20 OFFICIAL USE ONLY PA Department of Revenue Homepage 2020

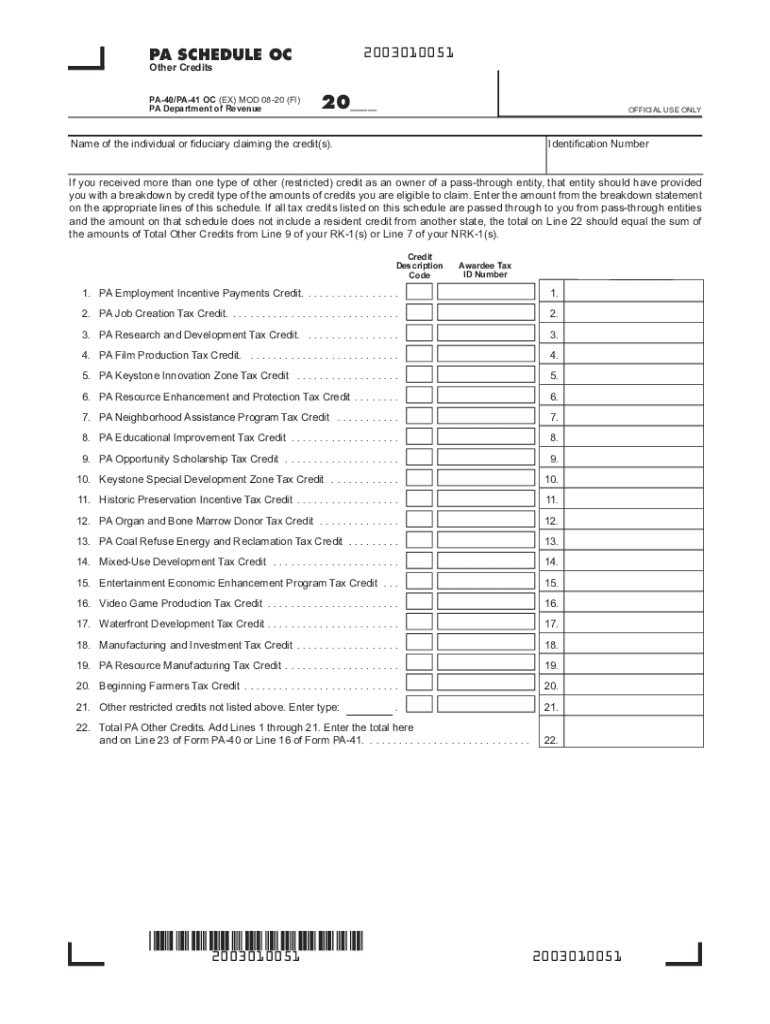

Understanding the Pennsylvania OC Form

The Pennsylvania OC form, often referred to as the PA OC, is essential for individuals seeking to claim various tax credits. This form is specifically designed to report other credits that may apply to your tax situation. Understanding its purpose and the information it requires is crucial for accurate filing. The form is part of the broader Pennsylvania Department of Revenue system, which aims to streamline tax reporting and compliance for residents.

Steps to Complete the Pennsylvania OC Form

Completing the Pennsylvania OC form involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documentation related to your income, deductions, and any credits you plan to claim.

- Fill Out the Form: Carefully input your information into the designated fields, ensuring that all entries are accurate and complete.

- Review for Errors: Double-check your entries for any mistakes or omissions that could affect your tax return.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal Use of the Pennsylvania OC Form

The Pennsylvania OC form is legally binding when completed accurately and submitted according to state regulations. It is important to adhere to the guidelines set forth by the Pennsylvania Department of Revenue to avoid penalties. The form must be signed and dated by the taxpayer or authorized representative to validate its legitimacy.

Filing Deadlines for the Pennsylvania OC Form

Timely submission of the Pennsylvania OC form is crucial to avoid late fees and penalties. Generally, the form must be filed by the tax deadline, which is typically April 15th for individuals. However, extensions may be available under certain circumstances. Always check the Pennsylvania Department of Revenue website for the most current deadlines.

Required Documents for the Pennsylvania OC Form

When completing the Pennsylvania OC form, certain documents are required to support your claims. These may include:

- Income statements, such as W-2s or 1099s

- Documentation for any credits you are claiming

- Previous tax returns for reference

Having these documents ready can simplify the process and help ensure that your form is completed accurately.

Penalties for Non-Compliance with the Pennsylvania OC Form

Failure to file the Pennsylvania OC form on time or inaccuracies in the submitted information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the implications of non-compliance and to take proactive steps to ensure that your form is filed correctly and punctually.

Quick guide on how to complete 20 official use only pa department of revenue homepage

Effortlessly Prepare 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Edit and eSign 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage without Stress

- Locate 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, either by email, text (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 20 official use only pa department of revenue homepage

Create this form in 5 minutes!

How to create an eSignature for the 20 official use only pa department of revenue homepage

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to pa oc?

airSlate SignNow is a powerful eSignature platform that enables businesses to efficiently send and eSign documents. With its intuitive interface and rich features, it streamlines the document signing process, making it an ideal solution for those needing a reliable pa oc function.

-

What are the key features of airSlate SignNow for pa oc?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage. These functionalities enhance the pa oc experience by ensuring that documents are easily accessible and efficiently managed throughout the signing process.

-

How much does airSlate SignNow cost for pa oc users?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective option for pa oc. You can choose from monthly or annual subscriptions, with no hidden fees, ensuring that you only pay for the features you utilize.

-

Can airSlate SignNow integrate with other tools for better pa oc management?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and more. These integrations enhance the pa oc capabilities by allowing users to automate workflows and centralize documents across different platforms.

-

What are the benefits of using airSlate SignNow for my pa oc needs?

Using airSlate SignNow simplifies the signing process, reducing turnaround time and improving efficiency for pa oc tasks. Its user-friendly interface allows even non-technical users to manage document workflows, enhancing business productivity.

-

Is airSlate SignNow secure for handling pa oc documents?

Absolutely, airSlate SignNow employs advanced security measures such as encryption and secure access controls to safeguard your pa oc documents. Compliance with industry standards ensures that your sensitive data remains protected at all times.

-

How can businesses benefit from the mobile capabilities of airSlate SignNow for pa oc?

The mobile app for airSlate SignNow allows users to send and sign documents on-the-go, making it perfect for pa oc. This flexibility means you can manage document workflows efficiently, whether in the office or out in the field.

Get more for 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage

- Az hunt application form

- Az change business address form

- To application for registration of foreign llc form

- Tulare county fictitious business name form

- Hcd 433a form 101283243

- Minimum financial requirements worksheet form 2602372

- Re examination application california board of barbering and barbercosmo ca form

- California customer disclosure form

Find out other 20 OFFICIAL USE ONLY PA Department Of Revenue Homepage

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors