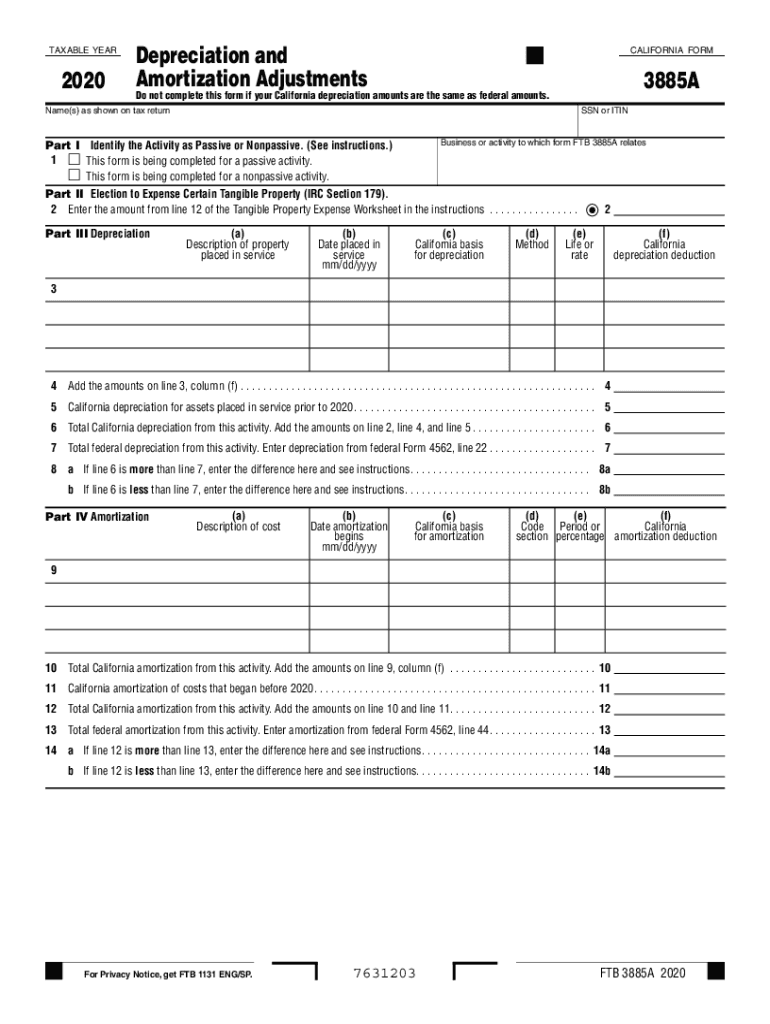

Form 3885A Depreciation and Amortization Adjustments Form 3885A Depreciation and Amortization Adjustments 2020

What is the Form 3885A?

The Form 3885A, also known as the California Depreciation and Amortization Adjustments form, is a crucial document for taxpayers in California. It is primarily used to report depreciation and amortization adjustments for assets used in a business or for income-producing purposes. This form allows individuals and businesses to claim deductions for the depreciation of their assets, which can significantly impact their tax liabilities. Understanding the nuances of the 3885A form is essential for accurate tax reporting and compliance.

How to Use the Form 3885A

Using the Form 3885A involves several steps to ensure accuracy and compliance with California tax regulations. Taxpayers must first gather all relevant information regarding their depreciable assets, including purchase dates, costs, and the method of depreciation used. Once the necessary data is compiled, the taxpayer can fill out the form, detailing each asset and the corresponding depreciation adjustments. It is important to follow the instructions carefully to avoid errors that could lead to penalties or audits.

Steps to Complete the Form 3885A

Completing the Form 3885A requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial records related to your assets.

- Determine the depreciation method applicable to each asset.

- Fill in the form with accurate information, including asset descriptions and depreciation amounts.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return.

Key Elements of the Form 3885A

The Form 3885A includes several key elements that are critical for accurate reporting. These elements typically consist of:

- Asset Description: A detailed description of each asset being depreciated.

- Cost Basis: The original cost of the asset, including any additional expenses incurred.

- Depreciation Method: The method used to calculate depreciation, such as straight-line or declining balance.

- Year of Service: The year in which the asset was placed in service.

Legal Use of the Form 3885A

The Form 3885A is legally recognized for reporting depreciation and amortization adjustments in California. Proper use of this form ensures compliance with state tax laws, allowing taxpayers to take advantage of available deductions. It is essential to maintain accurate records and submit the form in conjunction with other required tax documentation to avoid any legal complications.

Filing Deadlines / Important Dates

Filing the Form 3885A must align with the overall tax filing deadlines set by the California Franchise Tax Board. Typically, the form should be submitted by the same deadline as your state income tax return. Staying informed about these deadlines is crucial to avoid penalties and ensure timely processing of your tax documents.

Quick guide on how to complete 2020 form 3885a depreciation and amortization adjustments 2020 form 3885a depreciation and amortization adjustments

Execute Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments seamlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The most efficient method to modify and eSign Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments effortlessly

- Find Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments and click on Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or hide sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3885a depreciation and amortization adjustments 2020 form 3885a depreciation and amortization adjustments

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3885a depreciation and amortization adjustments 2020 form 3885a depreciation and amortization adjustments

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the form 3885a and why is it important?

The form 3885a is used to report depreciation and amortization for tax purposes. It's crucial for businesses as it helps determine deductions that can ultimately reduce tax liability, making accurate completion essential for financial planning and compliance.

-

How can airSlate SignNow assist in filling out the form 3885a?

airSlate SignNow offers user-friendly templates and eSigning capabilities that streamline the process of completing the form 3885a. You can easily fill in required information, save your progress, and securely sign the document, making tax season less stressful.

-

Is airSlate SignNow a cost-effective solution for managing form 3885a?

Yes, airSlate SignNow provides a cost-effective solution for managing your form 3885a needs. With competitive pricing and various plans, businesses can ensure that they have access to the necessary tools without exceeding their budget.

-

What features does airSlate SignNow offer for completing the form 3885a?

airSlate SignNow comes equipped with features like customizable templates, bulk sending, and secure eSigning, which are essential for completing the form 3885a efficiently. These capabilities enable you to manage your documents seamlessly and ensure compliance.

-

Can I integrate airSlate SignNow with other software to manage the form 3885a?

Absolutely! airSlate SignNow supports various integrations with popular accounting and tax software, allowing for a streamlined workflow when dealing with the form 3885a. This ensures that your data is consistent across platforms and minimizes manual entry errors.

-

What are the benefits of using airSlate SignNow for the form 3885a?

Using airSlate SignNow for the form 3885a simplifies the eSigning process and enhances collaboration with stakeholders. The platform’s security features also ensure that your sensitive financial data is protected while you complete necessary tax documentation.

-

Is there a trial period available for testing airSlate SignNow for form 3885a?

Yes, airSlate SignNow offers a free trial period, allowing you to test the features and functionalities before committing to a subscription. During this trial, you can explore how efficiently you can manage the form 3885a and other documents.

Get more for Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments

Find out other Form 3885A Depreciation And Amortization Adjustments Form 3885A Depreciation And Amortization Adjustments

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document