Alabama Form Adv U5 10 2003-2026

What is the Alabama Form ADV U5 10?

The Alabama Form ADV U5 10 is a regulatory document used by investment advisers to disclose specific information about their business practices, services, and fees. This form is crucial for maintaining transparency with clients and regulatory bodies. It serves as a uniform application for investment advisers and is essential for compliance with state regulations. The form includes details such as the adviser's qualifications, investment strategies, and any disciplinary history, ensuring that clients have a comprehensive understanding of the adviser's background and operations.

Steps to Complete the Alabama Form ADV U5 10

Completing the Alabama Form ADV U5 10 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, business structure, and financial information. Next, fill out each section of the form carefully, providing clear and concise responses. It is important to review the form for any errors or omissions before submission. Once completed, the form should be signed and dated to validate the information provided. Finally, submit the form through the appropriate channels, whether online or by mail, following state-specific submission guidelines.

Legal Use of the Alabama Form ADV U5 10

The legal use of the Alabama Form ADV U5 10 is governed by state and federal regulations that require investment advisers to provide accurate and complete information. This form is used to register with the Alabama Securities Commission and is essential for compliance with the Investment Advisers Act of 1940. Failure to properly complete or submit the form can result in penalties, including fines or revocation of the adviser's license. Therefore, it is crucial for advisers to understand their legal obligations when using this form.

Filing Deadlines / Important Dates

Investment advisers must be aware of specific filing deadlines associated with the Alabama Form ADV U5 10. Typically, the form must be submitted annually, along with any amendments that reflect changes in the adviser's business practices or personal information. It is important to check for any updates or changes in deadlines, as these can vary based on state regulations or specific circumstances. Staying informed about these dates helps ensure timely compliance and avoids potential penalties.

Required Documents

When preparing to submit the Alabama Form ADV U5 10, several supporting documents may be required. These can include proof of the adviser's qualifications, financial statements, and any relevant disclosures regarding disciplinary history. Additionally, documentation that verifies the business structure and operational practices may also be necessary. Having these documents ready can streamline the submission process and enhance the accuracy of the information provided.

Form Submission Methods

The Alabama Form ADV U5 10 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. If submitting by mail, it is advisable to use a reliable service to ensure the form arrives on time. In-person submissions may be made at designated regulatory offices, providing an opportunity to ask questions or clarify any concerns regarding the form.

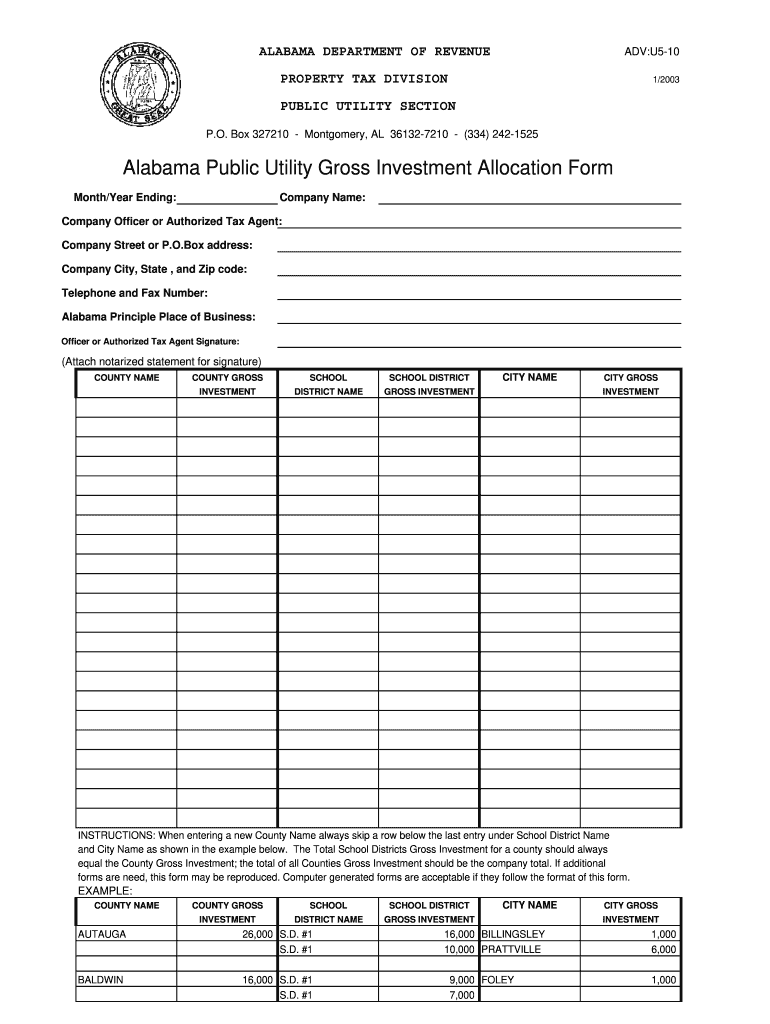

Quick guide on how to complete alabama public utility gross investment allocation form

Your assistance manual on how to prepare your Alabama Form Adv U5 10

If you’re interested in learning how to finalize and submit your Alabama Form Adv U5 10, here are some concise instructions to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to enhance your online document management. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, draft, and complete your income tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revisit to amend any responses as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finish your Alabama Form Adv U5 10 in moments:

- Create your account and start managing PDFs within minutes.

- Utilize our catalog to obtain any IRS tax forms; browse through various versions and schedules.

- Click Obtain form to access your Alabama Form Adv U5 10 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Signature Tool to incorporate your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save the changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased mistakes and delayed refunds. Remember to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

I am about to start a new venture in the form of a website, and I have a few investors who are interested in making an investment in return for a stake in the company. How can I accurately figure out what percent of ownership to allocate to each person relative to his/her investment value?

Don't give up too much but also be realistic in estimating the profibility of your venture. If you think you'll have $50k in sales the first year and 100k in year two don't sell 50% of the company for a total of $10k. Make each split representative of how much each is investing. If you have an idea that everyone thinks is a $500k business then investor #1 at $10k should get approx 2% of the business, so on and so forth. This is a basic "presale" of estimated worth example but honestly all you should keep in mind is that they stakes should be proportionate at the outset to make sure there aren't grumblings of being treated unfairly. Don't sell one stake of 25% for less than another at 10%. And lastly always retain at the very minimum 51% of the business for yourself.

Create this form in 5 minutes!

How to create an eSignature for the alabama public utility gross investment allocation form

How to create an eSignature for the Alabama Public Utility Gross Investment Allocation Form online

How to make an eSignature for your Alabama Public Utility Gross Investment Allocation Form in Google Chrome

How to generate an eSignature for signing the Alabama Public Utility Gross Investment Allocation Form in Gmail

How to generate an electronic signature for the Alabama Public Utility Gross Investment Allocation Form from your mobile device

How to make an eSignature for the Alabama Public Utility Gross Investment Allocation Form on iOS devices

How to make an eSignature for the Alabama Public Utility Gross Investment Allocation Form on Android

People also ask

-

What is the u5 tax division form?

The u5 tax division form is a crucial document used in tax reporting and compliance. It helps businesses ensure that they accurately report income and expenses related to tax obligations. Understanding this form is essential for maintaining compliance and avoiding potential legal issues.

-

How does airSlate SignNow facilitate the completion of the u5 tax division form?

airSlate SignNow simplifies the process of completing the u5 tax division form by providing an intuitive platform for electronic signatures and document management. Users can easily upload, fill out, and eSign the form in a matter of minutes, enhancing efficiency and accuracy. This eliminates the hassles of printing and mailing paper documents.

-

Is there a cost associated with using airSlate SignNow for the u5 tax division form?

Yes, airSlate SignNow offers cost-effective pricing plans to suit various business needs when handling the u5 tax division form. Our pricing structure is transparent, ensuring you pay only for the features you require. This allows businesses of all sizes to access powerful document management tools without breaking the bank.

-

What features does airSlate SignNow offer for managing the u5 tax division form?

airSlate SignNow includes features such as customizable templates, electronic signatures, and real-time tracking for the u5 tax division form. These tools streamline the documentation process and ensure that all parties are kept informed throughout the signing process. Additionally, users can set reminders and notifications to enhance workflow efficiency.

-

Can I integrate airSlate SignNow with other applications for the u5 tax division form?

Absolutely! airSlate SignNow offers a wide range of integrations with popular applications to facilitate the management of the u5 tax division form. Whether you use CRM systems or accounting software, our platform can sync seamlessly, allowing for a unified workflow and improved document handling.

-

What are the benefits of using airSlate SignNow for the u5 tax division form?

Using airSlate SignNow for the u5 tax division form provides numerous benefits, including improved accuracy, speed, and compliance. The ability to eSign documents reduces the risk of errors and speeds up the process signNowly. Additionally, secure cloud storage ensures that your documents are safe and easily accessible.

-

How secure is my data when using airSlate SignNow for the u5 tax division form?

Security is a top priority for airSlate SignNow. When handling the u5 tax division form, your data is protected with industry-standard encryption protocols. This ensures that sensitive information remains confidential and secure, giving you peace of mind while managing important tax documents.

Get more for Alabama Form Adv U5 10

- 1f p 738 form

- Adlro amended form

- Affidavit in support of motion for leave to proceed on appeal in forma pauperis courts state hi

- State of hawai i courts state hi form

- Administrative driver s license revocation office adlro courts state hi form

- Set order courts form

- Hawaii form reconsider license

- Edp ss form

Find out other Alabama Form Adv U5 10

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word