UCT 101 E , Quarterly Contribution Report to Be Filed with Quarterly Wage Report This Form is Used by Employers to Report Their 2012

Understanding the UCT 101 E Form

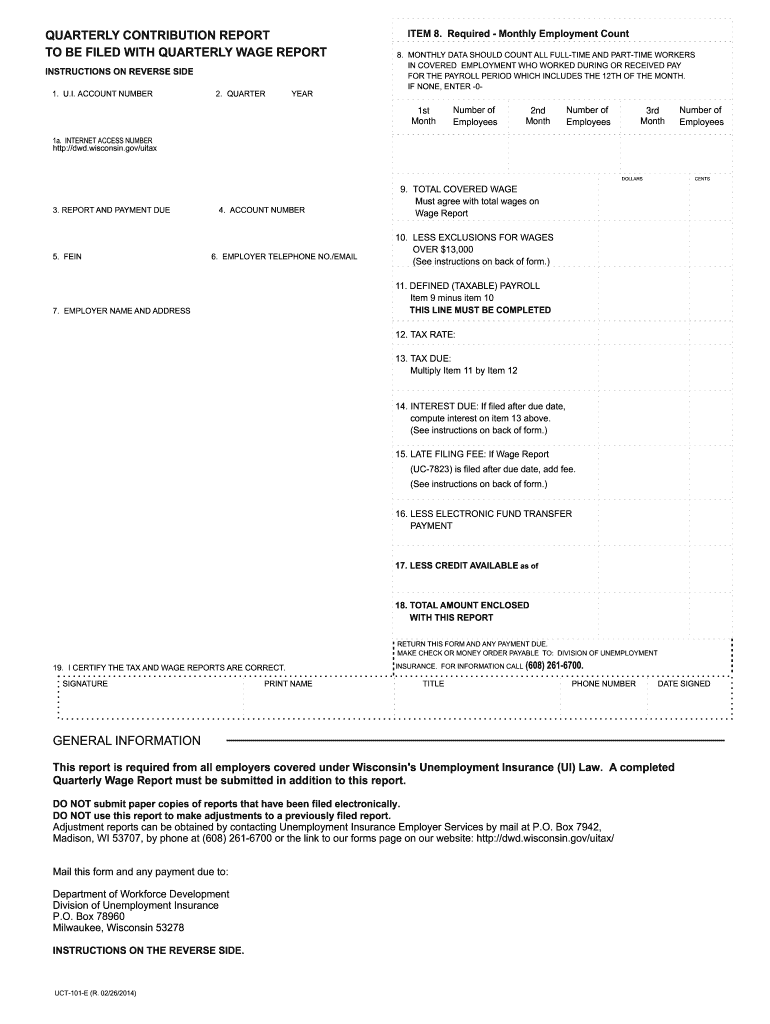

The UCT 101 E, or Quarterly Contribution Report to be filed with the Quarterly Wage Report, is a crucial document for employers in the United States. This form is specifically designed for reporting quarterly Unemployment Insurance (UI) tax information. Employers must select the appropriate UCT 101 form corresponding to the year of the report they need to submit. This ensures compliance with state regulations and accurate reporting of employee wages and contributions to unemployment insurance programs.

Steps to Complete the UCT 101 E Form

Completing the UCT 101 E form involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records for the quarter, including total wages paid and the number of employees. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect the payroll data. It is also essential to review the completed form for any errors before submission. Finally, submit the form by the designated deadline to avoid penalties.

Legal Use of the UCT 101 E Form

The UCT 101 E form serves a legal purpose in the context of unemployment insurance reporting. By accurately completing and submitting this form, employers fulfill their legal obligations under state unemployment compensation laws. This ensures that their employees are eligible for unemployment benefits if needed. Additionally, maintaining proper records of submitted forms can protect employers from potential disputes or audits regarding their unemployment tax contributions.

Filing Deadlines for the UCT 101 E Form

Employers must adhere to specific filing deadlines for the UCT 101 E form to remain compliant with state regulations. Typically, the form is due on the last day of the month following the end of each quarter. For example, reports for the first quarter must be submitted by April 30, while second-quarter reports are due by July 31. It is crucial for employers to mark these dates on their calendars to avoid late fees or penalties associated with non-compliance.

Obtaining the UCT 101 E Form

Employers can obtain the UCT 101 E form through various channels. Most state unemployment agencies provide the form on their official websites for easy access. Additionally, employers may request a physical copy from their state agency if needed. It is important to ensure that the correct version of the form is used, as different years may have slight variations in requirements or formatting.

Penalties for Non-Compliance with the UCT 101 E Form

Failure to file the UCT 101 E form on time or submitting inaccurate information can result in significant penalties for employers. These may include monetary fines, increased tax rates, or legal action by state agencies. To avoid these consequences, employers should prioritize timely and accurate completion of the form, ensuring that all information is verified before submission.

Quick guide on how to complete uct 101 e 20112012 quarterly contribution report to be filed with quarterly wage report this form is used by employers to

Complete UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their smoothly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Manage UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their effortlessly

- Locate UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uct 101 e 20112012 quarterly contribution report to be filed with quarterly wage report this form is used by employers to

Create this form in 5 minutes!

How to create an eSignature for the uct 101 e 20112012 quarterly contribution report to be filed with quarterly wage report this form is used by employers to

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the UCT 101 E form?

The UCT 101 E form, also known as the Quarterly Contribution Report To Be Filed With Quarterly Wage Report, is specifically designed for employers to report their Quarterly Unemployment Insurance (UI) Tax Information. This form ensures compliance with state regulations and provides a structured way to deliver essential financial data.

-

How do I complete the UCT 101 E form?

To complete the UCT 101 E form, gather all relevant payroll records and information about your employees' wages and contributions. The form allows you to report crucial details needed for your Quarterly Unemployment Insurance UI Tax responsibilities. Ensure that you select the correct UCT 101 Form for the year of the report you need.

-

What are the deadlines for filing the UCT 101 E form?

Deadlines for filing the UCT 101 E form typically align with your quarterly reporting schedule. It’s essential to check your state’s specific deadlines to avoid penalties or late fees associated with the Quarterly Contribution Report To Be Filed With Quarterly Wage Report. Timely submission is critical for keeping your business compliant.

-

Can airSlate SignNow help with filing the UCT 101 E form?

Yes, airSlate SignNow can streamline the process of completing and filing the UCT 101 E form. Our platform provides easy-to-use tools that allow you to eSign documents and maintain organized records, making it simple to prepare your Quarterly Contribution Report To Be Filed With Quarterly Wage Report.

-

What are the benefits of using airSlate SignNow for the UCT 101 E form?

Using airSlate SignNow for the UCT 101 E form offers enhanced efficiency and accuracy in your reporting process. Our solution is cost-effective, allowing you to save time and reduce errors, while ensuring you meet your obligations for the Quarterly Unemployment Insurance UI Tax Information.

-

Is airSlate SignNow compatible with other payroll systems for the UCT 101 E form?

Absolutely! airSlate SignNow seamlessly integrates with various payroll systems, allowing for smooth data transfer when filling out the UCT 101 E form. This integration supports accurate reporting for your Quarterly Contribution Report To Be Filed With Quarterly Wage Report and simplifies your administrative tasks.

-

What should I do if I make a mistake on the UCT 101 E form?

If you make a mistake on the UCT 101 E form, you should correct it promptly by following your state’s guidelines for amendments. Generally, you may need to refile the form with the corrected information to ensure your Quarterly Unemployment Insurance UI Tax Information is accurate.

Get more for UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their

Find out other UCT 101 E , Quarterly Contribution Report To Be Filed With Quarterly Wage Report This Form Is Used By Employers To Report Their

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form