Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things to Know 2020

Understanding Utah State Income Taxes

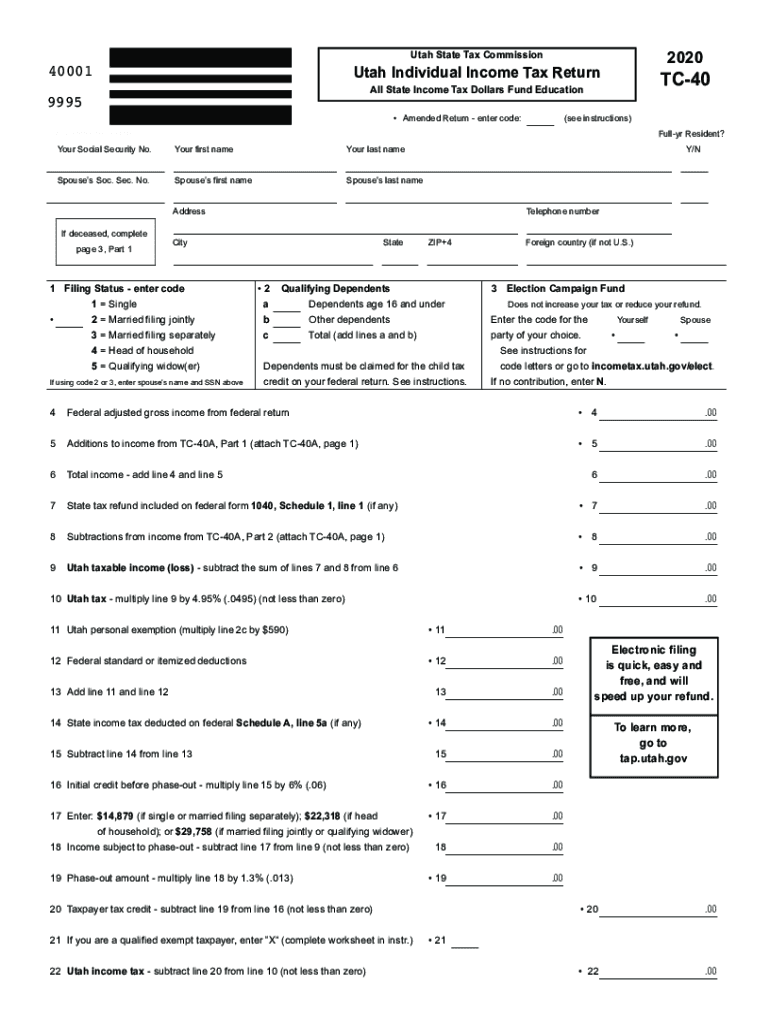

The Utah state income tax is a tax levied on the income of residents and non-residents earning income within the state. The tax rate is a flat rate, meaning that all taxpayers are taxed at the same percentage regardless of their income level. As of the latest updates, the Utah income tax rate is four point nine five percent. This tax is essential for funding state services, including education, infrastructure, and public safety.

Key Elements of Utah State Income Tax Forms

When filing your Utah state income tax, it is important to understand the key elements of the required forms. The primary form for individual income tax is the TC-40. This form collects essential information about your income, deductions, and credits. Additionally, you may need to include supporting documents, such as W-2s or 1099s, to substantiate your income claims. Understanding these elements ensures that your tax return is complete and accurate.

Steps to Complete the Utah State Income Tax Filing

Completing your Utah state income tax filing involves several steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Obtain the TC-40 form and any additional schedules that apply to your situation.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review your completed form for errors or omissions.

- Submit your tax return either electronically or by mailing it to the Utah State Tax Commission.

Each of these steps is crucial for ensuring compliance and avoiding potential penalties.

Payment Methods for Utah State Income Taxes

Utah offers various payment methods for settling your state income tax obligations. Taxpayers can choose to pay online through the Utah State Tax Commission's website, by mail with a check or money order, or in person at designated locations. Electronic payments are often the most convenient, allowing for immediate confirmation of your payment. Ensure that you keep records of your payment for future reference.

Filing Deadlines and Important Dates

Being aware of filing deadlines is crucial for avoiding penalties. The standard deadline for filing your Utah state income tax return is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers who need more time can file for an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance with Utah State Income Tax

Failure to comply with Utah state income tax regulations can result in significant penalties. Common penalties include late filing fees, which can accumulate over time, and interest on any unpaid taxes. In severe cases, taxpayers may face legal action or liens against their property. It is essential to file your taxes accurately and on time to avoid these consequences.

Quick guide on how to complete utah income taxesutah state tax commissionpayment methods utah income taxesutah state tax filing utah state taxes things to

Prepare Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know with ease

- Locate Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utah income taxesutah state tax commissionpayment methods utah income taxesutah state tax filing utah state taxes things to

Create this form in 5 minutes!

How to create an eSignature for the utah income taxesutah state tax commissionpayment methods utah income taxesutah state tax filing utah state taxes things to

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow's role in managing Utah state income tax documents?

airSlate SignNow streamlines the process of creating, sending, and signing documents related to Utah state income tax. Our platform ensures that you can easily manage tax documents while maintaining compliance. This helps businesses save time and reduce the hassle often associated with tax documentation.

-

How does airSlate SignNow simplify Utah state income tax filing?

airSlate SignNow simplifies Utah state income tax filing by allowing users to eSign important documents securely and from anywhere. With our platform, you can quickly send tax forms, receive signatures, and store them electronically. This efficiency can lead to timely submissions and reduce potential penalties.

-

What features does airSlate SignNow offer to assist with Utah state income tax compliance?

airSlate SignNow provides features such as secure eSigning, document templates, and audit trails to assist with Utah state income tax compliance. These tools ensure that all necessary documents are accurately completed and stored, minimizing the risk of errors. Our solution helps keep your business organized during tax season.

-

Is airSlate SignNow cost-effective for handling Utah state income tax documents?

Yes, airSlate SignNow is a cost-effective solution for handling Utah state income tax documents. Our pricing plans are designed to fit various budgets, allowing businesses of all sizes to benefit from our eSignature services. Investing in our platform can lead to signNow savings in both time and resources during tax preparation.

-

Can airSlate SignNow integrate with accounting software for Utah state income tax?

Absolutely! airSlate SignNow supports integrations with various accounting software to facilitate Utah state income tax processes. This means you can streamline document creation and signing directly within your existing tools, enhancing productivity and accuracy in tax management.

-

What are the benefits of using airSlate SignNow for Utah state income tax purposes?

Using airSlate SignNow for Utah state income tax provides numerous benefits, including faster document turnaround times and improved compliance. Our user-friendly interface ensures that you can eSign documents quickly, while our secure platform protects sensitive tax information. This combination of efficiency and security allows you to focus more on your business.

-

How secure is airSlate SignNow for Utah state income tax documents?

airSlate SignNow prioritizes security and compliance when it comes to handling Utah state income tax documents. We utilize encryption and secure cloud storage to protect your sensitive information. Our platform also adheres to industry best practices, ensuring your tax documents remain confidential and protected at all times.

Get more for Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know

- Fillable bureau of professional licensing po box 30670 form

- Village of long grove license application solicitor form

- Pdf solicitation permit application note all information must be

- Form 2200 127

- Wisconsin online fishing license form

- Dnr 3400 25a form

- In mississippi who can sign a dnr order form

- Form 2200 127 special event application and permit

Find out other Utah Income TaxesUtah State Tax CommissionPayment Methods Utah Income TaxesUtah State Tax Filing Utah State Taxes Things To Know

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple