PA Schedule OC Other Credits PA 40PA 41 OC 2022-2026

What is the PA Schedule OC Other Credits PA 40PA 41 OC

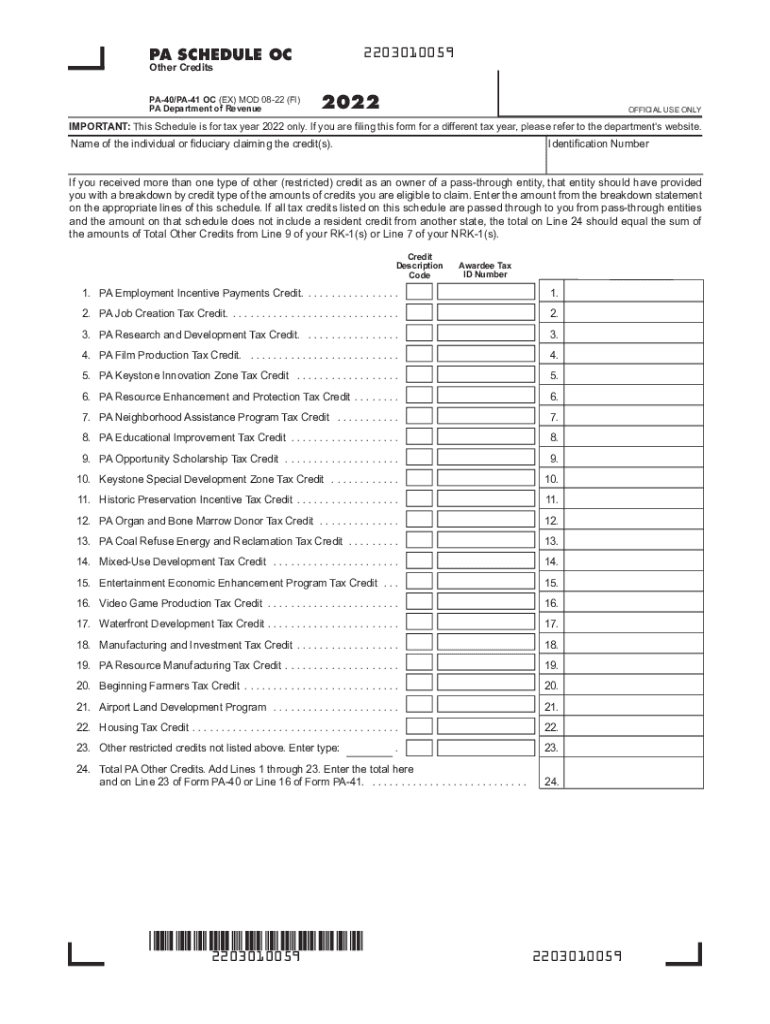

The PA Schedule OC is a crucial form for Pennsylvania taxpayers, specifically designed to report other credits that may not be included in the standard PA-40 form. This schedule allows taxpayers to claim various credits that can reduce their overall tax liability. Common credits reported on this form include those related to education, business investments, and specific deductions that apply to unique financial situations. Understanding the PA Schedule OC is essential for ensuring that taxpayers maximize their eligible credits and comply with state tax regulations.

How to use the PA Schedule OC Other Credits PA 40PA 41 OC

Using the PA Schedule OC involves several steps to ensure accurate reporting of other credits. First, gather all necessary documentation that supports your claims for credits. This may include receipts, tax forms, and any relevant financial statements. Next, carefully fill out the PA Schedule OC by entering the appropriate information in the designated fields. Ensure that each credit is clearly identified and that calculations are accurate. Once completed, the schedule should be attached to your PA-40 form when filing your state taxes.

Steps to complete the PA Schedule OC Other Credits PA 40PA 41 OC

Completing the PA Schedule OC requires attention to detail. Follow these steps:

- Collect all relevant documents and information related to the credits you intend to claim.

- Begin filling out the form, starting with your personal information at the top.

- List each credit you are claiming, ensuring to include the correct amounts and any necessary supporting details.

- Double-check all entries for accuracy, particularly calculations.

- Attach the completed PA Schedule OC to your PA-40 form before submission.

Key elements of the PA Schedule OC Other Credits PA 40PA 41 OC

Several key elements are essential for understanding the PA Schedule OC. These include:

- Taxpayer Information: This section requires your personal details, including name, address, and Social Security number.

- Credit Listings: A detailed list of all credits claimed, including the type of credit and the amount.

- Supporting Documentation: Any necessary documentation that validates your claims for credits must be attached.

- Signature: The form must be signed and dated to validate the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the PA Schedule OC. Typically, Pennsylvania state tax returns, including the PA-40 and its schedules, are due on April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any changes to deadlines that may occur due to state regulations or specific circumstances.

Eligibility Criteria

Eligibility for claiming credits on the PA Schedule OC varies depending on the specific credit. Generally, taxpayers must meet certain income thresholds, residency requirements, and other criteria established by the Pennsylvania Department of Revenue. It is crucial to review the specific guidelines for each credit to ensure that you qualify before claiming them on your tax return.

Quick guide on how to complete pa schedule oc other credits pa 40pa 41 oc

Complete PA Schedule OC Other Credits PA 40PA 41 OC effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage PA Schedule OC Other Credits PA 40PA 41 OC on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to alter and eSign PA Schedule OC Other Credits PA 40PA 41 OC effortlessly

- Locate PA Schedule OC Other Credits PA 40PA 41 OC and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow takes care of your document management needs with just a few clicks on any device of your choice. Modify and eSign PA Schedule OC Other Credits PA 40PA 41 OC and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule oc other credits pa 40pa 41 oc

Create this form in 5 minutes!

How to create an eSignature for the pa schedule oc other credits pa 40pa 41 oc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA Schedule OC?

The PA Schedule OC is a document used for reporting and reconciling income generated by various sources in Pennsylvania. Understanding how to accurately complete the PA Schedule OC is crucial for ensuring compliance and maximizing your tax benefits.

-

How can airSlate SignNow help with the PA Schedule OC?

With airSlate SignNow, you can easily upload, sign, and send your PA Schedule OC electronically. This streamlines the process, ensuring that your tax documents are handled efficiently and securely without the hassle of paper trails.

-

What features does airSlate SignNow offer for handling the PA Schedule OC?

airSlate SignNow provides features such as customizable templates, in-person signing, and secure cloud storage. These tools facilitate a smooth workflow for managing your PA Schedule OC while ensuring all data remains confidential and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the PA Schedule OC?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. The costs are designed to provide a cost-effective solution for managing documents like the PA Schedule OC, giving you value for your investment.

-

Can I integrate airSlate SignNow with my existing systems for managing the PA Schedule OC?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, allowing you to manage the PA Schedule OC alongside your other business tools. This helps streamline operations and maintain consistency in document handling.

-

What benefits does using airSlate SignNow provide for the PA Schedule OC?

Using airSlate SignNow for the PA Schedule OC provides benefits such as increased efficiency, reduced turnaround time, and improved accuracy in document handling. These advantages ultimately help you meet critical deadlines and enhance operational productivity.

-

How secure is my information when using airSlate SignNow for the PA Schedule OC?

Security is a top priority at airSlate SignNow. Your information regarding the PA Schedule OC is protected through state-of-the-art encryption and secure access protocols, ensuring that your sensitive data is safeguarded at all times.

Get more for PA Schedule OC Other Credits PA 40PA 41 OC

Find out other PA Schedule OC Other Credits PA 40PA 41 OC

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter