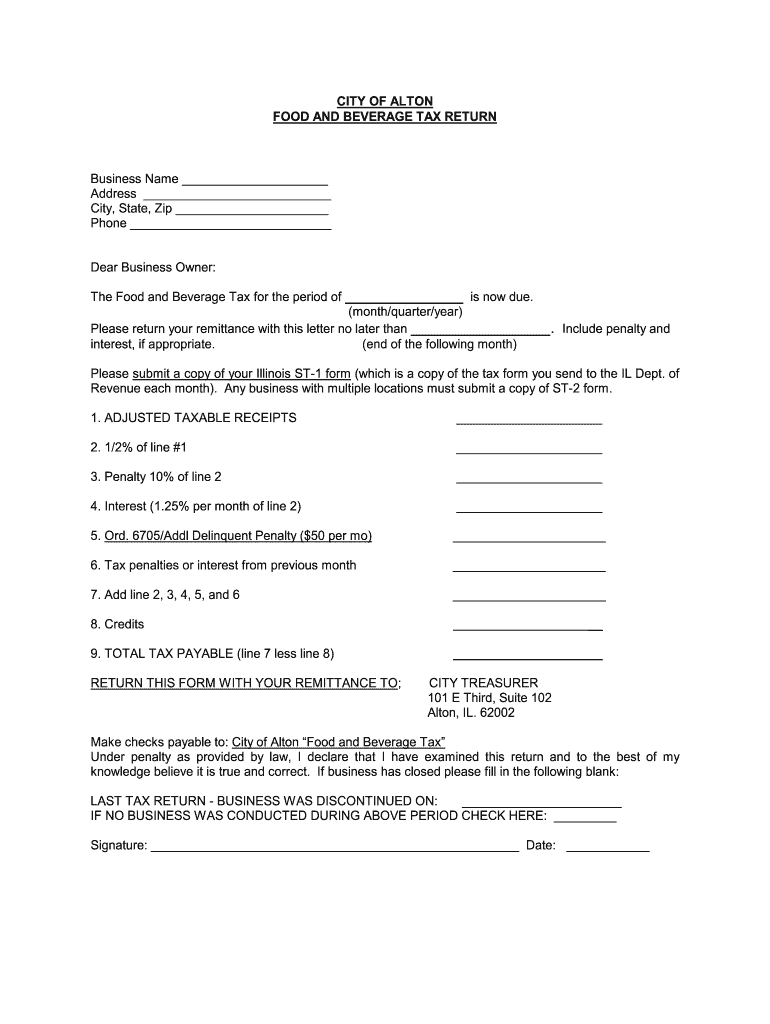

The Food and Beverage Tax Return for the City of Alton is a specific form that businesses must complete to report and remit taxes collected on food and beverage sales. This tax is typically levied on establishments that sell prepared food and drinks, including restaurants, cafes, and catering services. Understanding this return is essential for compliance and ensuring that the correct amounts are reported to the city authorities.

Steps to complete the Food And Beverage Tax Return City Of Alton

Completing the Food and Beverage Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data, including total sales of food and beverages for the reporting period. Next, calculate the total tax collected based on the applicable tax rate. After that, fill out the form with the required information, ensuring all figures are accurate. Finally, submit the form by the designated deadline, either online or via mail, depending on the submission options provided by the city.

How to obtain the Food And Beverage Tax Return City Of Alton

Businesses can obtain the Food and Beverage Tax Return for the City of Alton through the city’s official website or by visiting the local tax office. The form is typically available for download in a PDF format, allowing for easy printing and completion. Additionally, businesses may inquire directly with city officials for any updates or changes to the form or filing process.

Required Documents

To complete the Food and Beverage Tax Return, businesses must have certain documents on hand. These include sales receipts, records of tax collected, and any previous tax returns filed. Maintaining organized records will facilitate accurate reporting and help prevent discrepancies during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Food and Beverage Tax Return in the City of Alton are crucial for compliance. Typically, returns are due on a quarterly basis, with specific dates set by the city. It is important for businesses to mark these dates on their calendars to avoid late fees or penalties associated with non-compliance.

Penalties for Non-Compliance

Failure to file the Food and Beverage Tax Return on time can result in penalties imposed by the City of Alton. These penalties may include fines and interest on unpaid taxes. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing for all businesses subject to this tax.

Quick guide on how to complete city of alton food and beverage tax return form

Complete Food And Beverage Tax Return City Of Alton effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Food And Beverage Tax Return City Of Alton on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Food And Beverage Tax Return City Of Alton with ease

- Locate Food And Beverage Tax Return City Of Alton and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and electronically sign Food And Beverage Tax Return City Of Alton and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

Create this form in 5 minutes!

How to create an eSignature for the city of alton food and beverage tax return form

How to make an electronic signature for the City Of Alton Food And Beverage Tax Return Form in the online mode

How to generate an eSignature for your City Of Alton Food And Beverage Tax Return Form in Chrome

How to create an electronic signature for putting it on the City Of Alton Food And Beverage Tax Return Form in Gmail

How to generate an electronic signature for the City Of Alton Food And Beverage Tax Return Form right from your smart phone

How to generate an electronic signature for the City Of Alton Food And Beverage Tax Return Form on iOS

How to create an electronic signature for the City Of Alton Food And Beverage Tax Return Form on Android devices

People also ask

-

What is the Food And Beverage Tax Return City Of Alton?

The Food And Beverage Tax Return City Of Alton is a tax form that businesses in the food and beverage industry must complete to report their taxable sales to the city. This return is essential for compliance with local tax regulations and helps fund city services. Filing accurately and on time is crucial to avoid penalties.

-

How can airSlate SignNow help me with my Food And Beverage Tax Return City Of Alton?

airSlate SignNow simplifies the process of preparing and submitting your Food And Beverage Tax Return City Of Alton by allowing you to create, sign, and send documents electronically. Our platform ensures that your forms are securely stored and easily accessible, making compliance straightforward. You can save time and reduce errors with our user-friendly interface.

-

What features does airSlate SignNow offer for filing the Food And Beverage Tax Return City Of Alton?

airSlate SignNow offers features like electronic signatures, customizable templates, and document tracking specifically designed for the Food And Beverage Tax Return City Of Alton. These tools streamline the filing process and enhance collaboration among your team. Additionally, our platform provides integration with various accounting software to keep your financial records up to date.

-

Is airSlate SignNow cost-effective for filing the Food And Beverage Tax Return City Of Alton?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the Food And Beverage Tax Return City Of Alton. With flexible pricing plans, you can choose the option that best fits your budget without compromising on essential features. This affordability allows businesses of all sizes to manage their tax returns efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software for the Food And Beverage Tax Return City Of Alton?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easy to manage your Food And Beverage Tax Return City Of Alton alongside your financial records. This integration ensures that your data is synchronized, reducing the likelihood of errors and streamlining your tax filing process.

-

What are the benefits of using airSlate SignNow for my Food And Beverage Tax Return City Of Alton?

Using airSlate SignNow for your Food And Beverage Tax Return City Of Alton offers numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. Our platform allows for quick turnaround times on document approvals and signatures, which is crucial during tax season. Additionally, you can access your documents from anywhere, ensuring you stay organized and compliant.

-

How secure is airSlate SignNow when handling the Food And Beverage Tax Return City Of Alton?

airSlate SignNow prioritizes security, using advanced encryption and authentication measures to protect your Food And Beverage Tax Return City Of Alton and other sensitive documents. Our platform complies with industry standards to ensure that your information remains confidential and secure. You can file your tax returns with confidence, knowing that your data is protected.

Get more for Food And Beverage Tax Return City Of Alton

- 12930 d form 2011

- Bflorida supreme court approved family law formb 12994b final bb flcourts

- 12960 motion for civil contemptenforcement 2010 form

- Extending florida form

- Florida change family form

- Florida family law rules of procedure form 12930c 2011

- Florida form 12903a 2010

- Florida supreme court approved family law form 12903b answer

Find out other Food And Beverage Tax Return City Of Alton

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF