Understand the Geothermal Tax Credit Extension in Pennsylvania Form

What is the Geothermal Tax Credit Extension in Pennsylvania

The Geothermal Tax Credit Extension in Pennsylvania is a financial incentive designed to encourage the installation of geothermal heating and cooling systems. This extension allows homeowners and businesses to claim a tax credit for a percentage of the costs associated with the installation of these energy-efficient systems. The credit aims to promote renewable energy use and reduce reliance on fossil fuels, ultimately benefiting both the environment and the economy.

Eligibility Criteria for the Geothermal Tax Credit Extension

To qualify for the Geothermal Tax Credit Extension in Pennsylvania, applicants must meet specific criteria. Eligible systems must be installed in residential or commercial properties and must adhere to certain efficiency standards set by the state. Additionally, the property must be located within Pennsylvania, and the installation must be completed within the specified timeframe outlined in the tax credit guidelines. Homeowners and businesses should ensure they have the necessary documentation to prove eligibility.

Steps to Complete the Geothermal Tax Credit Extension Application

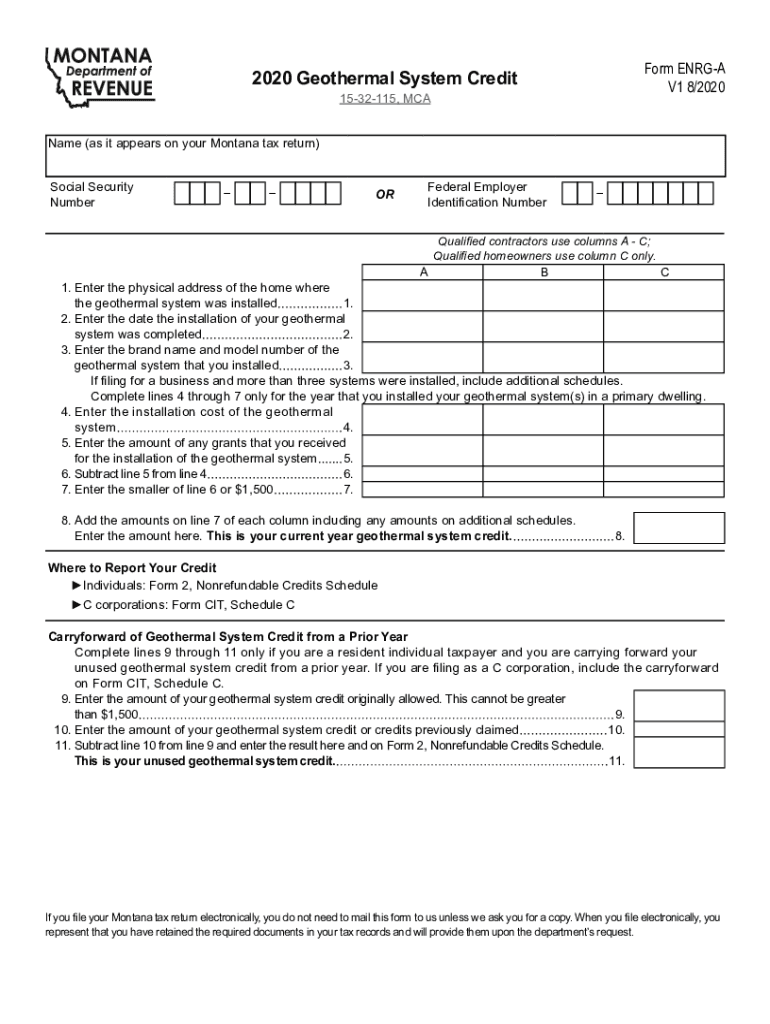

Completing the application for the Geothermal Tax Credit Extension involves several key steps. First, gather all required documentation, including proof of installation and expenses incurred. Next, fill out the appropriate tax forms, ensuring all information is accurate and complete. It is essential to review the guidelines to confirm that the installation meets all state requirements. Finally, submit the completed application along with the necessary documentation to the Pennsylvania Department of Revenue by the specified deadline.

Required Documents for the Application

When applying for the Geothermal Tax Credit Extension in Pennsylvania, several documents are required to support the application. These typically include:

- Proof of installation, such as an invoice or receipt from the contractor.

- Documentation showing the system meets state efficiency standards.

- Completed tax forms, including any necessary schedules.

