About Form 4562, Depreciation and Amortization IRS Tax Forms 2022-2026

What is Form 4562?

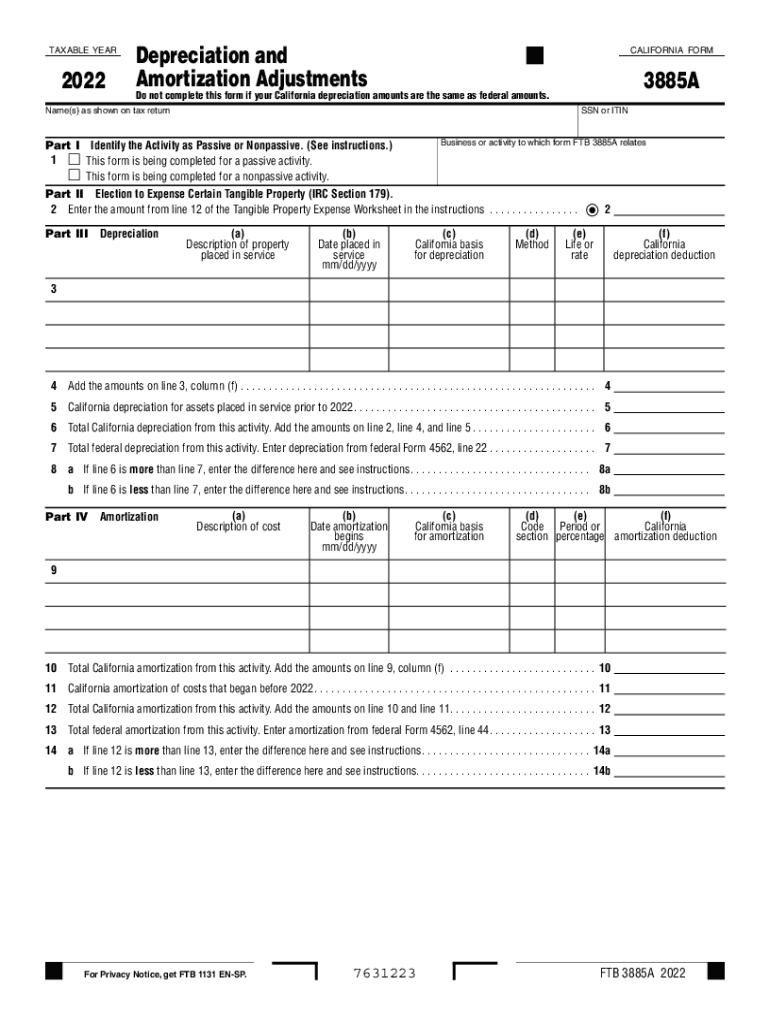

Form 4562, officially known as the Depreciation and Amortization form, is used by taxpayers to claim deductions for depreciation on property placed in service during the tax year. This form is essential for businesses and individuals who own assets that can depreciate over time, such as machinery, vehicles, and buildings. The form allows taxpayers to report the depreciation of these assets and any amortization of intangible assets, ensuring compliance with IRS regulations.

Key Elements of Form 4562

Understanding the key elements of Form 4562 is crucial for accurate completion. The form includes sections for:

- Part I: Election to Expense Certain Property Under Section 179, which allows taxpayers to deduct the cost of certain assets immediately.

- Part II: Special Depreciation Allowance, which provides additional depreciation for qualified property.

- Part III: MACRS Depreciation, detailing the Modified Accelerated Cost Recovery System for various asset classes.

- Part IV: Amortization, which pertains to intangible assets.

Each section requires specific information about the assets, including acquisition dates, costs, and the method of depreciation used.

Steps to Complete Form 4562

Completing Form 4562 involves several steps to ensure accuracy and compliance. Here’s a general outline:

- Gather all necessary documentation regarding the assets you are claiming depreciation for.

- Determine if you qualify for the Section 179 deduction and calculate the amount you wish to expense.

- Fill out Part I for Section 179 expenses, including the total cost of qualifying property.

- Complete Part II if applicable, noting any additional depreciation you are claiming.

- Use Part III to report MACRS depreciation for your assets, ensuring you select the correct recovery period.

- Fill out Part IV for any intangible assets you are amortizing.

Ensure all calculations are accurate and that you retain copies of the form and supporting documents for your records.

Legal Use of Form 4562

Form 4562 is legally binding when completed accurately and submitted to the IRS. It is essential to adhere to IRS guidelines regarding depreciation and amortization to avoid penalties. The information provided on this form must be truthful and reflect the taxpayer's actual financial situation. Misrepresentation or errors can lead to audits or fines, making it vital to consult with a tax professional if there are uncertainties.

Filing Deadlines for Form 4562

Form 4562 must be filed in conjunction with the taxpayer's annual income tax return. For most taxpayers, this means submitting the form by April 15 of the following year. However, if an extension is filed, the deadline may be extended to October 15. It is important to be aware of these deadlines to ensure compliance and avoid late filing penalties.

Examples of Using Form 4562

Form 4562 can be utilized in various scenarios, including:

- A business purchasing new equipment, such as computers or machinery, and opting to expense the cost under Section 179.

- An individual claiming depreciation on a rental property to reduce taxable income.

- A company amortizing costs related to patents or copyrights over their useful life.

These examples illustrate the form's versatility in different financial situations, emphasizing its importance for both individuals and businesses.

Quick guide on how to complete about form 4562 depreciation and amortization irs tax forms

Effortlessly Prepare About Form 4562, Depreciation And Amortization IRS Tax Forms on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage About Form 4562, Depreciation And Amortization IRS Tax Forms on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to Edit and eSign About Form 4562, Depreciation And Amortization IRS Tax Forms with Ease

- Find About Form 4562, Depreciation And Amortization IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with the instruments that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign About Form 4562, Depreciation And Amortization IRS Tax Forms to ensure seamless communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4562 depreciation and amortization irs tax forms

Create this form in 5 minutes!

People also ask

-

What is form 4562 and why is it important?

What is form 4562? It's a tax form used by businesses to report depreciation and amortization of tangible assets. This form is essential for ensuring that businesses can write off the costs of their investments, thereby reducing taxable income and maximizing tax benefits.

-

Who needs to file form 4562?

Businesses that have depreciable assets need to file what is form 4562. This includes sole proprietors, partnerships, corporations, and certain trust entities. It is important for any business wanting to claim depreciation deductions on their tax returns.

-

What information do I need to complete form 4562?

To complete what is form 4562, you'll need detailed information about your assets, including acquisition dates, cost, and the assets' signNow features. Additionally, information related to prior years' depreciation and any depreciable property you plan to dispose of must also be present.

-

Can airSlate SignNow help with the filing of form 4562?

Yes, airSlate SignNow simplifies the process of submitting what is form 4562 by allowing you to eSign and send documents securely. Our platform streamlines your document workflow, helping you stay organized and focused on your business taxes without the hassle of traditional paperwork.

-

How does airSlate SignNow ensure the security of my tax documents?

With airSlate SignNow, you can securely store and send your tax documents, including what is form 4562. We utilize advanced encryption and secure cloud storage to protect your sensitive information, ensuring compliance with privacy regulations and safeguarding against unauthorized access.

-

What are the benefits of using airSlate SignNow for eSigning form 4562?

Using airSlate SignNow for eSigning what is form 4562 offers numerous benefits, including reduced turnaround time and greater efficiency. Our user-friendly interface enables quick signature collection, eliminating the need for printing, scanning, or mailing, thus streamlining your entire tax process.

-

Is there a cost associated with using airSlate SignNow to handle form 4562?

Yes, there is a pricing structure for using airSlate SignNow, but it remains cost-effective compared to traditional signing methods. By investing in our service to manage what is form 4562 and other documents, you can save time and improve productivity, often resulting in a net gain in operational efficiency.

Get more for About Form 4562, Depreciation And Amortization IRS Tax Forms

Find out other About Form 4562, Depreciation And Amortization IRS Tax Forms

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document