Printable Minnesota Form M1LS Tax on Lump Sum Distribution 2020

What is the Printable Minnesota Form M1LS Tax On Lump Sum Distribution

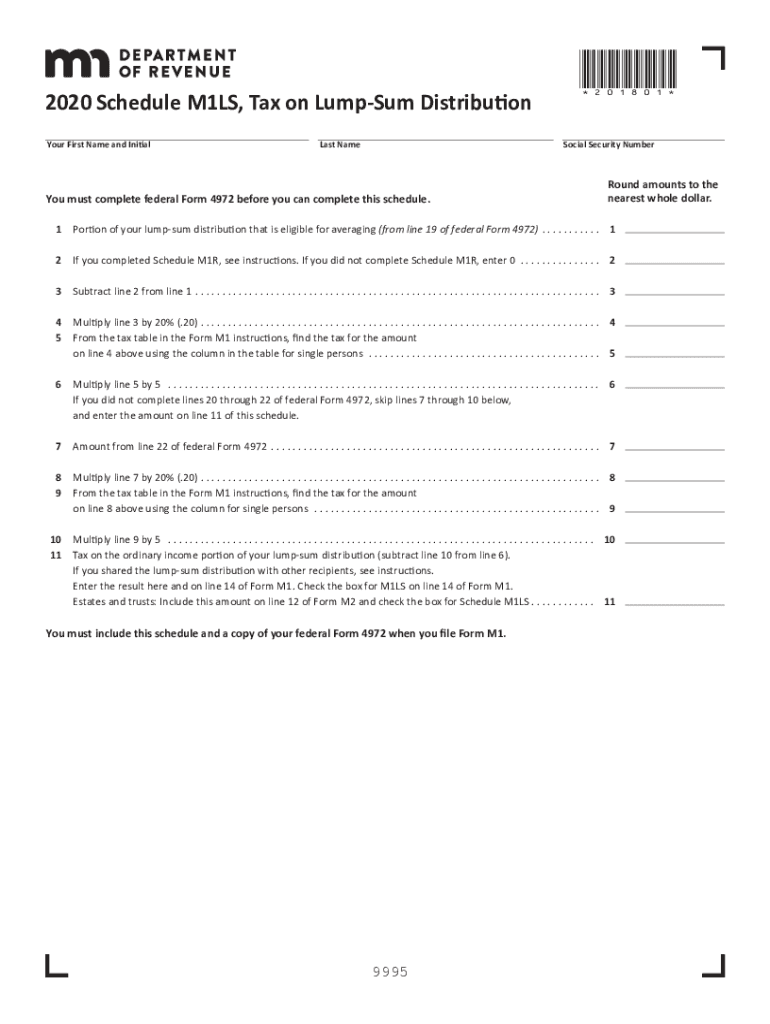

The Printable Minnesota Form M1LS is a tax form specifically designed for reporting lump sum distributions from retirement plans or other qualified plans. This form is essential for individuals who have received a one-time payment from their retirement accounts, ensuring that the correct amount of state tax is calculated and remitted. By using the M1LS form, taxpayers can accurately report their income and comply with Minnesota tax laws regarding these distributions.

How to use the Printable Minnesota Form M1LS Tax On Lump Sum Distribution

Using the Printable Minnesota Form M1LS involves several steps to ensure accurate completion. First, gather all necessary documentation related to your lump sum distribution, including the amount received and any tax withheld. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, report the total amount of the lump sum distribution and any applicable deductions. Finally, review the completed form for accuracy before submission.

Steps to complete the Printable Minnesota Form M1LS Tax On Lump Sum Distribution

Completing the Printable Minnesota Form M1LS requires careful attention to detail. Follow these steps:

- Obtain the latest version of the M1LS form from the Minnesota Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the total amount of the lump sum distribution received.

- Indicate any state tax withheld from the distribution.

- Calculate your total taxable income and any deductions you may qualify for.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Printable Minnesota Form M1LS Tax On Lump Sum Distribution

The Printable Minnesota Form M1LS is legally binding when filled out correctly and submitted to the appropriate tax authorities. To ensure its legal standing, the form must comply with state tax regulations, including accurate reporting of income and tax withheld. Additionally, the use of electronic signatures through a compliant platform can enhance the form's legitimacy, ensuring that it meets all necessary legal requirements for submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Printable Minnesota Form M1LS. Typically, this form must be submitted by the same deadline as your state income tax return, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any changes to deadlines announced by the Minnesota Department of Revenue, especially in light of special circumstances such as natural disasters or public health emergencies.

Required Documents

To complete the Printable Minnesota Form M1LS, you will need several documents to ensure accurate reporting. These include:

- Your W-2 or 1099-R forms that detail the lump sum distribution.

- Any documentation showing state tax withheld from the distribution.

- Records of any deductions or credits you intend to claim.

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete printable 2020 minnesota form m1ls tax on lump sum distribution

Complete Printable Minnesota Form M1LS Tax On Lump Sum Distribution effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Printable Minnesota Form M1LS Tax On Lump Sum Distribution on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Printable Minnesota Form M1LS Tax On Lump Sum Distribution without effort

- Obtain Printable Minnesota Form M1LS Tax On Lump Sum Distribution and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Modify and eSign Printable Minnesota Form M1LS Tax On Lump Sum Distribution and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 minnesota form m1ls tax on lump sum distribution

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 minnesota form m1ls tax on lump sum distribution

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is m1ls in relation to airSlate SignNow?

M1ls is a key feature of airSlate SignNow that simplifies the electronic signing process. It enables users to send, receive, and manage digital documents securely and efficiently. With m1ls, businesses can enhance their workflow and save time.

-

How does airSlate SignNow's pricing model work for m1ls?

AirSlate SignNow offers a flexible pricing model tailored to the needs of businesses using m1ls. Users can choose from various plans that cater to their budget and usage requirements. This cost-effective solution ensures that companies of all sizes can utilize the m1ls feature without breaking the bank.

-

What are the primary benefits of using m1ls with airSlate SignNow?

Using m1ls with airSlate SignNow provides numerous benefits, including faster document turnaround times and improved collaboration among team members. It enhances security through encrypted signatures, ensuring compliance and trust. Overall, m1ls streamlines document management and increases productivity.

-

What features are included with m1ls in airSlate SignNow?

M1ls includes a variety of features designed to optimize your eSigning experience. Key functionalities include customizable templates, in-person signing options, and automated workflows that save time. Additionally, m1ls ensures that all transactions are securely stored and accessible.

-

Does airSlate SignNow support integrations with other tools if I use m1ls?

Yes, airSlate SignNow supports various integrations that enhance the functionality of m1ls. You can seamlessly connect with popular applications such as Google Drive, Salesforce, and Zapier. This integration capability allows for a more streamlined workflow across different platforms.

-

Is m1ls suitable for small businesses using airSlate SignNow?

Absolutely, m1ls is particularly suitable for small businesses that need a cost-effective and efficient eSigning solution. It offers essential features that help manage documents without overwhelming users. Small businesses can leverage m1ls to improve their operations and customer satisfaction.

-

How secure is the m1ls feature on airSlate SignNow?

The m1ls feature on airSlate SignNow is designed with security in mind. It utilizes advanced encryption methods to protect sensitive documents during transmission and storage. This commitment to security ensures that businesses can use m1ls with confidence and peace of mind.

Get more for Printable Minnesota Form M1LS Tax On Lump Sum Distribution

- I want benefits form

- Sc adap form

- Local subdivision handbook and application sc peba scgov form

- Sc dhhs 3218 me form

- Insurance assistance application form

- Sc adap insurance application dhec sc form

- Direct dispensing application direct dispensing application form

- Pdf the state of pediatric traumatic brain injury in sc form

Find out other Printable Minnesota Form M1LS Tax On Lump Sum Distribution

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template