Nh Gas Tax Refund Form

What is the NH Gas Tax Refund Form

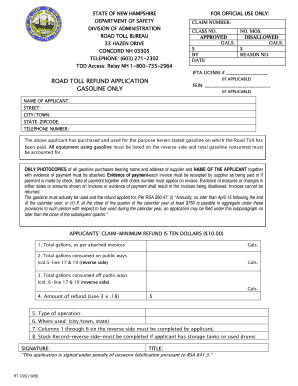

The NH gas tax refund form is a document used by individuals and businesses in New Hampshire to request a refund for gas taxes paid on fuel used for certain exempt purposes. This form is essential for those who qualify, such as commercial vehicle operators or individuals using fuel for off-road activities. Understanding the specifics of this form can help ensure that eligible parties receive the refunds they are entitled to.

Steps to Complete the NH Gas Tax Refund Form

Completing the NH gas tax refund form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your personal details, vehicle information, and fuel purchase receipts. Next, fill out the form carefully, making sure to provide all required information. It is important to double-check for any errors before submission. Finally, sign and date the form to validate your request.

How to Obtain the NH Gas Tax Refund Form

The NH gas tax refund form can be obtained through the New Hampshire Department of Revenue Administration's website or by visiting their local offices. Additionally, the form may be available at select government offices and public libraries. Ensure you have the most current version of the form to avoid any issues during the submission process.

Legal Use of the NH Gas Tax Refund Form

The NH gas tax refund form is legally binding when completed and submitted according to state regulations. It must be signed by the applicant, and any false information may result in penalties. Compliance with the legal requirements surrounding this form is crucial to ensure that the refund request is processed without complications.

Required Documents

When submitting the NH gas tax refund form, certain documents are required to support your claim. These typically include receipts for fuel purchases, proof of vehicle registration, and any relevant tax identification numbers. Gathering these documents in advance can streamline the application process and help avoid delays.

Form Submission Methods

The NH gas tax refund form can be submitted through various methods, including online submission, mailing the completed form, or delivering it in person to the appropriate state office. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline.

Eligibility Criteria

Eligibility for a refund using the NH gas tax refund form is based on specific criteria set by the state. Generally, individuals or businesses that use fuel for exempt purposes, such as off-road vehicles or commercial operations, may qualify. It is important to review the eligibility requirements carefully to ensure compliance and successful processing of your refund request.

Quick guide on how to complete nh gas tax refund form

Complete Nh Gas Tax Refund Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the tools you need to produce, modify, and eSign your documents quickly without delays. Manage Nh Gas Tax Refund Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nh Gas Tax Refund Form with ease

- Obtain Nh Gas Tax Refund Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Nh Gas Tax Refund Form and ensure excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nh gas tax refund form

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the NH gas tax refund form?

The NH gas tax refund form is a document used to apply for a refund on gas taxes paid by certain individuals and businesses in New Hampshire. This form is essential for those who meet specific eligibility requirements, allowing them to recover some of the taxes paid on fuel used for non-highway purposes.

-

Who is eligible to use the NH gas tax refund form?

Eligibility for the NH gas tax refund form generally includes individuals and businesses that can demonstrate that their fuel was used for non-highway purposes. This may include farmers, businesses using fuel for machinery, or other qualifying entities. Ensuring proper documentation will facilitate the refund process.

-

How do I fill out the NH gas tax refund form?

Filling out the NH gas tax refund form requires basic information about your fuel purchases and the intended use of the fuel. You'll need to provide details such as the amount of fuel purchased and receipts as proof. Using an eSigning solution like airSlate SignNow can streamline the completion and submission of your form.

-

What are the benefits of using airSlate SignNow for the NH gas tax refund form?

Using airSlate SignNow for the NH gas tax refund form offers a cost-effective and efficient way to manage your documentation. With our easy-to-use interface, you can complete your forms electronically, which minimizes paperwork and speeds up the submission process. Plus, the secure platform ensures that your information is protected.

-

Is there a fee to submit the NH gas tax refund form?

There is no fee charged by the state of New Hampshire for submitting the NH gas tax refund form itself. However, companies like airSlate SignNow may have fees for their services in preparing and eSigning documents. It's advisable to review the pricing options to find a solution that meets your needs.

-

How long does it take to receive a refund after submitting the NH gas tax refund form?

Once you submit the NH gas tax refund form, the processing time can vary, but it typically takes several weeks. The timeframe may depend on the volume of claims being processed by the state. To ensure a smooth and timely process, ensure your form is filled out accurately before submission.

-

Can I track my NH gas tax refund form submission status?

While airSlate SignNow provides tracking features for documents you send, tracking the NH gas tax refund form submission status directly depends on the state’s processing system. Once submitted, you may need to contact the New Hampshire Department of Revenue Administration for updates on your refund status.

Get more for Nh Gas Tax Refund Form

- Payment form of pag ibig loan 2016 2019

- Full page fax print pep form

- Page 1 of 2 nsrp form 1 january 2017 republic of the philippines

- Employment pass application form for sponsorship cases

- Use this form to apply for a work permit for a foreign domestic

- Sos spf documents required for refund applications form

- Uk visa form 2018 2019

- How to fill outimmigration formukappendix 2 2018 2019

Find out other Nh Gas Tax Refund Form

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile