9 Tax Credits You Need to KnowThe Motley Fool Form

Understanding the Kansas 47 Tax Credit

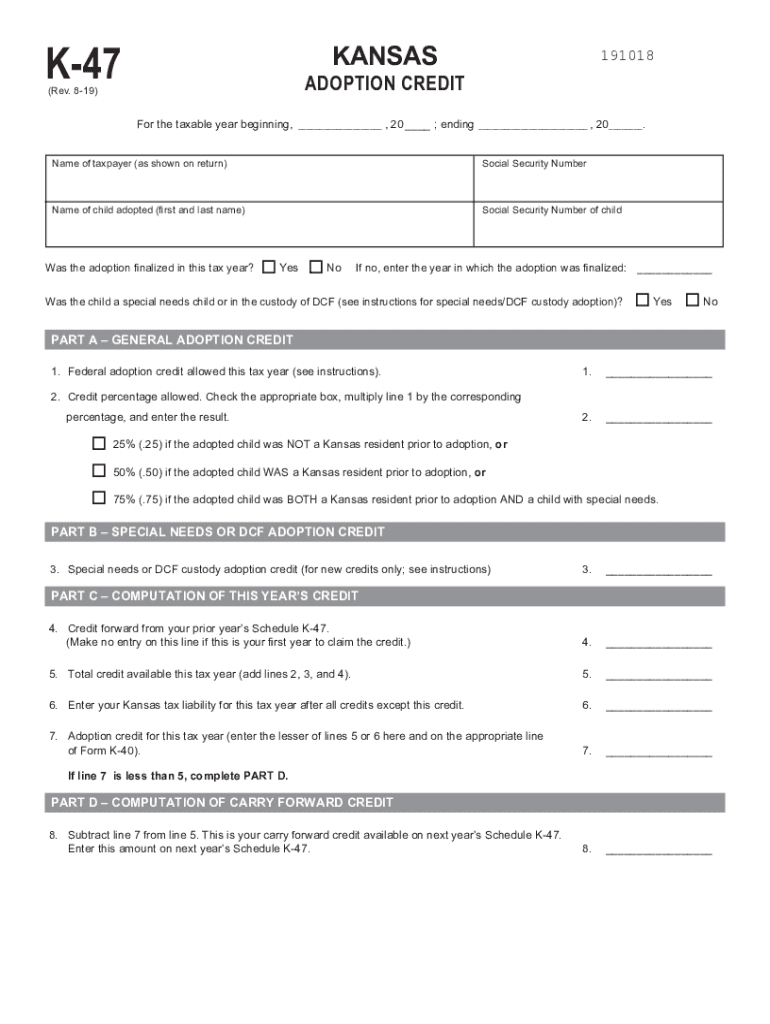

The Kansas 47, also known as the Kansas Adoption Credit, is a tax benefit designed to support families who adopt children. This credit can help alleviate some of the financial burdens associated with adoption expenses. Eligible taxpayers can receive a credit for a portion of the costs incurred during the adoption process, including legal fees, agency fees, and other related expenses. Understanding the specific requirements and limitations of this credit is essential for maximizing its benefits.

Eligibility Criteria for the Kansas 47

To qualify for the Kansas 47 tax credit, certain eligibility criteria must be met. These include:

- The taxpayer must be a resident of Kansas.

- The adoption must be finalized through a court order.

- Expenses must be directly related to the adoption process.

- The credit is available for both domestic and international adoptions.

It is important to review the specific guidelines set forth by the Kansas Department of Revenue to ensure compliance and eligibility.

Steps to Complete the Kansas 47 Form

Filling out the Kansas 47 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation related to the adoption expenses.

- Complete the Kansas 47 form accurately, ensuring all information is correct.

- Attach any required supporting documents, such as receipts and legal paperwork.

- Submit the form either electronically or by mail before the deadline.

Following these steps can help ensure a smooth filing process and maximize the chances of receiving the credit.

Required Documents for the Kansas 47

When filing for the Kansas 47 tax credit, specific documents are necessary to substantiate your claim. These documents may include:

- Final adoption decree or court order.

- Receipts for all qualifying adoption-related expenses.

