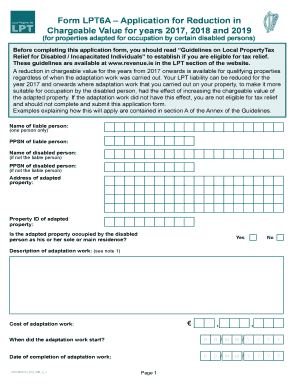

FORM LPT 6A Application for Reduction in Chargeable Value for Years , and Application for Reduction in Chargeable Value for Year 2019

Understanding the FORM LPT 6A Application For Reduction In Chargeable Value

The FORM LPT 6A Application For Reduction In Chargeable Value is a crucial document for property owners seeking to adjust the assessed value of their property for taxation purposes. This application is typically used to request a reduction in the chargeable value for specific years, which can lead to lower property taxes. Understanding the purpose and implications of this form is essential for anyone looking to manage their property tax liabilities effectively.

Steps to Complete the FORM LPT 6A Application

Completing the FORM LPT 6A Application requires careful attention to detail. Here are the general steps to follow:

- Gather necessary information, including property details and previous chargeable values.

- Complete the application form accurately, ensuring all fields are filled out as required.

- Provide any supporting documentation that may be necessary to substantiate your request.

- Review the completed form for accuracy before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Legal Use of the FORM LPT 6A Application

The FORM LPT 6A Application is legally binding when completed and submitted according to the relevant regulations. It must comply with local laws governing property taxation and reductions. Ensuring that the application meets all legal requirements is vital for its acceptance by tax authorities.

Required Documents for Submission

When submitting the FORM LPT 6A Application, certain documents may be required to support your claim. Commonly required documents include:

- Proof of ownership of the property.

- Previous assessment notices or tax bills.

- Any relevant appraisal reports or evidence of property value changes.

Having these documents ready will facilitate a smoother application process.

Eligibility Criteria for the FORM LPT 6A Application

To qualify for a reduction in chargeable value using the FORM LPT 6A, applicants must meet specific eligibility criteria. Generally, these may include:

- Ownership of the property in question.

- Demonstrating a valid reason for requesting a reduction, such as a decline in property value.

- Filing the application within the designated timeframe set by local tax authorities.

Form Submission Methods

The FORM LPT 6A Application can typically be submitted through various methods, ensuring convenience for applicants. Common submission methods include:

- Online submission through the official tax authority website.

- Mailing the completed application to the appropriate tax office.

- In-person submission at designated tax authority locations.

Choosing the right method will depend on personal preference and the specific requirements of the local tax authority.

Quick guide on how to complete form lpt 6a application for reduction in chargeable value for years 2017 2018 and 2019 application for reduction in chargeable 399855406

Prepare FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year effortlessly on any gadget

Web-based document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without any hindrances. Manage FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year on any device using the airSlate SignNow applications available for Android or iOS, and simplify any document-related task today.

How to edit and eSign FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year without any hassle

- Obtain FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form lpt 6a application for reduction in chargeable value for years 2017 2018 and 2019 application for reduction in chargeable 399855406

Create this form in 5 minutes!

How to create an eSignature for the form lpt 6a application for reduction in chargeable value for years 2017 2018 and 2019 application for reduction in chargeable 399855406

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the FORM LPT 6A Application For Reduction In Chargeable Value For Years?

The FORM LPT 6A Application For Reduction In Chargeable Value For Years is a crucial document designed for property owners seeking a reduction in their property's chargeable value. This application helps taxpayers to potentially lower their local property tax liabilities based on assessed value criteria.

-

How does the FORM LPT 6A application benefit my business?

Utilizing the FORM LPT 6A Application For Reduction In Chargeable Value For Years can signNowly benefit your business by reducing your local property tax obligations. By properly completing and submitting this application, you can optimize your financial expenditures and redirect those savings to other areas of your business.

-

What features does airSlate SignNow offer for processing the FORM LPT 6A application?

airSlate SignNow provides a user-friendly platform that streamlines the process of completing the FORM LPT 6A Application For Reduction In Chargeable Value For Years. Features include easy document uploads, electronic signatures, and real-time collaboration, making it easier to manage your applications efficiently.

-

Is there a cost associated with using airSlate SignNow for my FORM LPT 6A application?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans are tailored to suit different needs while providing essential features for completing the FORM LPT 6A Application For Reduction In Chargeable Value For Years and managing other document workflows.

-

How can I integrate airSlate SignNow with other tools I use for managing FORM LPT 6A applications?

airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your workflow management for the FORM LPT 6A Application For Reduction In Chargeable Value For Years. You can easily connect SignNow with your CRM, project management software, and other applications to streamline the process.

-

What steps are involved in submitting the FORM LPT 6A application through airSlate SignNow?

To submit the FORM LPT 6A Application For Reduction In Chargeable Value For Years through airSlate SignNow, first create and complete the application template. Next, utilize the eSignature feature to sign your document, and finally, submit it directly to the relevant authorities through the platform's submission options.

-

Can I track the status of my FORM LPT 6A application after submission?

Yes, airSlate SignNow allows you to track the status of your FORM LPT 6A Application For Reduction In Chargeable Value For Years after submission. Users receive notifications on the status changes, ensuring that you are always informed about your application process.

Get more for FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year

- Department of california highway patrol application for terminal inspection 2007 form

- Google reg 227 form

- Owneramp39s request to purge a manufactured home title coloradogov colorado form

- Co driver handbook form

- Co dr2219 form denvergov

- Ct motor carrier 2009 form

- Alabama public service commission ucr ingov form

- R229 form 2009

Find out other FORM LPT 6A Application For Reduction In Chargeable Value For Years , And Application For Reduction In Chargeable Value For Year

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document