- Any additional forms required by the Pennsylvania Department of Revenue.

Filing Deadlines for the Geothermal Tax Credit Extension

Filing deadlines for the Geothermal Tax Credit Extension are crucial for applicants to keep in mind. Typically, the application must be submitted within a specific period following the installation of the geothermal system. It is advisable to check the Pennsylvania Department of Revenue's official guidelines for the exact dates and any potential extensions. Missing the deadline may result in losing the opportunity to claim the tax credit.

Legal Use of the Geothermal Tax Credit Extension

The legal use of the Geothermal Tax Credit Extension is governed by Pennsylvania state laws and regulations. Applicants must ensure that their installations comply with all local building codes and energy efficiency standards. Additionally, any misrepresentation of information on the application could lead to penalties or disqualification from the tax credit. It is essential to maintain transparency and accuracy throughout the application process.

Quick guide on how to complete understand the geothermal tax credit extension in pennsylvania

Effortlessly Prepare Understand The Geothermal Tax Credit Extension In Pennsylvania on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without interruption. Manage Understand The Geothermal Tax Credit Extension In Pennsylvania on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Understand The Geothermal Tax Credit Extension In Pennsylvania with minimal effort

- Acquire Understand The Geothermal Tax Credit Extension In Pennsylvania and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal recognition as an original ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the headache of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Understand The Geothermal Tax Credit Extension In Pennsylvania to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the understand the geothermal tax credit extension in pennsylvania

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Geothermal Tax Credit Extension in Pennsylvania?

The Geothermal Tax Credit Extension in Pennsylvania allows homeowners and businesses to take advantage of tax credits when investing in geothermal energy systems. To fully understand the benefits, it's essential to research and review the specifics of the program, as it can signNowly reduce installation costs. This initiative encourages energy efficiency and renewable energy use in the state.

-

How can I qualify for the Geothermal Tax Credit Extension in Pennsylvania?

To qualify, you must install a geothermal heating and cooling system that meets specific criteria laid out by the state. Understanding the geothermal tax credit extension in Pennsylvania involves familiarizing yourself with eligibility requirements, which typically require the system to be purchased and installed by a certified professional.

-

What are the financial benefits of the Geothermal Tax Credit Extension?

The financial benefits of understanding the geothermal tax credit extension in Pennsylvania include signNow tax savings and reduced energy costs. Depending on the size and type of the system, these credits can cover a substantial portion of installation expenses, resulting in faster return on investment and long-term savings on utility bills.

-

How does the Geothermal Tax Credit affect my overall installation costs?

Understanding the geothermal tax credit extension in Pennsylvania can greatly reduce your overall installation costs. The tax credit allows you to recoup a percentage of your investment, thereby making geothermal systems more affordable. This helps mitigate the upfront financial barrier typically associated with renewable energy systems.

-

Can businesses benefit from the Geothermal Tax Credit Extension in Pennsylvania?

Yes, businesses can benefit from understanding the geothermal tax credit extension in Pennsylvania just like homeowners. The extension not only offers financial incentives but also promotes corporate responsibility through investment in sustainable practices. Many businesses find that featuring geothermal energy in their operations enhances their brand image and reduces operational costs.

-

Are there specific deadlines for applying for the Geothermal Tax Credit Extension?

Yes, understanding the geothermal tax credit extension in Pennsylvania involves being aware of important deadlines. Typically, applications must be submitted by specific dates set forth by the state. To ensure you don’t miss out on your tax credits, it’s essential to stay informed and apply promptly.

-

Do I need to hire a professional to install a geothermal system in order to claim the tax credit?

To successfully understand the geothermal tax credit extension in Pennsylvania, it's crucial to have a licensed professional install your geothermal system. The installation must meet industry standards to qualify for the credit, and hiring a certified installer ensures compliance and maximizes the benefits of the tax extension.

Get more for Understand The Geothermal Tax Credit Extension In Pennsylvania

- Form llp 2 amendment to registration of a limited liability partnership

- Online california architects business entity report form

- Dsa 291 form

- Dtsc form 1478

- Form llc 12 llc statement of information

- Warehousemans lien california mobilehome form

- Articles of incorporation montana secretary of state sos mt form

- Professional limited liability company form

Find out other Understand The Geothermal Tax Credit Extension In Pennsylvania

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament