Form Schedule M1LS Tax on Lump Sum Distribution Legal Forms 2022-2026

What is the Form Schedule M1LS Tax on Lump Sum Distribution?

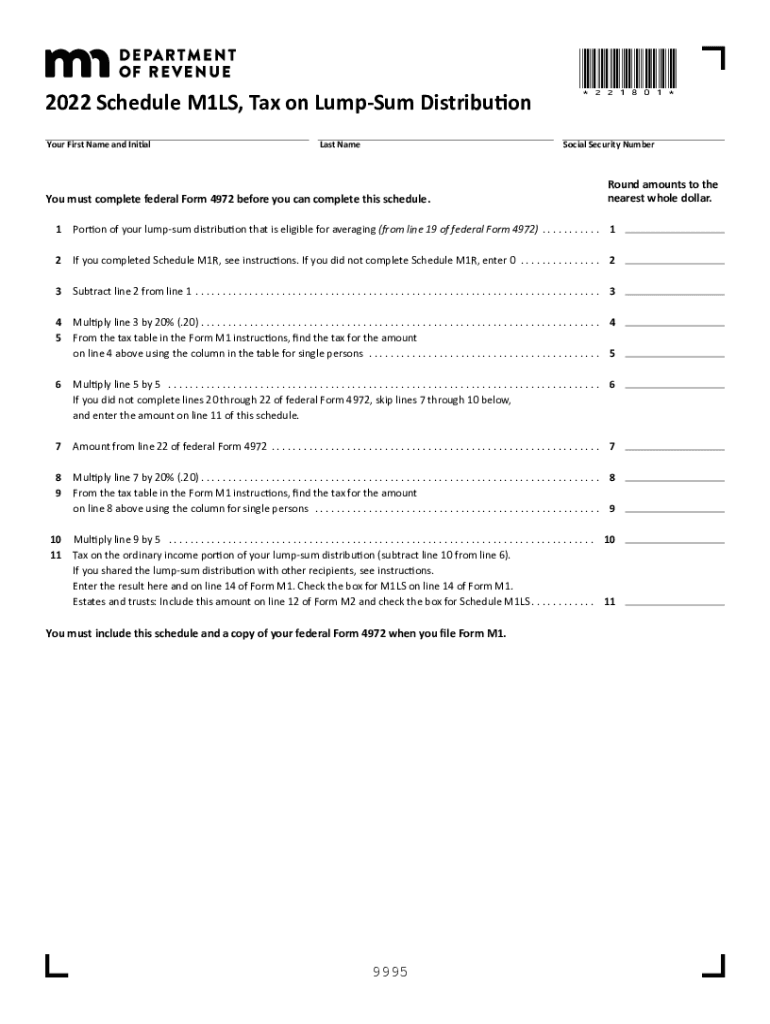

The Form Schedule M1LS is a specific tax form used in the United States to report and calculate taxes on lump sum distributions from retirement plans, pensions, or other similar financial arrangements. This form is essential for individuals who receive a one-time payment from their retirement accounts, allowing them to comply with tax regulations. Understanding the purpose of this form is crucial for accurate tax reporting and to avoid potential penalties.

Steps to Complete the Form Schedule M1LS Tax on Lump Sum Distribution

Completing the Form Schedule M1LS involves several key steps to ensure accuracy and compliance. First, gather all necessary documents related to your lump sum distribution, including any tax statements from your retirement plan. Next, accurately fill out your personal information, including your Social Security number and the amount received. Calculate the taxable portion of your distribution, taking into account any applicable deductions or exemptions. Finally, review your completed form for errors before submitting it with your tax return.

Legal Use of the Form Schedule M1LS Tax on Lump Sum Distribution

The legal use of the Form Schedule M1LS is governed by IRS regulations, which require accurate reporting of lump sum distributions for tax purposes. This form must be completed and filed in accordance with federal tax laws to ensure that the distribution is taxed appropriately. Failure to use the form correctly can lead to legal consequences, including fines or audits. It is essential to understand the legal implications of the information provided on this form to maintain compliance with tax regulations.

IRS Guidelines for the Form Schedule M1LS Tax on Lump Sum Distribution

The IRS provides specific guidelines for completing the Form Schedule M1LS, which include instructions on eligibility, required information, and deadlines for submission. Taxpayers must adhere to these guidelines to ensure their forms are processed correctly. The IRS also outlines the consequences of incorrect filings, emphasizing the importance of accuracy in reporting lump sum distributions. Familiarizing oneself with these guidelines can help prevent issues during tax season.

Filing Deadlines for the Form Schedule M1LS Tax on Lump Sum Distribution

Filing deadlines for the Form Schedule M1LS align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due by April 15 of each year, although extensions may be available. It is important to be aware of these deadlines to avoid late fees or penalties. Taxpayers should also consider any state-specific deadlines that may apply, as these can vary across different jurisdictions.

Required Documents for the Form Schedule M1LS Tax on Lump Sum Distribution

To complete the Form Schedule M1LS accurately, several documents are required. These include your retirement plan statements, Form 1099-R, which reports distributions from pensions, and any other relevant tax documents that detail your income. Having these documents on hand will facilitate the completion of the form and ensure that all necessary information is reported accurately, reducing the risk of errors.

Quick guide on how to complete form schedule m1ls tax on lump sum distribution free legal forms

Complete Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms without stress

- Locate Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, text message (SMS), or an invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form schedule m1ls tax on lump sum distribution free legal forms

Create this form in 5 minutes!

People also ask

-

What is the best way to schedule m1ls using airSlate SignNow?

To schedule m1ls with airSlate SignNow, simply log into your account, navigate to the scheduling feature, and select the m1ls you wish to schedule. Ensure you specify the desired date and time, and the system will handle the rest. It's a seamless process designed to enhance your document management capabilities.

-

Are there any costs associated with scheduling m1ls?

Yes, scheduling m1ls may involve costs depending on your selected airSlate SignNow plan. We offer various pricing tiers that cater to different business sizes and needs. Review our pricing page for detailed information to find an option that suits your budget.

-

What features should I expect when I schedule m1ls?

When you schedule m1ls using airSlate SignNow, you can expect features such as automated reminders, customizable templates, and secure eSigning options. These features enhance the efficiency of your document workflows and improve overall collaboration within your team.

-

What are the benefits of using airSlate SignNow to schedule m1ls?

Using airSlate SignNow to schedule m1ls offers numerous benefits, including reduced turnaround times, higher accuracy in document management, and increased compliance with legal standards. It simplifies the eSigning process and streamlines your business operations, ultimately saving you time and resources.

-

Can I integrate airSlate SignNow with other tools when scheduling m1ls?

Yes, airSlate SignNow supports integrations with various third-party applications, enhancing your ability to schedule m1ls efficiently. Popular integrations include CRM systems, project management tools, and cloud storage services, allowing seamless data flow across platforms.

-

Is it easy to manage scheduled m1ls in airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive dashboard that allows you to manage all your scheduled m1ls effortlessly. You can view, edit, or cancel scheduled items directly from your interface, ensuring you have complete control over your document workflow.

-

How secure is the scheduling process for m1ls with airSlate SignNow?

The scheduling process for m1ls with airSlate SignNow is highly secure. We employ advanced encryption and security protocols to protect your data throughout the scheduling and eSigning processes, ensuring compliance with industry standards and safeguarding sensitive information.

Get more for Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms

- List exhibits template form

- Nebraska bankruptcy guide and forms package for chapters 7 or 13 nebraska

- Bill of sale with warranty by individual seller nebraska form

- Bill of sale with warranty for corporate seller nebraska form

- Bill of sale without warranty by individual seller nebraska form

- Bill of sale without warranty by corporate seller nebraska form

- Verification of creditors matrix nebraska form

- Correction statement and agreement nebraska form

Find out other Form Schedule M1LS Tax On Lump Sum Distribution Legal Forms

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed