Form it 2106 1 'Reconciliation of Estimated Income Tax

What is the Form IT 2106 1 'Reconciliation Of Estimated Income Tax

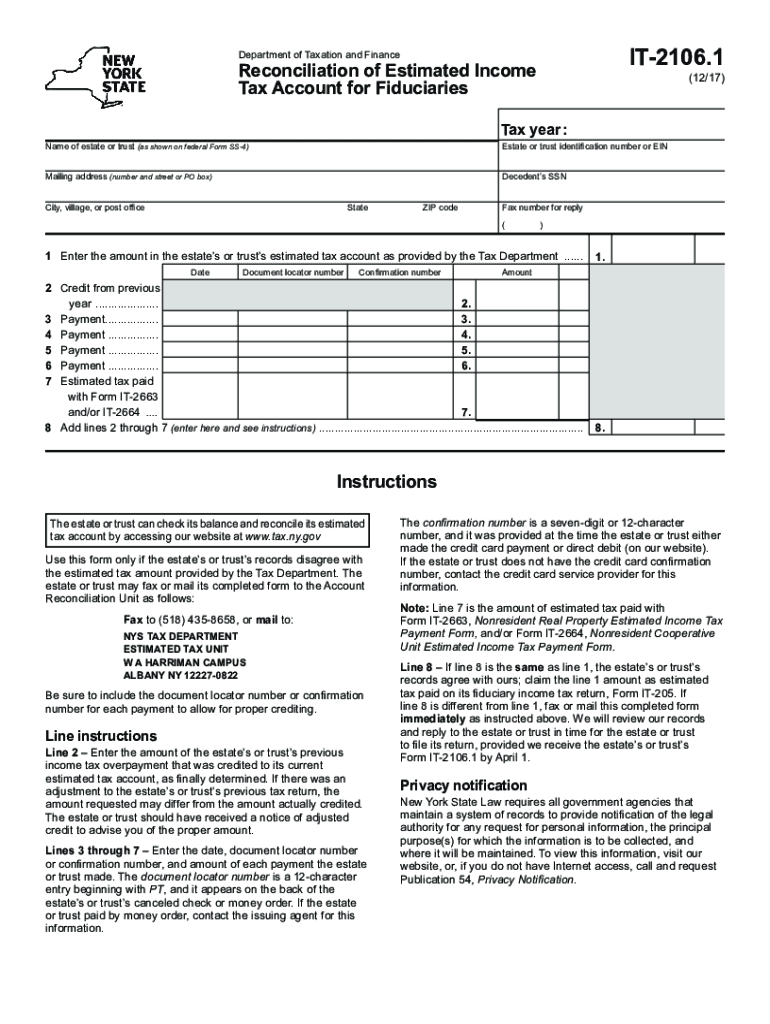

The Form IT 2106 1, known as the Reconciliation of Estimated Income Tax, is a crucial document for taxpayers in the United States. This form is primarily used to reconcile estimated tax payments made throughout the year with the actual tax liability incurred. It ensures that taxpayers accurately report their income and tax obligations, allowing them to settle any discrepancies between estimated payments and actual tax owed.

How to use the Form IT 2106 1 'Reconciliation Of Estimated Income Tax

Using the Form IT 2106 1 involves a few straightforward steps. First, gather all relevant financial documents, including income statements and previous tax returns. Next, fill out the form with accurate information regarding your estimated tax payments and total income. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. This form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the Form IT 2106 1 'Reconciliation Of Estimated Income Tax

Completing the Form IT 2106 1 requires careful attention to detail. Here are the steps to follow:

- Collect necessary documents, including income records and prior tax returns.

- Enter your personal information, such as name, address, and Social Security number.

- Report your estimated tax payments made during the year.

- Calculate your total income and determine your actual tax liability.

- Compare your estimated payments with your actual tax owed.

- Sign and date the form before submission.

Key elements of the Form IT 2106 1 'Reconciliation Of Estimated Income Tax

The key elements of the Form IT 2106 1 include personal identification information, a detailed summary of estimated tax payments, and a calculation section for determining the total tax liability. Additionally, the form requires a signature to validate the information provided. Ensuring that all sections are completed accurately is essential for compliance and to avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2106 1 are crucial for taxpayers to adhere to. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines to avoid late fees or penalties.

Penalties for Non-Compliance

Failing to file the Form IT 2106 1 or inaccuracies in the submitted information can lead to significant penalties. Taxpayers may face fines based on the amount of tax owed and the duration of non-compliance. Additionally, the IRS may impose interest on any unpaid taxes, further increasing the financial burden. It is essential to complete and submit the form accurately and on time to avoid these consequences.

Quick guide on how to complete form it 21061 ampquotreconciliation of estimated income tax

Effortlessly Prepare Form IT 2106 1 'Reconciliation Of Estimated Income Tax on Any Device

Digital document management has become prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the features you require to create, modify, and eSign your documents swiftly without delays. Manage Form IT 2106 1 'Reconciliation Of Estimated Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Form IT 2106 1 'Reconciliation Of Estimated Income Tax with Ease

- Locate Form IT 2106 1 'Reconciliation Of Estimated Income Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 2106 1 'Reconciliation Of Estimated Income Tax and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 21061 ampquotreconciliation of estimated income tax

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

Form IT 2106 1 'Reconciliation Of Estimated Income Tax' is a form used to reconcile estimated income tax payments with actual tax liabilities. It helps taxpayers ensure they are paying the correct amount of taxes throughout the year. This form is essential for accurate tax reporting and helps avoid penalties.

-

How does airSlate SignNow assist with Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

airSlate SignNow allows users to easily prepare, sign, and send Form IT 2106 1 'Reconciliation Of Estimated Income Tax' digitally. This streamlines the process, reducing paperwork and ensuring quick submission of forms. With our platform, businesses can manage their tax documents efficiently.

-

Is there a fee associated with using airSlate SignNow for Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

Yes, airSlate SignNow offers various pricing plans based on the features needed. Each plan is designed to provide cost-effective solutions for businesses, including capabilities to manage forms like the Form IT 2106 1 'Reconciliation Of Estimated Income Tax'. Evaluate your needs to choose the best plan.

-

Can I integrate airSlate SignNow with other platforms when managing Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

Absolutely! airSlate SignNow offers integrations with several popular platforms, enabling seamless workflow management for Form IT 2106 1 'Reconciliation Of Estimated Income Tax'. This helps in synchronizing data and enhancing productivity across multiple business applications.

-

What are the key benefits of using airSlate SignNow for tax forms like Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

Using airSlate SignNow provides key benefits such as improved efficiency, reduced paper usage, and enhanced security for sensitive tax documents like Form IT 2106 1 'Reconciliation Of Estimated Income Tax'. Our solution ensures that all signatures and data are secure and compliant with regulations.

-

How secure is airSlate SignNow when handling Form IT 2106 1 'Reconciliation Of Estimated Income Tax'?

airSlate SignNow prioritizes security, using advanced encryption and protocols to protect your tax forms, including Form IT 2106 1 'Reconciliation Of Estimated Income Tax'. Our platform complies with industry standards to ensure that your sensitive information remains safe.

-

Can I track the status of Form IT 2106 1 'Reconciliation Of Estimated Income Tax' once sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your sent Form IT 2106 1 'Reconciliation Of Estimated Income Tax'. This ensures you are always updated on the progress and can follow up if necessary, improving communication and efficiency.

Get more for Form IT 2106 1 'Reconciliation Of Estimated Income Tax

Find out other Form IT 2106 1 'Reconciliation Of Estimated Income Tax

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online