Taylor, John Li Ed Realities, and Research Proceedings of a Eric Form

Understanding the Declaration Status Form

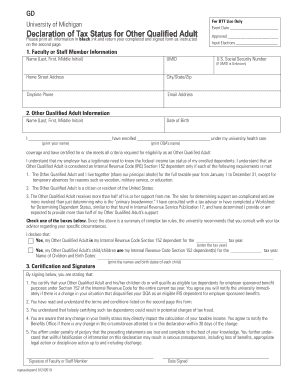

The declaration status form is a crucial document used primarily for tax purposes in the United States. It allows individuals to declare their tax status, which can affect their eligibility for various tax benefits and obligations. This form is essential for both individuals and organizations to ensure compliance with federal and state tax regulations. Understanding the specific requirements and implications of this form can help taxpayers navigate their financial responsibilities effectively.

Steps to Complete the Declaration Status Form

Filling out the declaration status form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number, filing status, and any relevant financial data. Next, carefully read the instructions provided with the form to understand what information is required. Complete each section of the form methodically, ensuring that all fields are filled out accurately. Finally, review the form for any errors before submission, as inaccuracies can lead to delays or penalties.

Eligibility Criteria for the Declaration Status Form

Eligibility to use the declaration status form typically depends on your tax situation. Individuals must assess their filing status, which can include options such as single, married filing jointly, or head of household. Additionally, certain qualifications may apply based on income levels, dependents, and other factors that influence tax obligations. Understanding these criteria is vital to ensure that the correct form is used and that all relevant information is reported.

IRS Guidelines for the Declaration Status Form

The Internal Revenue Service (IRS) provides specific guidelines regarding the declaration status form. These guidelines outline the requirements for completing the form, including what information must be disclosed and how it should be submitted. Adhering to these guidelines is essential for maintaining compliance with federal tax laws. Taxpayers should regularly consult the IRS website or official publications for any updates or changes to the guidelines that may affect their filing process.

Form Submission Methods

There are several methods available for submitting the declaration status form. Taxpayers can choose to file online through authorized e-filing services, which often provide a streamlined process and quicker processing times. Alternatively, forms can be mailed to the appropriate IRS address, allowing for traditional submission methods. In some cases, individuals may also have the option to submit the form in person at designated IRS offices. Understanding these submission methods can help taxpayers select the most convenient and efficient option for their needs.

Penalties for Non-Compliance

Failing to complete and submit the declaration status form accurately and on time can result in significant penalties. The IRS may impose fines for late submissions, errors, or omissions on the form. Additionally, individuals may face interest charges on any unpaid taxes that arise from inaccuracies in their tax status declaration. Being aware of these potential penalties underscores the importance of careful completion and timely submission of the form to avoid unnecessary financial repercussions.

Quick guide on how to complete taylor john li ed realities and research proceedings of a eric

Complete Taylor, John Li Ed Realities, And Research Proceedings Of A Eric effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, as you can easily find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Taylor, John Li Ed Realities, And Research Proceedings Of A Eric on any platform with airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The easiest way to modify and electronically sign Taylor, John Li Ed Realities, And Research Proceedings Of A Eric without hassle

- Find Taylor, John Li Ed Realities, And Research Proceedings Of A Eric and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Taylor, John Li Ed Realities, And Research Proceedings Of A Eric and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taylor john li ed realities and research proceedings of a eric

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the declaration status form?

The declaration status form is a document used to convey specific information regarding the submission and approval of declarations within a business process. With airSlate SignNow, you can easily create, send, and eSign declaration status forms, enhancing your workflow efficiency.

-

How can I track my declaration status form in airSlate SignNow?

AirSlate SignNow provides real-time tracking features for your declaration status form. You can easily see when the form is sent, viewed, and signed, ensuring that you stay informed throughout the entire process.

-

Is there a cost associated with using the declaration status form?

AirSlate SignNow offers cost-effective solutions for managing your declaration status form. Pricing varies based on the features you need, but our plans are designed to be affordable for businesses of all sizes.

-

What features are included with the declaration status form?

The declaration status form in airSlate SignNow includes several features such as customizable templates, secure eSigning, and document storage. These features streamline the signing process and enhance document management efficiency.

-

Can I integrate the declaration status form with other applications?

Yes, airSlate SignNow allows you to integrate the declaration status form with various applications, including CRM and project management tools. This integration helps automate your processes and ensures seamless workflows.

-

How does using the declaration status form benefit my business?

Utilizing the declaration status form through airSlate SignNow can signNowly improve your business operations. It increases efficiency, reduces paperwork, and speeds up the signing process, leading to better productivity and faster decision-making.

-

Is the declaration status form secure for sensitive information?

Absolutely! The declaration status form created with airSlate SignNow is secured with bank-level encryption and complies with industry standards to protect your sensitive information. You can trust that your documents are safe and confidential.

Get more for Taylor, John Li Ed Realities, And Research Proceedings Of A Eric

- District court denver juvenile courtcounty courts state co form

- Courts state co 6968392 form

- District courtdenver juvenile courtcounty courts state co form

- Name changeclerk ampamp comptroller palm beach county form

- Courts state co 6968344 form

- Jdf 1095 form

- Information to pro se divorce wchildren courts state co

- Information to pro se divorce wchildren courts state co 6968247

Find out other Taylor, John Li Ed Realities, And Research Proceedings Of A Eric

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer