How Do I Get an Exempt Organization Certificate 2011-2026

What is an exempt organization certificate?

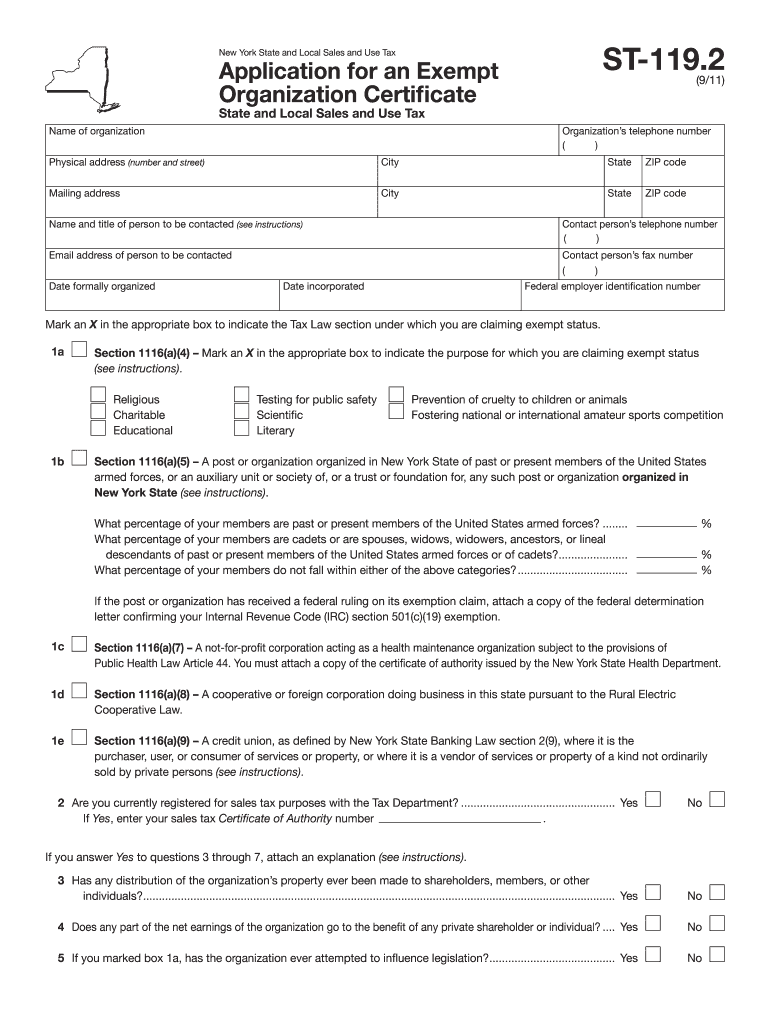

An exempt organization certificate is a document that allows qualifying organizations to operate without paying certain taxes, such as sales tax. This certificate is crucial for non-profit entities, as it verifies their tax-exempt status under federal and state laws. Organizations that typically qualify include charities, educational institutions, and religious groups. By obtaining this certificate, these organizations can make purchases without incurring sales tax, which helps them allocate more resources towards their missions.

How to obtain an exempt organization certificate

To obtain an exempt organization certificate, organizations must first determine their eligibility based on state and federal guidelines. The process generally involves the following steps:

- Complete the necessary application form, which may vary by state.

- Gather required documentation, such as proof of tax-exempt status from the IRS.

- Submit the application to the appropriate state agency, which may include the Department of Revenue or a similar entity.

- Wait for approval, which can take several weeks depending on the state.

Once approved, the organization will receive the certificate, allowing them to make tax-exempt purchases.

Key elements of the exempt organization certificate

When filling out the exempt organization certificate, certain key elements must be included to ensure its validity:

- Organization Name: The legal name of the organization applying for the certificate.

- Tax Identification Number: The organization's Employer Identification Number (EIN) issued by the IRS.

- Address: The physical address of the organization.

- Type of Organization: A description of the organization's purpose and activities.

- Signature: An authorized representative must sign the certificate to validate it.

Completing these elements accurately is essential for the certificate to be accepted by vendors and state authorities.

Legal use of the exempt organization certificate

The exempt organization certificate serves as legal proof of an organization's tax-exempt status. Organizations must use this certificate appropriately to avoid penalties. Misuse, such as using the certificate for personal purchases or by non-qualified entities, can lead to legal repercussions. It is important for organizations to educate their staff on the proper use of the certificate and to maintain accurate records of all transactions made under this exemption.

Required documents for the application

When applying for an exempt organization certificate, organizations typically need to submit several documents, including:

- IRS Determination Letter: A letter confirming the organization's tax-exempt status.

- Bylaws or Articles of Incorporation: Documentation that outlines the organization's structure and purpose.

- Financial Statements: Recent financial statements may be required to demonstrate the organization's operations.

- Identification Documents: Proof of identity for the individuals submitting the application.

Having these documents ready can streamline the application process and help ensure a successful outcome.

Eligibility criteria for the exempt organization certificate

Eligibility for an exempt organization certificate varies by state but generally includes the following criteria:

- The organization must be recognized as a tax-exempt entity under the Internal Revenue Code.

- The organization should operate primarily for charitable, educational, religious, or similar purposes.

- The organization must not engage in activities that benefit private interests or individuals.

Understanding these criteria is essential for organizations seeking to obtain and maintain their exempt status.

Quick guide on how to complete exempt organization certificate form

Your assistance manual on how to prepare your How Do I Get An Exempt Organization Certificate

If you’re curious about how to finalize and submit your How Do I Get An Exempt Organization Certificate, here are some brief instructions on how to simplify tax filing.

Initially, you simply need to create your airSlate SignNow account to alter your approach to managing paperwork online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms easily. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and go back to update details as necessary. Streamline your tax processes with advanced PDF manipulation, eSigning, and user-friendly sharing.

Adhere to the following steps to complete your How Do I Get An Exempt Organization Certificate in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our catalog to access any IRS tax form; explore different versions and schedules.

- Click Get form to load your How Do I Get An Exempt Organization Certificate in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to apply your legally-recognized eSignature (if needed).

- Review your document and amend any mistakes.

- Store changes, print your version, send it to your recipient, and save it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and postpone refunds. Additionally, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do I collect sales tax when selling to a non-profit organization?

Why is this question asked under the topic of “nonprofit fundaising?” When nonprofits receive funds in support of their work, these are donations and the nature of that transaction isn’t that of a sale nor is there any sale tax applicable. What is it that you are selling?The answer to that question doesn’t really matter. As you know, merchants in the U.S list the price of merchandise pre-tax, when it is on display online or in a store, and then add on any applicable state and local sales tax on top of that price before asking for payment. The payment that the customer provides at the Point of Sale should already account for any applicable sales tax.Many nonprofit organizations are tax exempt under section 501(c)3 of the IRS code. This exempts them from paying the pro forma taxes and fees that for-profit organizations must pay related to things like postage, income and investment products. No actual people or organizations in the U.S. are exempted from sales tax per the same U.S. code because sales taxes are subnational only and are levied at the discretion of the 50 states and their constituent municipalities. There is no federal sales tax from which nonprofit organizations could be exempted.

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

-

Do I need to fill out form 8843 if I'm not exempt but also do not meet the substantial presence test?

It would not be a problem to file 1040-NR without the 8843. After all, the purpose of the 8843 is to exclude days of presence in the USA for the purposes of the Substantial Presence Test. If none of the days during the tax year qualifies for exclusion do not attach the form.

Create this form in 5 minutes!

How to create an eSignature for the exempt organization certificate form

How to generate an eSignature for the Exempt Organization Certificate Form in the online mode

How to make an eSignature for the Exempt Organization Certificate Form in Google Chrome

How to make an eSignature for putting it on the Exempt Organization Certificate Form in Gmail

How to make an electronic signature for the Exempt Organization Certificate Form right from your smart phone

How to create an electronic signature for the Exempt Organization Certificate Form on iOS

How to make an electronic signature for the Exempt Organization Certificate Form on Android devices

People also ask

-

What is an Exempt Organization Certificate?

An Exempt Organization Certificate is a document that certifies an entity's tax-exempt status under IRS regulations. Understanding how to obtain this certificate is crucial for nonprofits and organizations looking to receive donations and grants. Knowing how do I get an Exempt Organization Certificate can help streamline your funding applications and tax reporting.

-

How do I get an Exempt Organization Certificate through airSlate SignNow?

To get an Exempt Organization Certificate using airSlate SignNow, you can easily create and sign your application digitally. Start by accessing our user-friendly platform, where you can upload your documents, fill out the necessary forms, and get them eSigned securely. This simplifies the process and ensures you understand how do I get an Exempt Organization Certificate efficiently.

-

What are the benefits of using airSlate SignNow for obtaining an Exempt Organization Certificate?

Using airSlate SignNow for your Exempt Organization Certificate offers several advantages, including quick document turnaround and enhanced security. Our platform allows you to manage and track your documents in one place, ensuring that you never lose track of important paperwork. This makes it easier to understand how do I get an Exempt Organization Certificate while maintaining compliance.

-

Is airSlate SignNow affordable for small nonprofits seeking an Exempt Organization Certificate?

Absolutely! airSlate SignNow provides a cost-effective solution for small nonprofits that need to obtain an Exempt Organization Certificate. We offer various pricing plans to fit different budgets, ensuring that even small organizations can access the tools they need. This affordability helps you focus on your mission while figuring out how do I get an Exempt Organization Certificate.

-

Can I integrate airSlate SignNow with other software to manage my Exempt Organization Certificate applications?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage your Exempt Organization Certificate applications more efficiently. Whether you use CRM systems, accounting software, or other tools, our integrations help streamline your workflow. Understanding how do I get an Exempt Organization Certificate becomes simpler when you leverage these integrations.

-

What features does airSlate SignNow offer for managing documents related to Exempt Organization Certificates?

airSlate SignNow offers robust features such as document templates, secure eSigning, and automated workflows to facilitate the management of documents related to Exempt Organization Certificates. These features help reduce administrative burdens and improve efficiency. With airSlate SignNow, you’ll quickly learn how do I get an Exempt Organization Certificate while ensuring accuracy in your submissions.

-

Is technical support available for users needing help with Exempt Organization Certificates?

Yes, airSlate SignNow provides comprehensive technical support to assist users with any questions or challenges related to obtaining their Exempt Organization Certificate. Our knowledgeable support team is available to guide you through the process, ensuring you have all the resources necessary. This support is invaluable when figuring out how do I get an Exempt Organization Certificate.

Get more for How Do I Get An Exempt Organization Certificate

Find out other How Do I Get An Exempt Organization Certificate

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast