Printable Delaware Form 209 Claim for Refund of Deceased Taxpayer 2020

What is the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

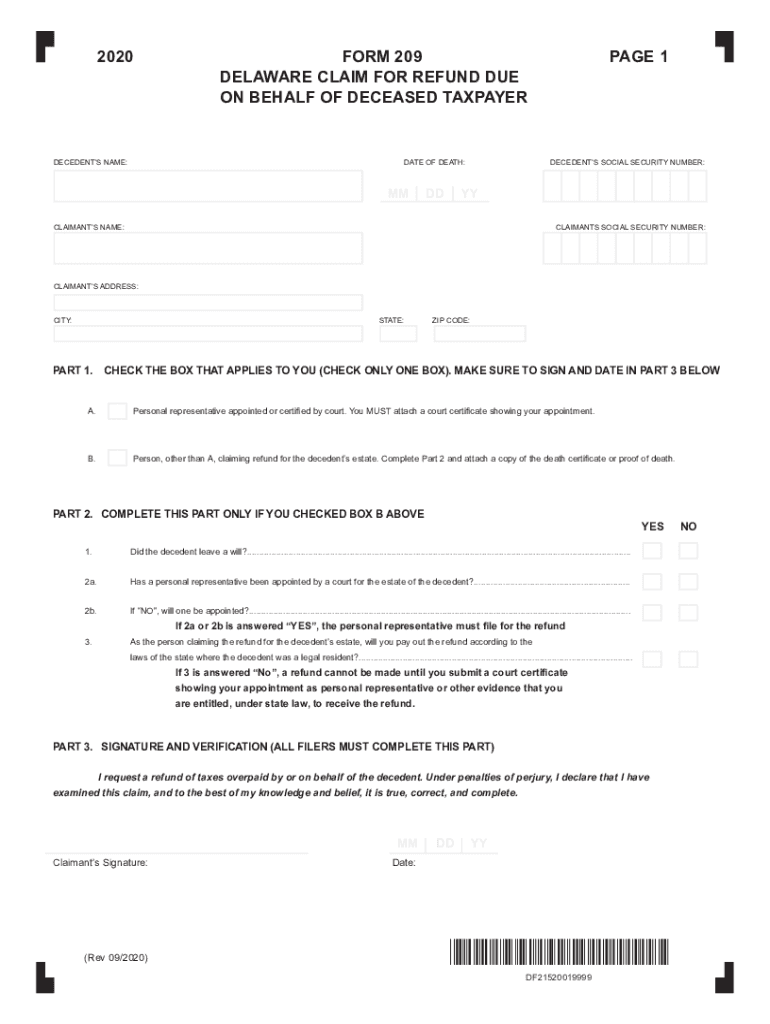

The Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer is a tax form used to claim a refund of taxes that were overpaid by a deceased individual. This form allows the legal representative or executor of the deceased's estate to recover any excess tax payments made prior to their passing. It is essential for ensuring that the estate is settled fairly and that any funds owed to the deceased are returned to the rightful beneficiaries.

How to Use the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

Using the Printable Delaware Form 209 involves filling out the required information accurately. The form typically requires details such as the deceased's name, Social Security number, and the tax year for which the refund is being claimed. The legal representative must also provide their contact information and relationship to the deceased. Once completed, the form must be signed and dated to validate the claim.

Steps to Complete the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

Completing the Printable Delaware Form 209 involves several key steps:

- Gather necessary documents, including the deceased's tax returns and any relevant financial records.

- Fill in the personal information of the deceased, ensuring accuracy in names and Social Security numbers.

- Indicate the tax year for which the refund is being claimed.

- Provide your information as the claimant, including your name, address, and relationship to the deceased.

- Review the completed form for any errors or omissions.

- Sign and date the form to confirm its authenticity.

Legal Use of the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

The Printable Delaware Form 209 is legally binding once it is signed by the authorized representative of the deceased's estate. It must be submitted in accordance with Delaware state tax regulations. The form is designed to ensure that any refunds due to the deceased are properly claimed and processed, adhering to all legal requirements. Failure to use the form correctly may result in delays or denial of the refund.

Required Documents

To successfully file the Printable Delaware Form 209, certain documents are required:

- The deceased's tax returns for the relevant years.

- Proof of the claimant's relationship to the deceased, such as a will or court appointment as executor.

- Any correspondence from the Delaware Division of Revenue regarding tax payments or refunds.

Form Submission Methods

The Printable Delaware Form 209 can be submitted through various methods:

- By mail to the Delaware Division of Revenue.

- In-person at a local Delaware Division of Revenue office.

- Electronically, if applicable, through authorized e-filing services.

Quick guide on how to complete printable 2020 delaware form 209 claim for refund of deceased taxpayer

Effortlessly Prepare Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer with Ease

- Find Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, and mistakes that necessitate creating new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Revise and electronically sign Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 delaware form 209 claim for refund of deceased taxpayer

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 delaware form 209 claim for refund of deceased taxpayer

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer?

The Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer is a tax form used to claim a refund for overpaid taxes on behalf of a deceased individual. This form is essential for the estate of the deceased to ensure any due refunds are properly processed. Completing this form accurately can help beneficiaries claim funds owed to the deceased.

-

How can I access the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer?

You can access the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer through the airSlate SignNow platform. Our user-friendly interface allows you to download the form quickly and easily, ensuring you have the correct document ready for completion. We provide a step-by-step guide to assist you in filling the form out correctly.

-

What features does airSlate SignNow offer for the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer?

airSlate SignNow offers several features for managing the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer, including electronic signatures, document storage, and sharing capabilities. These features foster a simple and efficient process for completing and submitting the form. Additionally, our platform allows for real-time collaboration, making it easier to manage your tax documents.

-

Is there a cost associated with using airSlate SignNow for the Printable Delaware Form 209?

airSlate SignNow offers various pricing plans to suit different needs, including monthly and annual subscriptions. Users interested in the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer can choose a plan that provides access to all necessary features at a competitive rate. Detailed pricing information can be found directly on our website.

-

Can I integrate airSlate SignNow with other applications for the Printable Delaware Form 209?

Yes, airSlate SignNow can be seamlessly integrated with a variety of applications, enhancing the functionality of the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer. Our integration capabilities allow users to connect with CRM systems, cloud storage services, and more, streamlining your workflow. This ensures that you can manage your tax documentation efficiently.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for managing the Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer offers numerous benefits, including improved efficiency and reduced paperwork. Our platform provides a secure environment for document handling, ensuring all your sensitive tax information is protected. Additionally, the ability to eSign documents saves time and simplifies the submission process.

-

How do I ensure my Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer is completed accurately?

To ensure your Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer is completed accurately, follow our detailed instructions provided on the airSlate SignNow platform. We offer tips and guidelines to help you understand the requirements for each section of the form. Additionally, you can consult with a tax professional if you have specific questions related to your situation.

Get more for Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

- Nav data sheet form

- Cg5484ipdf child development services medical consent authorization uscg form

- Us coast guard deputy commandant for mission support form

- Pnp checklist homeland form

- Form n 300

- Application to file declaration of intention uscis form

- Slgsafe application for internet access pd f 4144 5 form

- Parent and student complaint form

Find out other Printable Delaware Form 209 Claim For Refund Of Deceased Taxpayer

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now