Consumer Use Tax Nevada 2003

What is the Consumer Use Tax Nevada

The Consumer Use Tax in Nevada is a tax imposed on the storage, use, or consumption of tangible personal property in the state. This tax applies to items purchased outside of Nevada for use within the state when sales tax was not paid at the time of purchase. It ensures that consumers contribute to state revenue in a manner similar to sales tax, helping to fund public services and infrastructure.

How to use the Consumer Use Tax Nevada

To utilize the Consumer Use Tax in Nevada, individuals and businesses must report and pay the tax on items they have purchased without paying sales tax. This includes goods bought online, from out-of-state vendors, or other transactions where sales tax was not collected. Taxpayers need to accurately calculate the amount owed based on the purchase price of the items and report this on the appropriate forms.

Steps to complete the Consumer Use Tax Nevada

Completing the Consumer Use Tax return involves several key steps:

- Gather all receipts and documentation for items purchased without sales tax.

- Determine the total value of these purchases to calculate the tax owed.

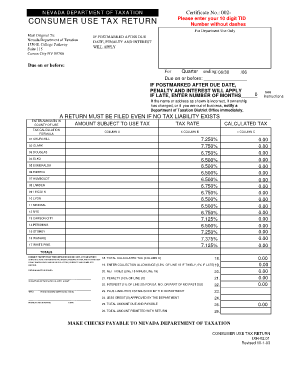

- Obtain the Nevada Department of Taxation Consumer Use Tax Return form.

- Fill out the form with accurate information, including your personal or business details and the total tax amount.

- Submit the completed form either online, by mail, or in-person, as per the guidelines provided by the Nevada Department of Taxation.

Legal use of the Consumer Use Tax Nevada

The legal use of the Consumer Use Tax in Nevada is governed by state tax laws. Taxpayers are required to comply with these laws by accurately reporting their taxable purchases and paying the appropriate tax. It is essential to maintain records of purchases and tax payments to ensure compliance and avoid potential penalties.

Required Documents

When filing the Consumer Use Tax return in Nevada, taxpayers must provide certain documents, including:

- Receipts or invoices for items purchased without sales tax.

- The completed Consumer Use Tax Return form.

- Any additional documentation that supports the tax calculations, such as shipping invoices or order confirmations.

Filing Deadlines / Important Dates

Filing deadlines for the Consumer Use Tax return in Nevada typically align with the state's tax calendar. Taxpayers should be aware of the following important dates:

- The annual filing deadline is generally the last day of the month following the end of the tax year.

- Quarterly filings may be required for businesses, with deadlines on the last day of the month following each quarter.

Penalties for Non-Compliance

Failure to comply with the Consumer Use Tax regulations in Nevada can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which is charged from the due date until the tax is paid.

- Potential legal action for persistent non-compliance, leading to further financial consequences.

Quick guide on how to complete consumer use tax nevada

Complete Consumer Use Tax Nevada effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Consumer Use Tax Nevada on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Consumer Use Tax Nevada without hassle

- Find Consumer Use Tax Nevada and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes requiring reprints. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Consumer Use Tax Nevada and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct consumer use tax nevada

Create this form in 5 minutes!

How to create an eSignature for the consumer use tax nevada

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is a Nevada Department of Taxation consumer use tax return?

The Nevada Department of Taxation consumer use tax return is a form that individuals or businesses use to report and pay consumer use tax on taxable purchases made outside of Nevada. This ensures that all transactions comply with state tax regulations. It's crucial for maintaining good standing with the Nevada tax authorities.

-

How can airSlate SignNow assist with filing a Nevada Department of Taxation consumer use tax return?

airSlate SignNow facilitates the process of signing and submitting your Nevada Department of Taxation consumer use tax return smoothly. With an intuitive interface, you can easily prepare documents, gather electronic signatures, and store everything securely. This saves you time and reduces the hassle of traditional document management.

-

What are the costs associated with using airSlate SignNow for tax returns?

Using airSlate SignNow for processing your Nevada Department of Taxation consumer use tax return is cost-effective with various pricing plans suitable for businesses of all sizes. Our competitive pricing starts at an affordable monthly rate, allowing you to choose a package that fits your needs. The investment is minimal compared to the time and resources saved.

-

Can I integrate airSlate SignNow with other tax software for filing my Nevada Department of Taxation consumer use tax return?

Yes, airSlate SignNow offers seamless integration with various tax software solutions, enhancing your ability to file your Nevada Department of Taxation consumer use tax return efficiently. This integration allows for better data management and automates parts of the filing process. It enables you to streamline operations and ensure compliance with tax regulations.

-

What features does airSlate SignNow offer that simplify the document signing process?

airSlate SignNow provides several features designed to simplify the document signing process, including templates, in-person signing, and customizable workflows for your Nevada Department of Taxation consumer use tax return. These features ensure all necessary information is included and that documents are easy to manage. Additionally, the platform allows for real-time tracking of document status.

-

Are there any benefits of using airSlate SignNow for compliance with the Nevada Department of Taxation?

Using airSlate SignNow helps ensure compliance with the Nevada Department of Taxation by providing secure document storage, verified eSignatures, and an audit trail. This level of organization and security is vital for meeting tax obligations. Furthermore, our easy-to-use interface minimizes errors, promoting accurate submissions and timely filing.

-

How does airSlate SignNow ensure the security of my sensitive tax documents?

airSlate SignNow prioritizes the security of your sensitive tax documents associated with your Nevada Department of Taxation consumer use tax return by employing state-of-the-art encryption and security protocols. All documents are securely stored and access is restricted to authorized users only. Additionally, we comply with industry standards to protect your data.

Get more for Consumer Use Tax Nevada

- Revised 515 board of bar examiners of delaware courts courts delaware form

- Form 12923 2011

- Motion for payment of unclaimed funds form

- Medical report cyberdrive illinois form

- Florida certificate competency broward form

- Supplement 3 georgia probate courts form

- Petitions for review amp applications for enforcement form

- State of new york industrial board of appeals x in the matter of the petition of name of company andor individuals filing the form

Find out other Consumer Use Tax Nevada

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form