Form Freddie Mac 65 Fillable 2009-2026

What is the Form Freddie Mac 65 Fillable

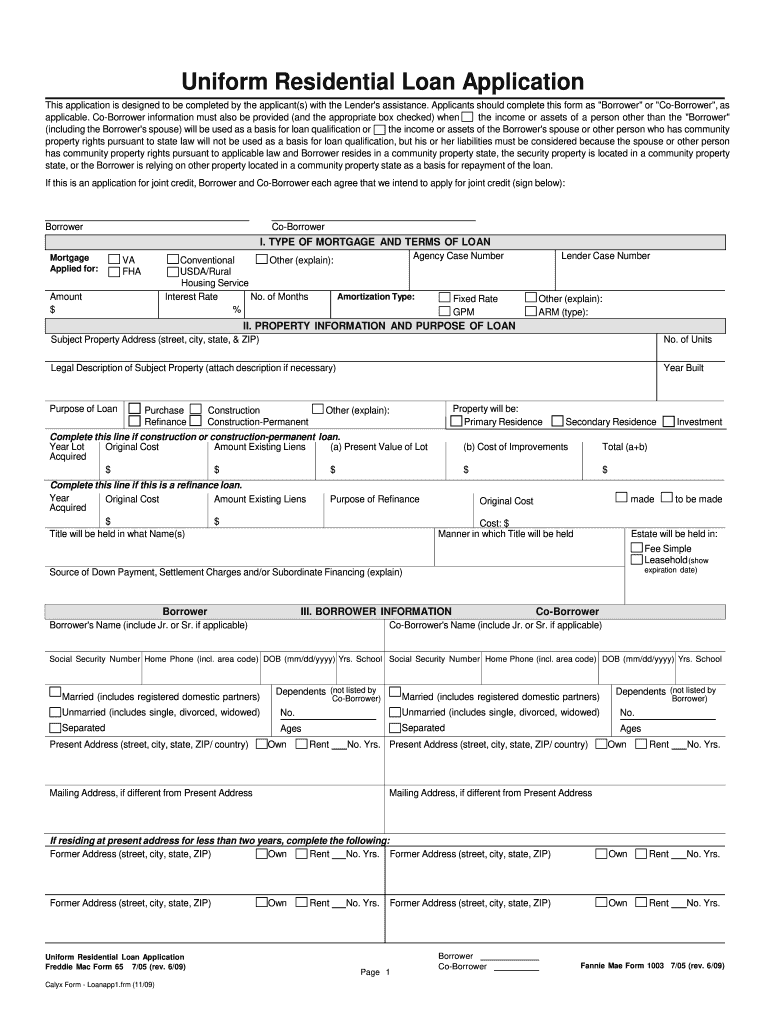

The Freddie Mac Form 65, also known as the Uniform Residential Loan Application, is a standardized document used by lenders to assess an applicant's eligibility for a residential loan. This form collects essential information about the borrower, including personal details, employment history, income, and financial obligations. The fillable version allows users to complete the form electronically, ensuring a more efficient and organized application process.

How to use the Form Freddie Mac 65 Fillable

To effectively use the Freddie Mac Form 65 fillable, start by downloading the form from a reliable source. Once you have the form, open it in a compatible PDF reader that supports fillable fields. Carefully enter your information in each section, ensuring accuracy and completeness. After filling out the form, review it for any errors before saving and submitting it to your lender. This electronic method streamlines the application process and minimizes the risk of lost paperwork.

Steps to complete the Form Freddie Mac 65 Fillable

Completing the Freddie Mac Form 65 fillable involves several straightforward steps:

- Download the form from a trusted source.

- Open the form in a PDF reader that supports fillable fields.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about your employment and income.

- List your assets and liabilities to give a comprehensive view of your financial situation.

- Review all entered information for accuracy.

- Save the completed form and submit it to your lender as instructed.

Legal use of the Form Freddie Mac 65 Fillable

The Freddie Mac Form 65 fillable is legally recognized as a valid application for residential loans when completed correctly. To ensure its legal standing, the form must be filled out accurately, and all required signatures must be obtained. Additionally, compliance with relevant federal and state regulations regarding eSignatures is essential. Using a trusted electronic signature solution can help meet these legal requirements and enhance the document's validity.

Key elements of the Form Freddie Mac 65 Fillable

Key elements of the Freddie Mac Form 65 fillable include:

- Borrower Information: Personal details such as name, address, and contact information.

- Employment History: Current and previous employment details to assess income stability.

- Income Information: Comprehensive disclosure of all sources of income.

- Asset and Liability Details: A complete list of assets and debts to evaluate financial health.

- Loan Information: Details regarding the type and amount of loan being applied for.

Form Submission Methods

The Freddie Mac Form 65 fillable can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders allow applicants to upload the completed form through their secure online portals.

- Email Submission: Some lenders may accept the form via email, provided it is sent securely.

- In-Person Submission: Applicants can also choose to print the completed form and deliver it directly to the lender's office.

Quick guide on how to complete form freddie mac 65 fillable

Complete Form Freddie Mac 65 Fillable effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents swiftly without delays. Manage Form Freddie Mac 65 Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Form Freddie Mac 65 Fillable without any hassle

- Find Form Freddie Mac 65 Fillable and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Form Freddie Mac 65 Fillable to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form freddie mac 65 fillable

Create this form in 5 minutes!

How to create an eSignature for the form freddie mac 65 fillable

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is a residential loan?

A residential loan is a type of financing used to purchase or refinance a home. It typically involves borrowing money from a lender and paying it back over time. Understanding the terms and rates of a residential loan is essential for making informed financial decisions.

-

How can airSlate SignNow help with residential loan document signing?

airSlate SignNow streamlines the signing process for residential loans by allowing users to electronically sign documents securely and efficiently. Our platform ensures that all parties can quickly complete necessary paperwork, which helps accelerate the closing process for your residential loan.

-

What features does airSlate SignNow offer for handling residential loan documents?

airSlate SignNow offers features like customizable templates, bulk sending, and advanced security options, which are ideal for managing residential loan paperwork. Additionally, users can track document status and send reminders, ensuring no step in the loan process is overlooked.

-

How does pricing work for airSlate SignNow’s residential loan services?

Pricing for airSlate SignNow is designed to be cost-effective and scalable, catering to both individual users and businesses. Understanding the pricing structure is important, as it can vary depending on the features utilized for your residential loan management.

-

Can airSlate SignNow integrate with other financial software for residential loans?

Yes, airSlate SignNow can seamlessly integrate with various financial and CRM software, enhancing your workflow for residential loans. This integration allows you to manage client relationships and document flows more effectively, saving time and reducing errors.

-

What benefits does eSigning provide for residential loan processes?

eSigning residential loan documents signNowly reduces time spent on paperwork, allowing for faster transaction times. By using airSlate SignNow, you benefit from enhanced security and greater convenience, ensuring all parties can sign documents from anywhere at any time.

-

Is airSlate SignNow secure for handling residential loan documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your residential loan documents. Ensuring confidentiality and compliance is a top priority, providing peace of mind when dealing with sensitive information.

Get more for Form Freddie Mac 65 Fillable

- Corrosion control study form 141 c environmental laboratory

- Texas home equity security form

- Myfloridalicense cam form

- Experience attestation 2013 form

- Pdffiller death certificate 2003 form

- Parent acknowledgement form texas 2004

- Fl doh and sw registered intern form

- Florida doh adult hiv confidential case report 2013 form

Find out other Form Freddie Mac 65 Fillable

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now