Ohio Use Tax Ohio Department of Taxation > Home 2020-2026

Understanding the Ohio Use Tax

The Ohio Use Tax is a tax imposed on the storage, use, or consumption of tangible personal property and certain services in Ohio. This tax applies when sales tax has not been paid at the time of purchase. It is essential for residents and businesses to understand their obligations under this tax to ensure compliance and avoid penalties. The Ohio Department of Taxation oversees the administration of this tax, providing guidelines and resources for taxpayers.

Steps to Complete the Ohio Use Tax

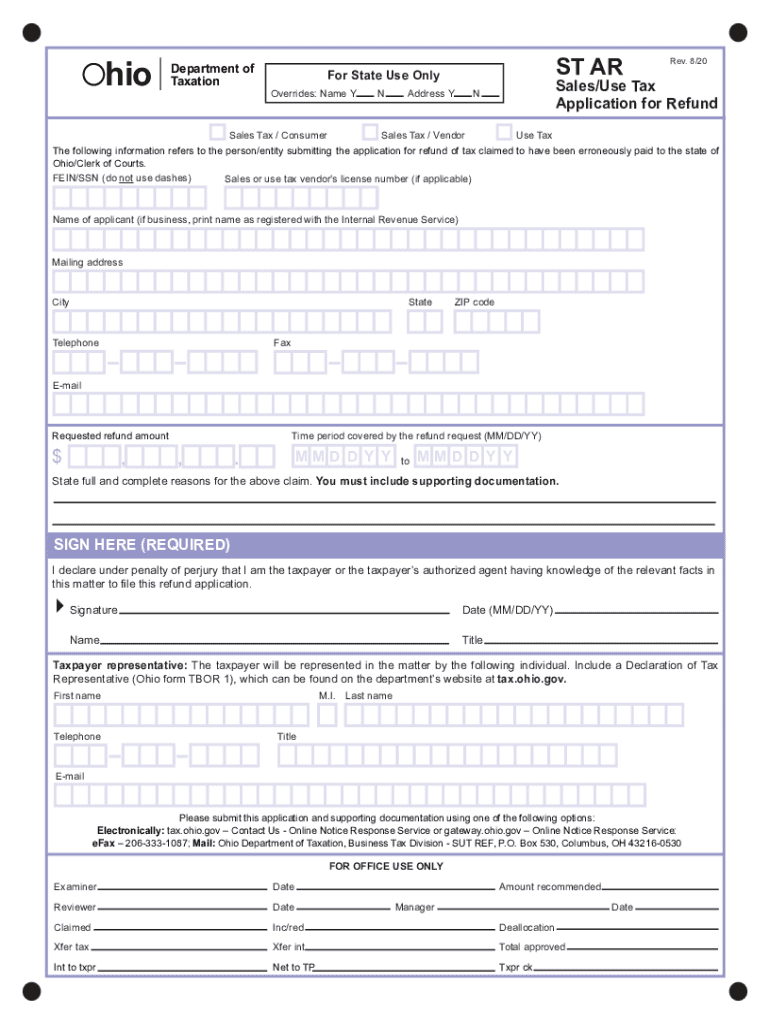

Completing the Ohio Use Tax involves several steps to ensure accuracy and compliance. First, gather all relevant purchase records, including receipts and invoices, to determine the amount of tax owed. Next, calculate the total use tax based on the purchase price of the items. After calculating the tax, fill out the appropriate form, typically the Ohio Use Tax Return. Finally, submit the completed form along with any payment due to the Ohio Department of Taxation by the specified deadline.

Required Documents for Filing

When filing the Ohio Use Tax, certain documents are necessary to support your submission. These documents typically include:

- Receipts or invoices for purchases made without sales tax

- Completed Ohio Use Tax Return form

- Any additional documentation requested by the Ohio Department of Taxation

Having these documents ready will facilitate a smoother filing process and help ensure compliance with tax regulations.

Filing Deadlines and Important Dates

Timely filing of the Ohio Use Tax is crucial to avoid penalties. The filing deadlines generally align with the state’s tax calendar. Typically, taxpayers must file their returns by the end of the month following the end of each quarter. For example, the deadline for the first quarter would be April 30. It is important to check the Ohio Department of Taxation’s official website for any updates or changes to these deadlines.

Penalties for Non-Compliance

Failure to comply with Ohio Use Tax regulations can result in penalties and interest charges. If a taxpayer does not file their return on time or fails to pay the tax owed, they may face a penalty of up to 15 percent of the unpaid tax. Additionally, interest accrues on any unpaid balance, further increasing the total amount owed. Understanding these penalties emphasizes the importance of adhering to filing requirements.

Eligibility Criteria for Exemptions

Certain exemptions may apply to the Ohio Use Tax, allowing specific individuals or entities to avoid taxation on certain purchases. Common exemptions include items purchased for resale, goods used in manufacturing, and certain nonprofit organizations. To qualify for an exemption, taxpayers must provide appropriate documentation and meet specific criteria set by the Ohio Department of Taxation.

Quick guide on how to complete ohio use tax ohio department of taxation ampgt home

Finalize Ohio Use Tax Ohio Department Of Taxation > Home effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect sustainable alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle Ohio Use Tax Ohio Department Of Taxation > Home on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Ohio Use Tax Ohio Department Of Taxation > Home with minimal effort

- Locate Ohio Use Tax Ohio Department Of Taxation > Home and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Ohio Use Tax Ohio Department Of Taxation > Home and guarantee effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio use tax ohio department of taxation ampgt home

Create this form in 5 minutes!

People also ask

-

What is an st ar form and how can it benefit my business?

An st ar form is a digital document that allows for efficient signing and execution of agreements. By using airSlate SignNow, businesses can streamline their workflow, reduce turnaround times, and enhance document security, ultimately leading to increased productivity.

-

How does pricing work for airSlate SignNow's st ar form service?

airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the complexity of your requirements and the number of users, you can choose a plan that best suits your budget while still benefiting from the st ar form's features.

-

What features are included when using the st ar form with airSlate SignNow?

When you use the st ar form with airSlate SignNow, you gain access to features like customizable templates, advanced security options, and comprehensive tracking capabilities. These features make it easier to manage eSigning processes effectively.

-

Can I integrate third-party applications with my st ar form on airSlate SignNow?

Yes, airSlate SignNow allows for easy integration with various popular applications. This ensures that your st ar form can seamlessly work with other tools that your business relies on, enhancing overall efficiency.

-

Is training available for using the st ar form on airSlate SignNow?

Absolutely! airSlate SignNow provides training resources, including tutorials and webinars, to help users familiarize themselves with the st ar form features. These resources are designed to make the onboarding process smooth and effective.

-

How secure is the st ar form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The st ar form is protected with advanced encryption and is compliant with global security standards, ensuring that your documents remain confidential and secure throughout the signing process.

-

How quickly can I send and receive signed st ar forms?

With airSlate SignNow, you can send st ar forms instantly, and signed documents can be received in minutes. This expedited process signNowly enhances your ability to close deals faster and improve overall operational efficiency.

Get more for Ohio Use Tax Ohio Department Of Taxation > Home

Find out other Ohio Use Tax Ohio Department Of Taxation > Home

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed