Health Care Flexible Spending Account Fsafeds 2019

What is the Health Care Flexible Spending Account Fsafeds

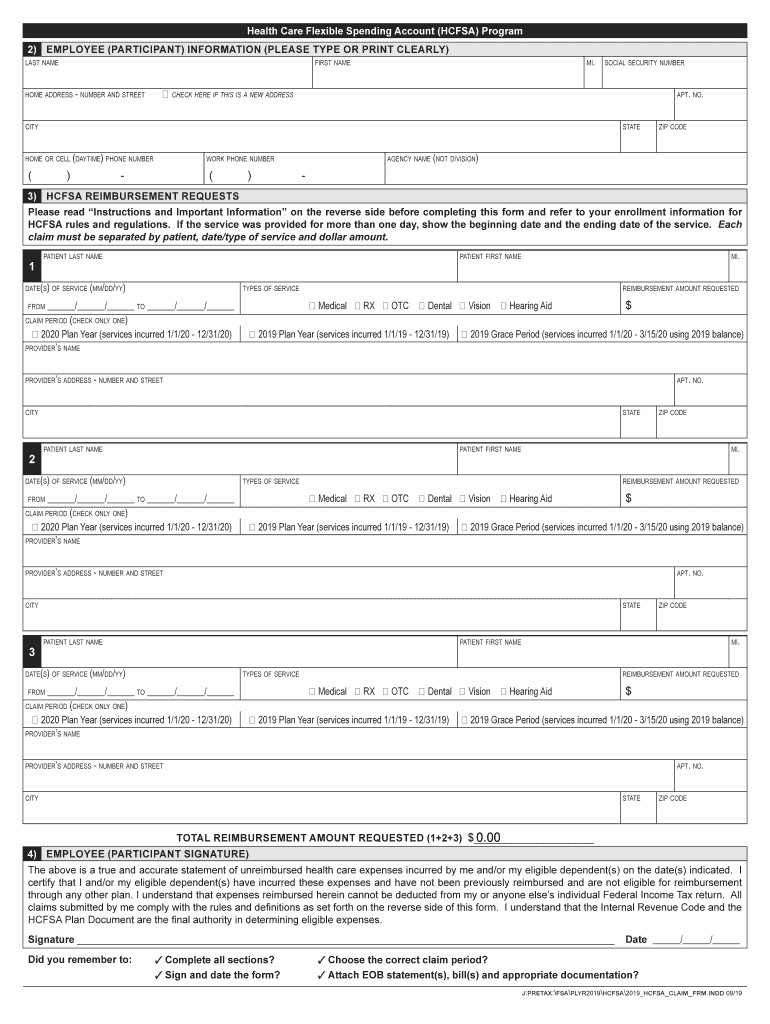

The Health Care Flexible Spending Account (FSAFEDS) is a benefit program offered to employees, allowing them to set aside pre-tax dollars for eligible medical expenses. This account helps reduce taxable income while providing a tax-advantaged way to pay for out-of-pocket health care costs. Employees can use funds for various medical expenses, including copayments, deductibles, and certain over-the-counter medications. Understanding the specifics of FSAFEDS is crucial for maximizing its benefits.

How to use the Health Care Flexible Spending Account Fsafeds

Using the Health Care Flexible Spending Account involves several straightforward steps. First, employees must enroll in the program during the open enrollment period. Once enrolled, they can contribute a portion of their salary to the account. To access funds, employees can use a debit card linked to their FSAFEDS account or submit claims for reimbursement. It is essential to keep receipts for all eligible expenses to ensure proper documentation when filing claims.

Steps to complete the Health Care Flexible Spending Account Fsafeds

Completing the Health Care Flexible Spending Account form involves a series of organized steps:

- Gather necessary personal and financial information.

- Determine the amount to contribute based on anticipated medical expenses.

- Fill out the enrollment form accurately, ensuring all required fields are completed.

- Submit the form by the designated deadline during the open enrollment period.

- Monitor the account and keep track of expenses throughout the year.

Legal use of the Health Care Flexible Spending Account Fsafeds

The legal use of the Health Care Flexible Spending Account is governed by IRS regulations. Participants must use funds exclusively for qualified medical expenses as defined by the IRS. Misuse of funds can lead to penalties, including taxation on the amount used improperly. It is important for employees to familiarize themselves with eligible expenses to maintain compliance and avoid potential legal issues.

Eligibility Criteria

Eligibility for the Health Care Flexible Spending Account typically requires employees to be enrolled in a qualifying health plan. Most employers offer this benefit to full-time employees, while part-time employees may have different eligibility requirements. Additionally, employees must enroll during the open enrollment period to participate in the FSAFEDS program. Understanding these criteria is vital for those looking to take advantage of this tax-saving opportunity.

Filing Deadlines / Important Dates

Filing deadlines for the Health Care Flexible Spending Account are crucial for participants to remember. Typically, employees must submit their enrollment forms during the open enrollment period, which occurs annually. Additionally, claims for reimbursement must be submitted by a specific deadline, often at the end of the plan year or a grace period thereafter. Staying informed about these dates helps ensure that employees do not miss out on benefits.

Required Documents

To effectively utilize the Health Care Flexible Spending Account, employees need to prepare certain documents. Key documents include:

- Enrollment form completed accurately.

- Receipts for eligible medical expenses.

- Claim forms for reimbursement submissions.

Having these documents organized and readily available can streamline the process of managing the FSAFEDS account.

Quick guide on how to complete health care flexible spending account fsafeds

Prepare Health Care Flexible Spending Account Fsafeds effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Health Care Flexible Spending Account Fsafeds on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to modify and eSign Health Care Flexible Spending Account Fsafeds with ease

- Locate Health Care Flexible Spending Account Fsafeds and then click Access Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Complete button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Health Care Flexible Spending Account Fsafeds and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct health care flexible spending account fsafeds

Create this form in 5 minutes!

How to create an eSignature for the health care flexible spending account fsafeds

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Health Care Flexible Spending Account Fsafeds?

A Health Care Flexible Spending Account Fsafeds is a tax-advantaged account that allows employees to use pre-tax dollars for eligible medical expenses. This type of account is part of employer-sponsored benefits, helping to reduce out-of-pocket healthcare costs.

-

How does a Health Care Flexible Spending Account Fsafeds work?

With a Health Care Flexible Spending Account Fsafeds, employees contribute a set amount of their salary before taxes, which can then be used for qualified medical expenses such as copays, prescriptions, and other health-related costs. Funds are available as soon as the account is funded, providing immediate access to tax-free money.

-

What are the benefits of using a Health Care Flexible Spending Account Fsafeds?

The primary benefit of a Health Care Flexible Spending Account Fsafeds is the tax savings. Contributions lower taxable income, and withdrawals for eligible expenses are tax-free, resulting in potential savings for employees. Additionally, it allows for better budgeting of healthcare costs throughout the year.

-

Can I change my contribution to the Health Care Flexible Spending Account Fsafeds?

Yes, employees can typically adjust their contributions to a Health Care Flexible Spending Account Fsafeds during the open enrollment period or if they experience a qualifying life event. This flexibility helps individuals manage their healthcare expenses according to their changing needs.

-

Are there any limits on how much I can contribute to my Health Care Flexible Spending Account Fsafeds?

Yes, there are contribution limits set by the IRS for Health Care Flexible Spending Account Fsafeds. For 2023, the maximum contribution limit is $3,050 per year. It's essential to check with your employer for specific limits as they might vary based on your plan.

-

What types of expenses are eligible under a Health Care Flexible Spending Account Fsafeds?

Eligible expenses under a Health Care Flexible Spending Account Fsafeds include medical, dental, and vision expenses such as deductibles, copays, and prescription drugs. Certain over-the-counter medications and health supplies may also qualify, making it a versatile option for managing health expenditures.

-

Can I use my Health Care Flexible Spending Account Fsafeds for dependent care expenses?

No, a Health Care Flexible Spending Account Fsafeds is specifically for medical expenses. However, there is a separate Dependent Care Flexible Spending Account available for childcare and dependent care costs, so be sure to utilize the account that fits your needs.

Get more for Health Care Flexible Spending Account Fsafeds

- Verification of mental health treatment services ibs4youcom form

- Alameda county behavioral health acbhcs form

- California blue cobra form

- Aboutintegrity medical transportation form

- Caedrs form

- Motherhood matterssm car seat safety molina healthcare form

- Facilityagency application form

- Contra costa mental health plan cchealth form

Find out other Health Care Flexible Spending Account Fsafeds

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free