Alabama Department of Revinue Website Form

What is the Alabama Department of Revenue Website

The Alabama Department of Revenue website serves as a central hub for individuals and businesses to access essential tax information and services. This official platform provides resources related to state taxes, including income tax, sales tax, and property tax. Users can find forms, guidelines, and updates regarding tax regulations and compliance. The website is designed to facilitate easy navigation, ensuring that users can quickly locate the information they need.

How to Use the Alabama Department of Revenue Website

To effectively use the Alabama Department of Revenue website, start by familiarizing yourself with its main sections. The homepage typically features links to popular services, such as filing taxes, checking refund status, and accessing forms. Users can also utilize the search function to find specific topics or documents. For those needing assistance, the website often includes FAQs, contact information, and resources for tax professionals.

Steps to Complete the Alabama Department of Revenue Website Forms

Completing forms on the Alabama Department of Revenue website involves several straightforward steps:

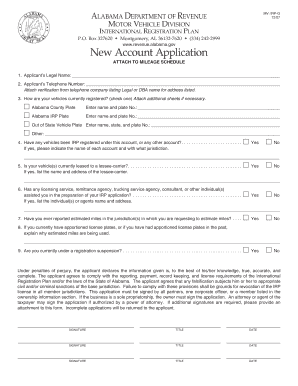

- Identify the specific form you need based on your tax situation.

- Download the form or access it directly on the website.

- Fill out the required fields accurately, ensuring all information is current.

- Review the form for completeness and correctness.

- Submit the form electronically through the website or print it for mailing.

Legal Use of the Alabama Department of Revenue Website

The Alabama Department of Revenue website is legally recognized for tax-related transactions. Forms submitted electronically are considered valid as long as they comply with state and federal regulations. It is essential to ensure that all submissions meet the legal requirements to avoid penalties. Utilizing the website’s resources can help ensure compliance with relevant laws and guidelines.

Required Documents for Alabama Department of Revenue Forms

When completing forms for the Alabama Department of Revenue, specific documents may be required depending on the type of form being submitted. Commonly required documents include:

- Proof of income, such as W-2s or 1099s.

- Identification, including Social Security numbers.

- Previous tax returns for reference.

- Documentation for any deductions or credits claimed.

Form Submission Methods

Users can submit forms to the Alabama Department of Revenue through various methods, including:

- Online submission via the department's website.

- Mailing printed forms to the designated address.

- In-person submission at local revenue offices.

Each method has its own processing times and requirements, so it is advisable to choose the method that best fits your needs.

Quick guide on how to complete alabama department of revinue website

Complete Alabama Department Of Revinue Website seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed files, as you can locate the necessary template and safely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Alabama Department Of Revinue Website on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to alter and electronically sign Alabama Department Of Revinue Website effortlessly

- Locate Alabama Department Of Revinue Website and click on Get Form to begin.

- Utilize the resources we offer to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which only takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Alabama Department Of Revinue Website and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revinue website

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What services does the Alabama Revenue Department of Revenue provide?

The Alabama Revenue Department of Revenue offers a range of services, including tax collection, issuance of licenses, and enforcement of tax laws. It plays a crucial role in ensuring compliance among businesses and individuals. Leveraging airSlate SignNow can streamline document management related to these services.

-

How can airSlate SignNow assist with paperwork related to the Alabama Revenue Department of Revenue?

airSlate SignNow simplifies the process of sending and electronically signing documents required by the Alabama Revenue Department of Revenue. By providing a secure, easy-to-use platform, businesses can ensure their documents are promptly processed and submitted. This enhances efficiency and compliance with state regulations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans designed to accommodate different business sizes and budgets. Each plan includes essential features to facilitate eSigning and document management. Businesses dealing with the Alabama Revenue Department of Revenue will find that investing in airSlate SignNow is a cost-effective solution to streamline their processes.

-

Can airSlate SignNow be integrated with software used by the Alabama Revenue Department of Revenue?

Yes, airSlate SignNow can be integrated with various software solutions commonly used in tax preparation and accounting. This includes systems that interact directly with the Alabama Revenue Department of Revenue. Such integrations can help maintain workflow efficiency and ensure that your documents are seamlessly managed.

-

What benefits does airSlate SignNow provide for businesses interacting with the Alabama Revenue Department of Revenue?

Utilizing airSlate SignNow offers numerous benefits for businesses, including reduced turnaround times for document processing and improved accuracy in submissions. This can lead to fewer compliance issues with the Alabama Revenue Department of Revenue. Additionally, electronic signatures enhance the professional appearance of document submissions.

-

Is airSlate SignNow secure for handling sensitive documents required by the Alabama Revenue Department of Revenue?

Absolutely. airSlate SignNow employs robust security measures, including encryption and secure storage, ensuring that sensitive documents related to the Alabama Revenue Department of Revenue are well-protected. Businesses can confidently manage their documents without fear of data bsignNowes.

-

How does airSlate SignNow enhance collaboration for teams dealing with the Alabama Revenue Department of Revenue?

airSlate SignNow enhances collaboration by allowing multiple team members to access, edit, and eSign documents simultaneously. This ensures that everyone involved in compliance with the Alabama Revenue Department of Revenue is on the same page. Effective collaboration can drastically improve the efficiency of your document processes.

Get more for Alabama Department Of Revinue Website

- Stotts application form

- Notice to financial institution form georgia

- Liberal arts math semester 2 review answers form

- Case based discussion template 223146571 form

- Form ftb 3582payment voucher for individual e filed returns form ftb 3582payment voucher for individual e filed returns

- Hospitality contract template form

- Horse transport contract template 787752091 form

- Host contract template form

Find out other Alabama Department Of Revinue Website

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document