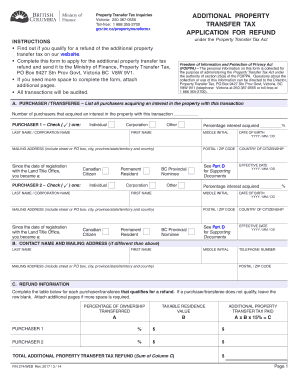

FIN 274, Additional Property Transfer Tax Application for Refund Complete This Form to Apply for a Refund of the Additional Prop 2017

What is the FIN 274, Additional Property Transfer Tax Application For Refund

The FIN 274 form is an official document used in the United States to apply for a refund of the Additional Property Transfer Tax. This tax is typically levied during property transactions, and the application for a refund may arise when a taxpayer believes they have overpaid or are eligible for a refund under specific circumstances. Completing this form accurately is essential to ensure that the request for a refund is processed efficiently.

Key Elements of the FIN 274 Application

When filling out the FIN 274 form, it is important to include several key elements to ensure your application is complete. These elements typically include:

- Taxpayer Information: Your name, address, and contact details.

- Property Details: Information about the property for which the tax was paid, including the address and transaction date.

- Tax Payment Information: Details regarding the tax payment, including the amount paid and any relevant transaction identifiers.

- Reason for Refund: A clear explanation of why you believe a refund is warranted.

Steps to Complete the FIN 274 Application

To successfully complete the FIN 274 form, follow these steps:

- Gather all necessary documentation, including proof of payment and property details.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide a detailed explanation for the refund request.

- Review the completed form for accuracy and completeness.

- Submit the form through the appropriate channels, either online or via mail.

Eligibility Criteria for Refund

To qualify for a refund using the FIN 274 form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- The property must have been subject to the Additional Property Transfer Tax.

- The applicant must have paid the tax in question.

- The reason for the refund must align with the acceptable grounds outlined by the taxing authority.

Form Submission Methods

The FIN 274 form can typically be submitted through various methods, ensuring convenience for applicants. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing through their official websites.

- Mail: Applicants can print the completed form and send it to the designated tax office.

- In-Person: Some applicants may choose to submit the form directly at their local tax office.

Legal Use of the FIN 274 Form

The FIN 274 form is legally recognized as a valid application for refund when completed correctly. It is crucial to adhere to all legal guidelines and requirements associated with the form. This includes ensuring that the form is signed and dated appropriately, as well as retaining copies of all submitted documents for your records. Compliance with state-specific regulations is also essential to avoid any issues during the refund process.

Quick guide on how to complete fin 274 additional property transfer tax application for refund complete this form to apply for a refund of the additional

Prepare FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop with ease

- Find FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 274 additional property transfer tax application for refund complete this form to apply for a refund of the additional

Create this form in 5 minutes!

How to create an eSignature for the fin 274 additional property transfer tax application for refund complete this form to apply for a refund of the additional

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is FIN 274, Additional Property Transfer Tax Application For Refund?

FIN 274, Additional Property Transfer Tax Application For Refund is a form that allows taxpayers to apply for a refund of the additional property transfer tax. By completing this form, you can seek a potential refund if you've overpaid or qualify for a refund under specific conditions applied by tax regulations.

-

How do I complete the FIN 274 form?

To complete the FIN 274, Additional Property Transfer Tax Application For Refund, you need to gather relevant transaction details, financial information, and any supporting documents required. The airSlate SignNow platform simplifies the process by allowing you to fill out and eSign the document digitally, ensuring accuracy and convenience.

-

What are the benefits of using airSlate SignNow for FIN 274 submissions?

Using airSlate SignNow to submit your FIN 274, Additional Property Transfer Tax Application For Refund completes the form efficiently and securely. The platform provides a user-friendly interface, ensuring you can manage your documents easily, reducing the time spent on paperwork while enhancing the accuracy of your submissions.

-

Is there a fee to use airSlate SignNow for application submission?

airSlate SignNow offers a cost-effective solution for users looking to eSign and manage their documents. While the platform may have subscription fees, the convenience and features offered can save you money by streamlining the process of completing the FIN 274, Additional Property Transfer Tax Application For Refund.

-

Can I track the status of my FIN 274 application using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your FIN 274, Additional Property Transfer Tax Application For Refund. You'll receive notifications regarding document activity, ensuring you're informed throughout the submission process.

-

What integrations does airSlate SignNow offer that can assist with my application?

airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your workflow while working on the FIN 274, Additional Property Transfer Tax Application For Refund. You can connect with platforms like Google Drive and Dropbox, making it easy to manage and access your documents from multiple sources.

-

Is airSlate SignNow secure for submitting sensitive information?

Absolutely! airSlate SignNow prioritizes the security of your data, employing advanced encryption protocols to protect your information while completing the FIN 274, Additional Property Transfer Tax Application For Refund. You can confidently submit sensitive documents, knowing that they are safeguarded against unauthorized access.

Get more for FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop

Find out other FIN 274, Additional Property Transfer Tax Application For Refund Complete This Form To Apply For A Refund Of The Additional Prop

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word