Verification of Mortgage Form 2007-2026

What is the Verification of Mortgage Form

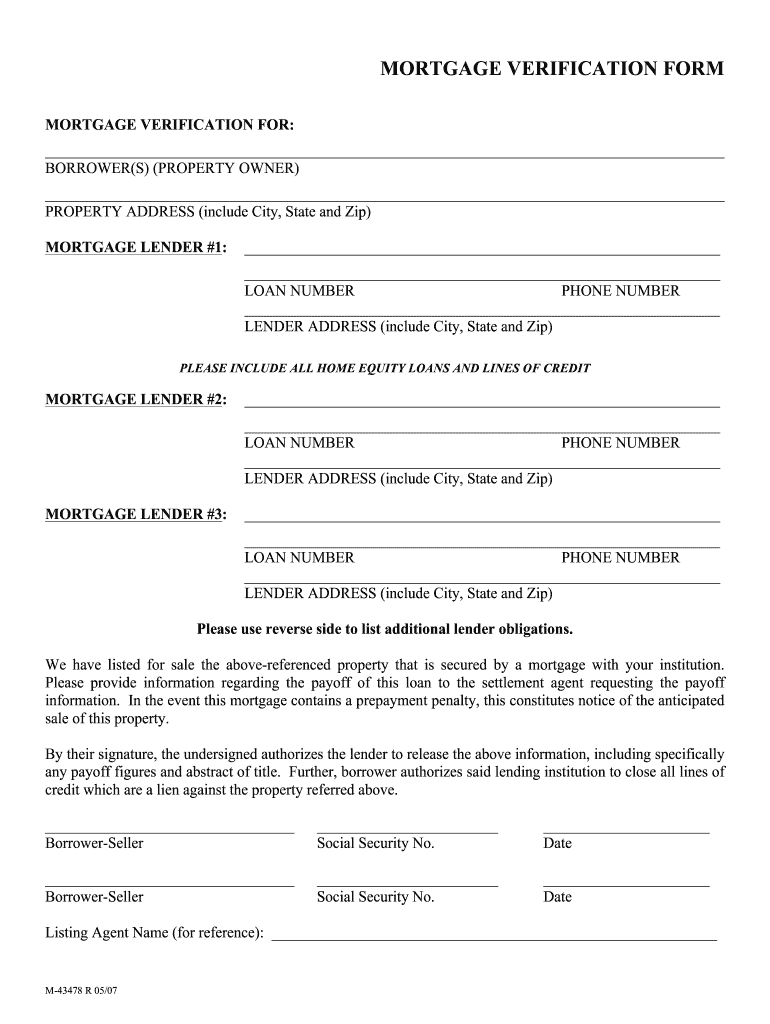

The verification of mortgage form is a document used to confirm the details of a mortgage loan. It is typically requested by lenders, financial institutions, or other parties involved in real estate transactions to validate a borrower's mortgage status. This form includes essential information such as the loan amount, payment history, and current balance. It serves as a crucial tool for assessing a borrower's financial standing and ensuring transparency in the mortgage process.

How to use the Verification of Mortgage Form

Using the verification of mortgage form involves several steps to ensure accurate completion. First, gather all necessary information related to the mortgage, including loan details and borrower information. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, it should be submitted to the relevant party, such as a lender or financial institution, for verification. This process helps facilitate loan applications, refinancing, or other financial transactions requiring proof of mortgage status.

Steps to complete the Verification of Mortgage Form

Completing the verification of mortgage form requires attention to detail. Follow these steps:

- Gather all relevant mortgage documents, including loan agreements and payment history.

- Fill in the borrower's personal information, including name, address, and contact details.

- Provide specific mortgage details, such as the loan number, original loan amount, and current balance.

- Include the lender's information, including their name and contact details.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Verification of Mortgage Form

The verification of mortgage form contains several key elements that are essential for its validity. These include:

- Borrower Information: This section captures the borrower's personal details.

- Loan Information: Includes specifics about the mortgage, such as the loan amount and type.

- Lender Information: Details about the lending institution, including contact information.

- Signature: The form typically requires the borrower's signature to authorize the verification.

Legal use of the Verification of Mortgage Form

The verification of mortgage form is legally binding when completed and signed correctly. It is essential for compliance with federal and state regulations regarding mortgage documentation. This form can be used in various legal contexts, such as loan applications, refinancing, and real estate transactions. Ensuring that the form is filled out accurately helps protect the interests of both borrowers and lenders, providing a clear record of mortgage obligations.

Who Issues the Form

The verification of mortgage form is typically issued by lenders or financial institutions. These entities require the form to assess a borrower's mortgage status during various financial transactions. In some cases, third-party verification services may also provide the form to facilitate the verification process. It is crucial for borrowers to obtain the form from a reputable source to ensure its validity and acceptance by the requesting party.

Quick guide on how to complete verification of mortgage pdf form

The optimal method to obtain and sign Verification Of Mortgage Form

Across your entire organization, ineffective workflows surrounding document authorization can consume a signNow amount of productive time. Executing paperwork like Verification Of Mortgage Form is a fundamental aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall productivity of the company. With airSlate SignNow, endorsing your Verification Of Mortgage Form is as simple and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it immediately without needing to install additional software on your computer or printing physical copies.

Steps to obtain and sign your Verification Of Mortgage Form

- Browse our collection by category or use the search bar to locate the document you require.

- View the form preview by clicking Learn more to verify it is the correct one.

- Hit Get form to start editing right away.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign tool to endorse your Verification Of Mortgage Form.

- Select the signing method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as needed.

With airSlate SignNow, you have everything required to handle your documents effectively. You can search for, complete, modify, and even send your Verification Of Mortgage Form all in one tab effortlessly. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

Create this form in 5 minutes!

How to create an eSignature for the verification of mortgage pdf form

How to create an electronic signature for your Verification Of Mortgage Pdf Form in the online mode

How to generate an eSignature for the Verification Of Mortgage Pdf Form in Chrome

How to generate an electronic signature for putting it on the Verification Of Mortgage Pdf Form in Gmail

How to generate an electronic signature for the Verification Of Mortgage Pdf Form right from your smartphone

How to create an electronic signature for the Verification Of Mortgage Pdf Form on iOS devices

How to make an electronic signature for the Verification Of Mortgage Pdf Form on Android devices

People also ask

-

What is a verification of mortgage form?

A verification of mortgage form is a document used by lenders to confirm the details of an existing mortgage loan. It typically includes information about the loan amount, payment history, and current status. Using airSlate SignNow, you can easily create, send, and eSign your verification of mortgage form securely and efficiently.

-

How does airSlate SignNow simplify the verification of mortgage form process?

airSlate SignNow streamlines the verification of mortgage form process by allowing users to digitally create and manage documents. With its user-friendly interface, you can quickly populate the form and send it for eSignature. This reduces the time and effort required compared to traditional paper methods.

-

What are the features included in the verification of mortgage form with airSlate SignNow?

The verification of mortgage form on airSlate SignNow includes features like customizable templates, document tracking, and multi-party signing. These features enhance the efficiency of the signing process, ensuring that you can verify mortgages quickly and without hassle. Additionally, the platform allows for integrations with various applications, improving workflow.

-

Is there a fee for using airSlate SignNow for verification of mortgage forms?

Yes, there is a fee associated with using airSlate SignNow for verification of mortgage forms. However, the pricing is competitive and offers a cost-effective solution for businesses. By using airSlate SignNow, you save time and resources that can be better spent elsewhere in your operations.

-

Can I use airSlate SignNow for multiple verification of mortgage forms?

Absolutely! You can use airSlate SignNow to manage multiple verification of mortgage forms simultaneously. Its easy-to-use platform allows you to handle numerous documents without confusion, making it ideal for businesses dealing with many mortgage verifications. This efficiency can signNowly enhance your overall productivity.

-

How secure is the verification of mortgage form process with airSlate SignNow?

The verification of mortgage form process with airSlate SignNow is highly secure. The platform employs advanced encryption methods to protect your documents and information throughout the signing process. You can confidently eSign and share your verification of mortgage forms, knowing that your data is safeguarded.

-

Does airSlate SignNow integrate with other tools for processing verification of mortgage forms?

Yes, airSlate SignNow offers integrations with various tools to enhance the processing of verification of mortgage forms. You can connect it with CRM systems, cloud storage, and other essential applications, thus streamlining your workflow. These integrations allow for a more comprehensive approach to document management and eSigning.

Get more for Verification Of Mortgage Form

Find out other Verification Of Mortgage Form

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free