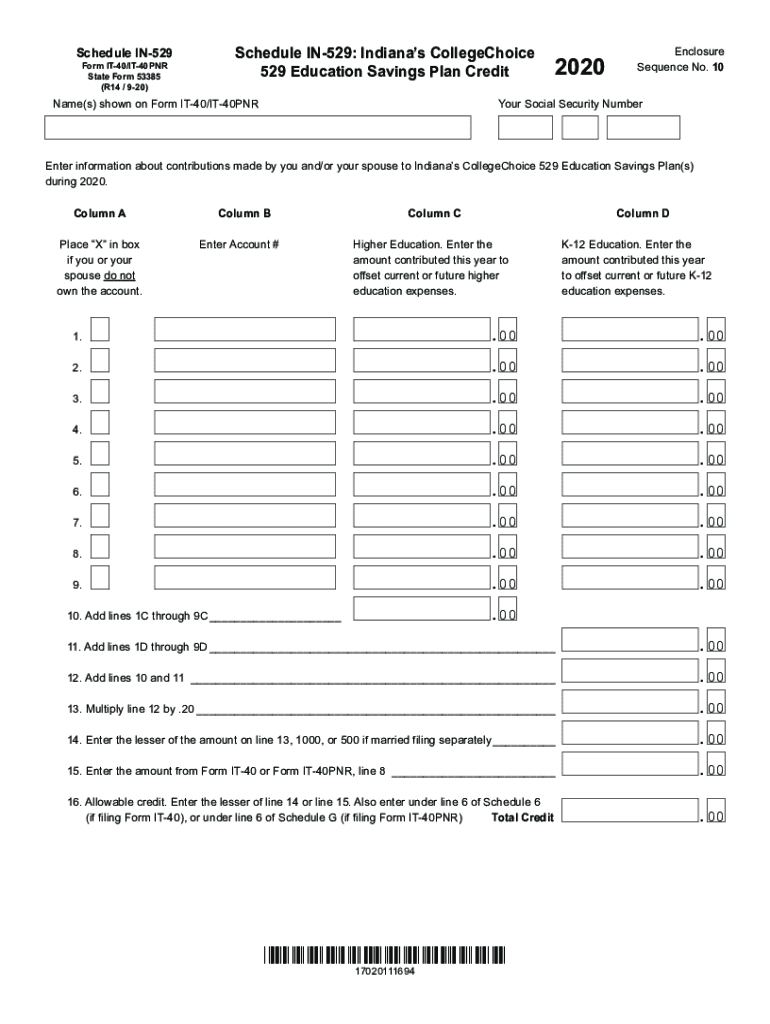

Printable Indiana Form in 529 Indiana's CollegeChoice 529 Education Savings Plan Credit 2020

Understanding the Indiana CollegeChoice 529 Plan

The Indiana CollegeChoice 529 Plan is a tax-advantaged savings plan designed to help families save for future education expenses. This plan allows account holders to invest in various investment options while enjoying tax benefits. Contributions to the plan can grow tax-free, and withdrawals for qualified education expenses are also tax-free. This makes the Indiana 529 Plan a valuable tool for families looking to manage the costs associated with higher education.

Steps to Access Your Indiana 529 Login

To access your Indiana 529 account, follow these straightforward steps:

- Visit the official Indiana CollegeChoice 529 website.

- Locate the login section on the homepage.

- Enter your username and password in the designated fields.

- Click the login button to access your account.

If you encounter any issues, consider using the password recovery option to reset your credentials.

Legal Considerations for the Indiana CollegeChoice 529 Plan

Using the Indiana CollegeChoice 529 Plan is governed by specific legal frameworks that ensure the security and legitimacy of your account. The plan complies with federal regulations, including the Internal Revenue Code, which outlines the tax advantages associated with 529 plans. Additionally, the plan adheres to privacy standards to protect your personal information, ensuring a secure environment for managing your education savings.

Eligibility Criteria for the Indiana CollegeChoice 529 Plan

To participate in the Indiana CollegeChoice 529 Plan, individuals must meet certain eligibility requirements. Generally, anyone can open an account, including parents, grandparents, and other relatives. There are no income restrictions for contributors, making it accessible for a wide range of families. However, to benefit from state tax deductions, account holders must be Indiana residents.

Required Documents for Indiana 529 Account Management

When managing your Indiana CollegeChoice 529 account, you may need to provide specific documentation. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Social Security numbers for account holders and beneficiaries.

- Bank account information for contributions and withdrawals.

Having these documents ready can streamline the process of managing your account and making transactions.

Form Submission Methods for Indiana CollegeChoice 529

Submitting forms for the Indiana CollegeChoice 529 Plan can be done through various methods. Account holders typically have the option to submit forms online, by mail, or in person. Online submissions are often the quickest and most efficient method, allowing for immediate processing. For those who prefer traditional methods, mailing forms to the designated address is also available. In-person submissions can be made at designated locations for direct assistance.

Quick guide on how to complete printable 2020 indiana form in 529 indianas collegechoice 529 education savings plan credit

Effortlessly Prepare Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit with Ease

- Locate Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your updates.

- Select your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 indiana form in 529 indianas collegechoice 529 education savings plan credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 indiana form in 529 indianas collegechoice 529 education savings plan credit

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Indiana 529 login process?

The Indiana 529 login process is designed to be simple and user-friendly. By visiting the official Indiana 529 website, you can enter your username and password to access your account. If you're a first-time user, you may need to register and create a new account.

-

How do I reset my Indiana 529 login password?

To reset your Indiana 529 login password, go to the login page and click on the 'Forgot Password' link. Follow the prompts to enter your email address and receive a reset link. Make sure to create a strong password that you can easily remember.

-

Can I access my Indiana 529 account on mobile devices?

Yes, you can access your Indiana 529 account on mobile devices. The Indiana 529 platform is optimized for mobile use, allowing you to login and manage your account easily. This makes tracking your investments and contributions accessible anytime and anywhere.

-

What features are available with the Indiana 529 login?

When you login to your Indiana 529 account, you can manage contributions, monitor savings growth, and view account statements. The platform also offers tools to help you plan for education expenses and make changes to your investment strategy as needed.

-

Is there a cost associated with the Indiana 529 plan?

The Indiana 529 plan has minimal fees associated with account maintenance and investment options. However, the benefits of tax advantages and potential growth can outweigh these costs. Always review the fee schedule prior to completing your Indiana 529 login to understand any applicable charges.

-

How does the Indiana 529 plan benefit my education savings?

The Indiana 529 plan provides tax-free growth for your education savings, which can signNowly enhance your funds over time. With contributions that may also be tax-deductible, the Indiana 529 login allows you to maximize your savings for future educational expenses efficiently.

-

What integrations does the Indiana 529 plan offer?

The Indiana 529 plan offers integrations with various financial tools and resources to help you manage your education savings effectively. You can link your bank account for easy contributions and withdrawals directly through the Indiana 529 login portal for seamless transactions.

Get more for Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit

- No income statement form

- Oregon statement of error form thursday

- Https health4all pnline reoister custom form 132

- Sel114 candidate filing individual electors sel114 candidate filing individual electors form

- Thinking report worksheet form

- Oebb appeal form

- Sel 400 oregon secretary of state form

- Publications ampamp forms oklahoma state auditor okgov

Find out other Printable Indiana Form IN 529 Indiana's CollegeChoice 529 Education Savings Plan Credit

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form