- Proof of payment for services rendered.

Having these documents ready can facilitate the filing process and provide the necessary evidence to support your claim.

Form Submission Methods for the Kansas 47

The Kansas 47 form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to:

- File electronically through the Kansas Department of Revenue's online portal.

- Mail the completed form along with all supporting documents to the appropriate address.

- Visit a local tax office for in-person submission and assistance.

Each method has its benefits, and taxpayers should select the one that best suits their needs.

IRS Guidelines Related to the Kansas 47

While the Kansas 47 is a state-specific tax credit, it is essential to be aware of IRS guidelines that may affect your federal tax return. The IRS provides general rules regarding adoption credits, which can influence how the Kansas 47 is applied. Taxpayers should ensure they understand how the state credit interacts with federal regulations, including any potential limitations on claiming both state and federal adoption credits.

Quick guide on how to complete 9 tax credits you need to knowthe motley fool

Effortlessly Prepare 9 Tax Credits You Need To KnowThe Motley Fool on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly without any holdups. Manage 9 Tax Credits You Need To KnowThe Motley Fool on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign 9 Tax Credits You Need To KnowThe Motley Fool with Ease

- Locate 9 Tax Credits You Need To KnowThe Motley Fool and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 9 Tax Credits You Need To KnowThe Motley Fool to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 9 tax credits you need to knowthe motley fool

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to kansas 47?

airSlate SignNow is a comprehensive eSignature solution that streamlines document management for businesses. With its easy-to-use interface, it helps organizations in regions like Kansas 47 to efficiently send, sign, and store documents electronically. This solution enhances productivity and ensures compliance in document handling.

-

How much does airSlate SignNow cost for businesses in kansas 47?

Pricing for airSlate SignNow varies depending on the features and number of users. In Kansas 47, businesses can expect affordable plans designed to fit different budgets, making it a cost-effective solution for eSigning documents. Explore the pricing page for specific details tailored to your needs.

-

What features does airSlate SignNow offer for users in kansas 47?

airSlate SignNow offers a variety of features tailored for users in Kansas 47, including customizable templates, bulk sending, and advanced security measures. These features ensure that businesses can manage their document workflows efficiently while maintaining compliance and data integrity. Additionally, real-time tracking enhances visibility throughout the signing process.

-

Can I integrate airSlate SignNow with other tools I use in kansas 47?

Yes, airSlate SignNow offers seamless integration with a range of tools and platforms commonly used by businesses in Kansas 47. This includes popular applications like Salesforce, Google Workspace, and more. These integrations enhance productivity and ensure that document workflows remain streamlined across different systems.

-

What are the benefits of using airSlate SignNow for businesses in kansas 47?

Using airSlate SignNow provides numerous benefits for businesses in Kansas 47, such as increased efficiency in document signing and enhanced security. The platform is designed to minimize operational costs and reduce the time spent on paperwork. Ultimately, it supports better collaboration and quicker decision-making for teams.

-

Is airSlate SignNow compliant with legal standards in kansas 47?

Yes, airSlate SignNow complies with legal standards and regulations for electronic signatures, making it a reliable choice for businesses in Kansas 47. The platform adheres to the ESIGN Act and UETA, ensuring that electronically signed documents hold the same legal weight as traditional paper documents. Trust in airSlate SignNow to keep your business compliant and secure.

-

How easy is it to use airSlate SignNow for signing documents in kansas 47?

airSlate SignNow is designed with user-friendliness in mind, making it very easy for users in Kansas 47 to sign documents. The intuitive interface allows even those without technical expertise to navigate the system effortlessly. Quick onboarding and support resources ensure that businesses can start using the platform effectively without delay.

Get more for 9 Tax Credits You Need To KnowThe Motley Fool

- Mass submetering of water and sewer certification form

- Pet ct prior authorization form nhporg

- Pet pet ct prior authorization form mass collaborative

- Youth player contract 1 12xls form

- Frederick county zip code map form

- Thermometer calibration log 406151541 form

- Michigan affidavit of identity form

- City of hamtramck building department form

Find out other 9 Tax Credits You Need To KnowThe Motley Fool

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online