Invesco Non Retirement Account Redemption Form 2013

What is the Invesco Non Retirement Account Redemption Form

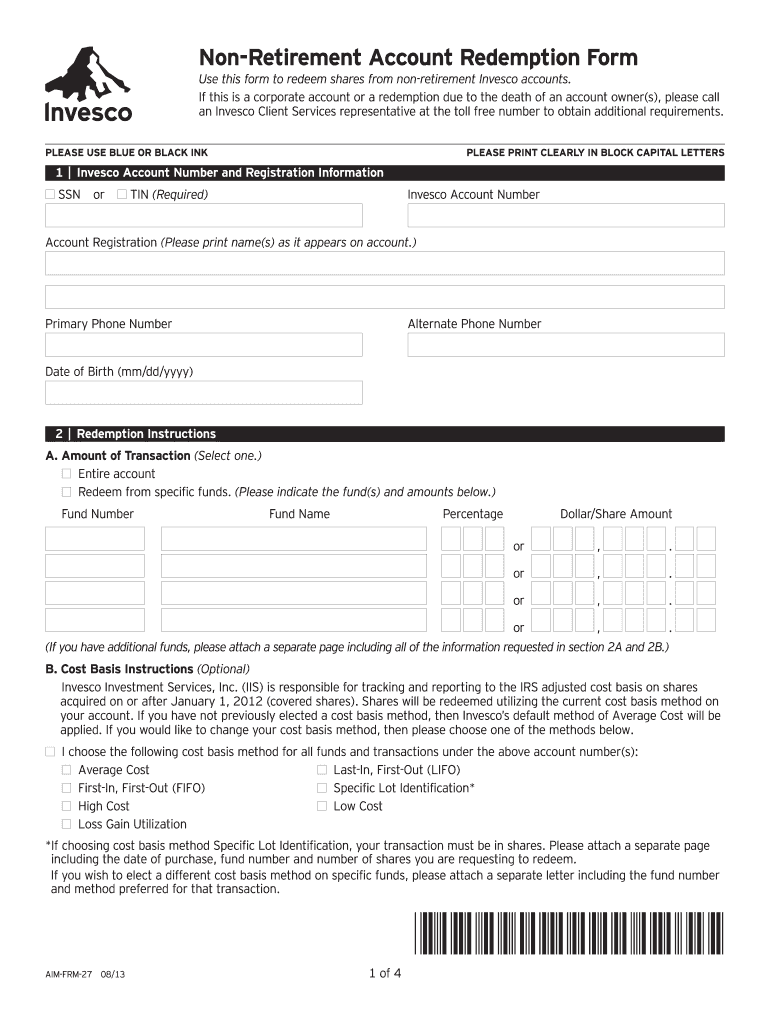

The Invesco Non Retirement Account Redemption Form is a specific document designed for investors who wish to redeem shares from their non-retirement accounts with Invesco. This form allows account holders to request the withdrawal of funds or the transfer of assets from their investment accounts. It is essential for ensuring that the redemption process is executed efficiently and in compliance with regulatory requirements. The form captures crucial information such as account details, the amount to be redeemed, and the method of payment, ensuring that all necessary data is collected for processing the request.

How to use the Invesco Non Retirement Account Redemption Form

Using the Invesco Non Retirement Account Redemption Form involves several straightforward steps. First, ensure that you have the correct form, which can typically be found on the Invesco website. Next, fill in your personal information, including your account number and contact details. Specify the amount you wish to redeem and choose your preferred method of payment, such as a check or electronic transfer. After completing the form, review all entries for accuracy before submitting it through the designated channels, whether online or via mail. Following these steps will help ensure a smooth redemption process.

Steps to complete the Invesco Non Retirement Account Redemption Form

Completing the Invesco Non Retirement Account Redemption Form requires careful attention to detail. Here are the steps to follow:

- Download the form from the Invesco website or obtain a physical copy.

- Fill in your personal and account information accurately, including your name, address, and account number.

- Indicate the amount you wish to redeem and select your payment method.

- Sign and date the form to validate your request.

- Submit the completed form as instructed, either online or by mailing it to the appropriate address.

Following these steps will help ensure that your redemption request is processed without delays.

Legal use of the Invesco Non Retirement Account Redemption Form

The Invesco Non Retirement Account Redemption Form is legally binding once it is completed and signed by the account holder. It complies with relevant financial regulations, ensuring that the redemption process adheres to industry standards. By using this form, investors confirm their intent to withdraw funds and authorize Invesco to process their request. It is important to understand that any inaccuracies or incomplete information may lead to processing delays or complications, which could affect the legality of the transaction.

Required Documents

When submitting the Invesco Non Retirement Account Redemption Form, it is essential to have certain documents ready to ensure a smooth process. Typically, you will need:

- A valid government-issued ID to verify your identity.

- Any previous account statements that may be relevant to the redemption.

- Proof of address, if not already on file with Invesco.

Having these documents prepared can help expedite the redemption process and ensure compliance with regulatory requirements.

Form Submission Methods

The Invesco Non Retirement Account Redemption Form can be submitted through various methods to accommodate different preferences. Investors can choose to submit the form online via the Invesco portal, which may offer a quicker processing time. Alternatively, the completed form can be mailed to the designated address provided by Invesco. Ensure that you follow the instructions carefully for your chosen submission method to avoid any delays in processing your redemption request.

Quick guide on how to complete redemption form

The simplest method to locate and endorse Invesco Non Retirement Account Redemption Form

Across the entirety of your organization, ineffective workflows surrounding document authorization can take up considerable working hours. Approving documents such as Invesco Non Retirement Account Redemption Form is an integral aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the organization’s overall efficacy. With airSlate SignNow, endorsing your Invesco Non Retirement Account Redemption Form is as straightforward and quick as possible. You will discover on this platform the most recent version of nearly any document. Even better, you can approve it instantly without needing to install external applications on your computer or printing hard copies.

How to acquire and validate your Invesco Non Retirement Account Redemption Form

- Browse through our collection by category or use the search bar to locate the document you require.

- Check the document preview by clicking on Learn more to confirm it’s the right one.

- Select Get form to begin editing immediately.

- Complete your document and incorporate any necessary information using the toolbar.

- Once finished, click the Sign feature to endorse your Invesco Non Retirement Account Redemption Form.

- Choose the signing option that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Hit Done to complete editing and move on to document-sharing options if required.

With airSlate SignNow, you possess everything necessary to manage your documents proficiently. You can locate, complete, edit, and even dispatch your Invesco Non Retirement Account Redemption Form within a single tab with no complications. Enhance your workflows with one, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct redemption form

FAQs

-

How do I redeem HDFC credit card reward points into cash or to pay credit card bill?

Another option for HDFC Diners club credit card is you can redeem your points as voucher and pay your bills. Instead of redeeming your points in hdfc net banking website it’s better to redeem as voucher and use it to pay bills. Below are the stepslogin to https://www.hdfcbankdinersclub.in/Select as GenerateVoucher on top right corner of page.3. In next page, you will be asked to Enter your credit card details and DOB. Fill the details and click on validate.4. After you enter all details, you can enter points to redeem and click on Generate Voucher button, you will be receiving your Voucher code to your email and SMS on your mobile number.5. Voucher code can be used to pay your bills, DTH, mobile, book flights on same website. It’s very useful. Try it out.Hope this helps.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

What is a mutual fund in simple terms? How can I invest in mutual funds?

What are Mutual Funds?In very simple terms, a mutual fund is you hiring an expert to invest your money. Every mutual fund has one or more fund manager. Fund managers are selected based on their knowledge in the domain a certain mutual fund wants to invest in. There are various types of mutual funds which are detailed below.For example, an equity mutual fund will have an equity expert. These experts invest or manage your money in return for a small fee. A mutual fund distributes the entire investment amount in small units (called units). Investors can buy these units instead of buying stocks directly.Process to Invest in Mutual FundsThe steps to Invest in mutual funds are as follows:1. Complete the KYC processKYC, short for Know Your Customer, is a mandatory process for anyone who wants to invest in mutual funds. The KYC form asks for basic details like your PAN No, address proof, email address, the name of your bank, your date of birth, et al. If you are investing through an intermediary, then they will request these details. The KYC process has become centralised and is now called central KYC. Read more here – What is CKYC?2. Provide Bank Account Details for RedemptionYou will be required to provide your bank account details so that the redemption of your mutual funds can be completed smoothly. Remember to enter the correct bank account details to ensure a smooth investment experience.3. Redeeming the Mutual FundIf you purchased the mutual funds through an AMC or a distributor then you can redeem the funds by sending a signed redemption formed to the AMC or the distributor. The form will ask for important details like your portfolio number, name, and scheme details. Fill all the details accurately and sign the redemption form before sending it to the AMC/Distributor. The proceeds from the redemption will be forwarded to your bank account in a few days.Alternatively, if you bought the mutual funds online, then you have the option to redeem them online through your investing app or through the AMC’s website. If you have invested through Groww, redemption is just a click with confirm button.4. TrackOnce you have invested in mutual funds, you must keep a track of your funds and how they are performing in the market. A good investor will always look for sudden changes and will track under-performance to review their investment. Acting too hastily in the event of market changes is not the best answer, but if a scheme’s return is below the benchmark consistently, it might be time for you to reconsider your investment in that scheme.You can track the performance of the funds you have invested in by checking the website of the mutual fund or other websites that provide daily updates regarding the performance of mutual funds. The AMC will also send out newsletters which include the performance of the funds and information related to your portfolio. Financial newspapers are also a rich source of information and they usually include the NAVs and sale price of different mutual funds.

-

Which is the best tax-saving mutual fund to invest in at the start of 2018 in India?

Which are Top 5 Best ELSS Tax Saving Mutual Funds 2018 to invest in India? How can we shortlist among the so many ELSS or Tax Saving Mutual Funds? Let me ease your work.Recently I wrote a post Top 10 Best SIP Mutual Funds to invest in India in 2018. In that post, I have not covered ELSS or Tax Saving Mutual Funds. Because yearly I used to write a separate for ELSS Funds. Hence, following the trend, I am writing this post.Before proceeding further, let us first recap the recommendations of 2017. Last year I wrote a post on this (Top 5 Best ELSS Tax Saving Mutual Funds to invest in 2017). Hence, it is mandatory to review the funds.You notice from above table that DSPBR Tax Saver Fund (G) has not beaten the benchmark since a year and ICICI Pru Long Term Equity Fund (G) since two years. However, when you look at their 5 years and 10 years returns, then easily beaten the benchmark.What are ELSS or Tax Saving Mutual Funds?ELSS (Equity Linked Savings Scheme) or Tax Saving Mutual Funds are the special funds which are meant for tax saving purpose under the Sec.80C of IT Act.Lock-in period of ELSS or Tax Saving Mutual Funds is 3 years. This is the lowest lock-in period among all tax saving instruments you invest. However, do remember that each investment (monthly SIP) is considered as a fresh investment. Hence, such each investment or monthly SIP must complete 3 years for liquidating. Let us say you started the monthly SIP on 1st January 2017, then the first SIP will be eligible for withdrawal after 3 years completion means after 1st January 2020. Same way 1st February 2017 SIP will be eligible for withdrawal after 1st February 2020. It will continue like that. Never be in wrong belief that one year SIP in ELSS funds means after 3 years can withdraw FULLY. You have to wait for fourth-year completion to completely withdraw the amount.ELSS falls under EEE tax rule (Exempt-Exempt-Exempt). There will be tax benefit during investment, no tax on whatever you earn and no tax at the time of withdrawal. This includes the divided declared from such funds are also tax-free in the hands of investors.The monthly investment required is as low as like Rs.500. There is no maximum limit. But the maximum tax benefit under Sec.80C is Rs.1.50,000 as of now.All ELSS or Tax Saving mutual funds will not have same investment mandate or never feel that they all invest in same stocks or sectors. Based on the fund mandate, they have rights to invest accordingly. Hence, you must understand the fund portfolio before jumping into investment.Never invest in ELSS or Tax Saving mutual funds with the intention that after 3 years you can easily come out investment with POSITIVE returns. This is the equity product. Hence, enter into such products only if you are ready to wait for more than 5 years or so.Tax Saving ALONE will not be your motive to invest in such products. You must have a proper financial goal in mind and along with that proper asset allocation a MUST. If you are unable to do that then it is a sheer waste of investing randomly.Why you have to invest in ELSS or Tax Saving Mutual Funds?# You must have long-term holding period to invest (strictly not less than 5 years).# You must invest in such funds only if you have a proper financial goal.# You must do the proper asset allocation between debt and equity or among other assets based on the time horizon of your financial goal.If the goal is below 5 years-Don’t touch equity product. Use the debt products of your choice like FDs, RDs or Debt Funds.If the goal is 5 years to 10 years-Allocate debt:equity in the ratio of 40:60.If the goal is more than 10 years-Allocate debt:equity in the ratio of 30:70.# You must have proper return expectation of your OWN before jumping into investment.# You must know what is your portfolio return expectation when you combine both debt and equity.# Finally, if you are feeling the shortfall in tax saving benefit under Sec.80C limit.Notice that I gave the priority of tax saving the LEAST. So understand first then jump into investment.Taxation of ELSS Tax Saving Mutual Funds for 2018ELSS or Tax Saving Mutual Funds are considered as equity mutual funds for tax treatment. Hence, they are taxed accordingly. I tried to explain the same in below image.The rate of taxation is as below for the current FY.Hope taxation part is clear to all of you. If you still have doubt, then refer my latest post “Mutual Fund Taxation FY 2017-18 and Capital Gain Tax Rates“.How I selected Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019?I will first screen the top 10 funds based on their returns to benchmark since inception. The funds who consistently beaten the benchmark are listed in that 10. Once I have the list in my hand, then I select the funds based on Risk-Return Analyzer.Many simply select the funds based on eye-catching returns. However, at what cost the fund is giving you a better return? To what extent it protects my investment during a downturn is what differentiate from good fund to bad fund.Again, I am not saying that these 5 funds alone be considered as “Top 5 Best ELSS Tax Saving Mutual Funds 2018”. There may be fewer other funds, which are good to compete with these funds. However, I may be biased towards few Mutual Fund Companies (purely on their size and how long they are in MF business in India). Below are the metrics I used to arrive at finally selecting the funds.If the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.Beta-Volatility measure and tell how much the fund changes for a given change in the Index. Lower the beta, lower the volatility. Hence, your fund must have lower beta.Standard deviation-It tells us how for a given set of returns, how much do fund returns deviate from the average. Lower the standard deviation, lower the volatility. Hence, your fund must have lower beta.Alpha-It is the risk-adjusted measure. By taking risks, how much the fund manager generated the return over the benchmark. Higher the alpha, higher the outperformance of the fund.Sharpe Ratio-It is the risk-adjusted measure. Higher the Sharpe ratio, better is the performance.Sortino Ratio-It is the risk-adjusted measure. Higher the Sortino ratio, better is the performance.Treynor Ratio-It is also be known as reward ratio. Higher the Treynor ratio, better is the performance.Information Ratio-This is calculated by average excess return obtained compared to a benchmark and divides it by the standard deviation of excess returns. Higher the information ratio, higher the consistency in beating the benchmark.Omega Ratio- It is a risk-return performance measure of an investment asset.Downside deviation-This is also be called as BAD RISK.Upside potential-This is exactly the opposite of Downside deviation.R-squared- It is a measure of how correlated the fund’s NAV movement is with its index.SIP Returns-For how many times the fund’s returns are above the index when we invest in SIP.Lump Sum Returns-For how many times the fund’s returns are above the index when we invest in a lump sum.Below are my Top 5 Best ELSS Tax Saving Mutual Funds 2018Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019Below are the 10 ELSS Tax Saving Mutual Funds under my radar. Based on these I shortlisted Top 5 Best ELSS Tax Saving Mutual Funds 2018-2019.Axis Long Term Equity Fund (Age 7 Yrs)Birla Sun Life Tax Plan (Age 18 Yrs)Birla Sun Life Tax Relief 96 (Age 21 Yrs)DSPBR Tax Saver Fund (Age 10 Yrs)Franklin India Taxshield (Age 18 Yrs)HDFC Long Term Advantage Fund (Age 16 Yrs)ICICI Prudential Long Term Equity Fund (Age 18 Yrs)IDFC Tax Advantage (Age 9 Yrs)L&T Tax Advantage Fund (Age 11 Yrs)Tata India Tax Saving Fund (Age 21 Yrs)Among these 1o funds, I have selected the Top 5 and listing them as below.You noticed that I did only one change. I removed ICICI Prudential Long Term Equity Fund due to it’s consistently 2 years underperformance to it’s benchmark and added Tata India Tax Saving Fund.However, those who are investing in ICICI Prudential Long Term Equity Fund may continue as usual for few more days by keeping an eye on the fund performance. For fresh investors, I am suggesting Tata India Tax Saving Fund over ICICI Prudential Long Term Equity Fund.Let me know if you have any doubts.Refer my other posts related to Mutual Funds of 2018Top 10 Best SIP Mutual Funds to invest in India in 2018Top and Best Debt Mutual Funds to invest in 2018

Create this form in 5 minutes!

How to create an eSignature for the redemption form

How to generate an eSignature for your Redemption Form online

How to generate an eSignature for your Redemption Form in Chrome

How to generate an electronic signature for signing the Redemption Form in Gmail

How to make an eSignature for the Redemption Form from your smart phone

How to create an electronic signature for the Redemption Form on iOS devices

How to make an electronic signature for the Redemption Form on Android

People also ask

-

What is the Invesco Non Retirement Account Redemption Form?

The Invesco Non Retirement Account Redemption Form is a document used by investors to request the withdrawal of funds from their Invesco non-retirement accounts. This form ensures that all necessary details are captured to process your redemption quickly and accurately.

-

How do I complete the Invesco Non Retirement Account Redemption Form?

To complete the Invesco Non Retirement Account Redemption Form, you will need to provide your account information, specify the amount to redeem, and sign the form. It's essential to double-check your details to avoid any delays in processing your request.

-

Are there any fees associated with the Invesco Non Retirement Account Redemption Form?

Typically, there are no fees for submitting the Invesco Non Retirement Account Redemption Form; however, it's advisable to check with Invesco for any potential charges that may apply to your specific account type or redemption amount.

-

How long does it take to process the Invesco Non Retirement Account Redemption Form?

Processing times for the Invesco Non Retirement Account Redemption Form may vary, but generally, you can expect a turnaround of a few business days once the form is submitted. Factors such as the method of redemption (electronic or check) can influence this time frame.

-

Can I submit the Invesco Non Retirement Account Redemption Form electronically?

Yes, airSlate SignNow allows you to submit the Invesco Non Retirement Account Redemption Form electronically, making the process faster and more convenient. By using our eSigning feature, you can complete and send your form from anywhere, at any time.

-

What are the benefits of using airSlate SignNow for the Invesco Non Retirement Account Redemption Form?

Using airSlate SignNow for the Invesco Non Retirement Account Redemption Form offers a streamlined, efficient solution for document signing and submission. Our platform ensures that your forms are securely stored and can be easily tracked, reducing the hassle of manual processes.

-

Is airSlate SignNow compatible with multiple devices for the Invesco Non Retirement Account Redemption Form?

Absolutely! airSlate SignNow is designed to be compatible with various devices, including desktops, tablets, and smartphones, allowing you to fill out and eSign the Invesco Non Retirement Account Redemption Form wherever you are.

Get more for Invesco Non Retirement Account Redemption Form

Find out other Invesco Non Retirement Account Redemption Form

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer