Instructions for Filling Out the Application for SalesUse Tax Refund Tax Ohio 2012

What is the Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio

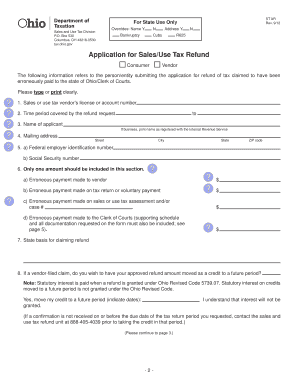

The Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio provide detailed guidance on how to complete the application process for obtaining a sales and use tax refund within the state of Ohio. This document outlines the eligibility criteria, necessary documentation, and specific procedures required to successfully submit your application. Understanding these instructions is crucial for ensuring compliance with state regulations and maximizing your chances of receiving a refund.

Steps to complete the Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio

Completing the application for a sales and use tax refund in Ohio involves several key steps:

- Gather all necessary documentation, including receipts and proof of tax payment.

- Carefully read the instructions to understand the eligibility requirements.

- Fill out the application form accurately, ensuring all information is complete.

- Review your application for any errors or omissions before submission.

- Submit the application through the designated method, whether online or via mail.

Required Documents

When filling out the application for the sales and use tax refund, it is essential to include specific documents to support your claim. Required documents typically include:

- Receipts or invoices that show the amount of sales tax paid.

- Proof of payment, such as bank statements or credit card statements.

- A completed application form, which must be signed and dated.

Having these documents ready will streamline the application process and help prevent delays.

Eligibility Criteria

To qualify for a sales and use tax refund in Ohio, applicants must meet certain eligibility criteria. Generally, eligibility includes:

- Having paid sales tax on purchases that are eligible for a refund.

- Submitting the application within the specified time frame set by the state.

- Providing accurate documentation to support the refund claim.

Understanding these criteria is vital to ensure that your application is valid and processed efficiently.

Form Submission Methods (Online / Mail / In-Person)

Applicants have multiple options for submitting the application for the sales and use tax refund in Ohio. These methods include:

- Online submission through the Ohio Department of Taxation's website, which allows for quick processing.

- Mailing the completed application form and required documents to the designated address.

- In-person submission at local tax offices, which may provide immediate assistance.

Choosing the right submission method can impact the speed and efficiency of your refund process.

Legal use of the Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio

The Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio are legally binding and must be followed to ensure compliance with state tax laws. Adhering to these instructions not only facilitates a smoother application process but also protects your rights as a taxpayer. Any discrepancies or failures to comply with the outlined procedures may result in delays or denial of your refund request.

Quick guide on how to complete instructions for filling out the application for salesuse tax refund tax ohio

Effortlessly Prepare Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio on Any Device

Digital document management has gained traction with organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any delays. Manage Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio effortlessly

- Locate Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that need.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and eSign Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for filling out the application for salesuse tax refund tax ohio

Create this form in 5 minutes!

How to create an eSignature for the instructions for filling out the application for salesuse tax refund tax ohio

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What are the instructions for filling out the application for Sales/Use Tax Refund Tax Ohio?

The instructions for filling out the application for Sales/Use Tax Refund Tax Ohio involve several steps. First, gather all necessary documents such as purchase receipts and tax exemption certificates. Then, follow the detailed guidelines provided in the application form to ensure accurate completion and submission.

-

What documents do I need to submit with the Sales/Use Tax Refund application in Ohio?

When applying for a Sales/Use Tax Refund in Ohio, you will need to submit proof of purchase, tax exemption certificates, and the completed application form. Make sure to retain copies of all documents for your records. These documents are essential for processing your refund request.

-

How long does it take to process the Sales/Use Tax Refund application in Ohio?

The processing time for a Sales/Use Tax Refund application in Ohio can vary. Generally, it takes several weeks for the Department of Taxation to review and approve your application. It's advisable to check the status periodically for any updates.

-

Are there any fees associated with filing the Sales/Use Tax Refund application in Ohio?

There are no fees to file a Sales/Use Tax Refund application in Ohio. However, ensure that you accurately complete the application to avoid any delays in processing your refund. Understanding the instructions for filling out the application for Sales/Use Tax Refund Tax Ohio is crucial.

-

How does airSlate SignNow help in filling out the application for Sales/Use Tax Refund Tax Ohio?

AirSlate SignNow provides an efficient platform to eSign and send documents, including tax refund applications. With its user-friendly interface, you can easily access and fill out the application for Sales/Use Tax Refund Tax Ohio, ensuring all required fields are completed correctly.

-

Can I track the status of my Sales/Use Tax Refund application in Ohio using airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Sales/Use Tax Refund application. You can receive notifications on document views and completions, giving you peace of mind during the refund process.

-

What are the benefits of using airSlate SignNow for tax refund applications?

Using airSlate SignNow for tax refund applications simplifies the document process by enabling electronic signatures and easy sharing. It enhances accuracy and reduces the chances of errors while filling out the instructions for filling out the application for Sales/Use Tax Refund Tax Ohio.

Get more for Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio

- Statement of practical experience state of new jersey form

- American sentinel university transcript request form

- Au statutory declaration form

- A research report in support of the owners guide to dbia form

- Liebert datamate form

- New patient forms beauty and body med lounge ampamp spa

- Maine health and environmental testing lab water mainegov form

- Pre registration form already on file

Find out other Instructions For Filling Out The Application For SalesUse Tax Refund Tax Ohio

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online