Boe530 Schedule C Detailed Allocation by Suboutlet of Combined State and Uniform Local Boe530 Schedule C Detailed Allocation by 2008

What is the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca

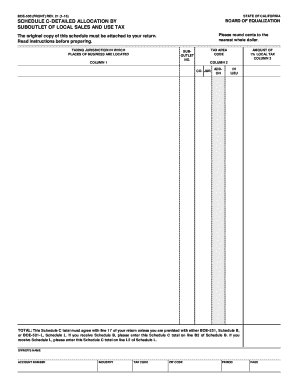

The Boe530 Schedule C is a crucial form used in California for reporting sales and use tax allocations. This form specifically focuses on the detailed allocation by suboutlet of combined state and uniform local taxes. It is essential for businesses with multiple locations to accurately report their tax obligations to ensure compliance with state regulations. The form helps in distinguishing the sales tax collected at each suboutlet, which is vital for proper tax distribution among local jurisdictions.

How to use the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca

Using the Boe530 Schedule C involves several steps to ensure accurate reporting. First, gather sales data from each suboutlet, including total sales and tax collected. Next, complete the form by entering the required information for each location. It's important to ensure that the figures align with your accounting records. Once the form is filled out, you can submit it electronically or via mail, depending on your preference and compliance requirements.

Steps to complete the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca

Completing the Boe530 Schedule C requires careful attention to detail. Here are the steps to follow:

- Collect sales data from each suboutlet, ensuring accuracy in total sales and tax collected.

- Access the Boe530 Schedule C form, either online or in a printable format.

- Fill in the required fields, including the name and address of each suboutlet.

- Enter the total sales and tax amounts for each location, ensuring they match your records.

- Review the completed form for accuracy before submission.

- Submit the form electronically or mail it to the appropriate tax authority.

Legal use of the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca

The Boe530 Schedule C is legally binding when completed and submitted according to state regulations. It serves as an official document for tax reporting purposes. Ensuring compliance with the relevant laws, such as the California Revenue and Taxation Code, is essential for the validity of the form. Properly completed forms can protect businesses from penalties and audits, making it crucial to adhere to legal standards.

Key elements of the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca

Key elements of the Boe530 Schedule C include:

- Suboutlet Information: Detailed identification of each suboutlet, including addresses and sales figures.

- Tax Allocation: Accurate reporting of state and local taxes collected at each location.

- Signature: Required signature of the responsible party certifying the accuracy of the information provided.

- Submission Method: Options for electronic or paper submission, depending on compliance preferences.

Filing Deadlines / Important Dates

Filing deadlines for the Boe530 Schedule C are typically aligned with quarterly sales tax reporting periods. Businesses should be aware of the specific due dates to avoid late penalties. It is advisable to check the California Department of Tax and Fee Administration website for the most current deadlines, as they can vary based on the business type and reporting frequency.

Quick guide on how to complete boe530 schedule c detailed allocation by suboutlet of combined state and uniform local boe530 schedule c detailed allocation by

Set up Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly option to traditional printed and signed documents since you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your files quickly and without interruptions. Handle Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By with ease

- Locate Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require new paper copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boe530 schedule c detailed allocation by suboutlet of combined state and uniform local boe530 schedule c detailed allocation by

Create this form in 5 minutes!

People also ask

-

What is the Boe530 Schedule C Detailed Allocation By Suboutlet?

The Boe530 Schedule C Detailed Allocation By Suboutlet is a financial document used for the accurate allocation of revenue generated from various suboutlets within combined state and uniform local authorities. Utilizing this tool helps businesses ensure compliance and transparency in their financial reporting. It's essential for businesses operating in multiple locations to maintain detailed records in accordance with local regulations.

-

How can airSlate SignNow help with the Boe530 Schedule C Detailed Allocation?

airSlate SignNow provides an efficient platform for electronically signing and sending your Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. This streamlines your document workflow, increases productivity, and ensures that all parties involved can quickly access necessary documentation.

-

What are the pricing options for using airSlate SignNow for Boe530 Schedule C detailed allocation?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, making it a cost-effective solution for managing your Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. Pricing is designed to fit your budget while providing all the necessary features for document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as easy document e-signatures, templates for repeated use, and integrations with other software tools. These functionalities enhance your ability to manage Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. effectively, ensuring a seamless workflow from creation to finalization.

-

Is it easy to integrate airSlate SignNow with existing documentation systems?

Yes, airSlate SignNow is designed to integrate smoothly with many existing documentation systems and software platforms. This flexibility is beneficial for businesses needing to manage the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. without disrupting current operations.

-

Can airSlate SignNow provide templates for the Boe530 Schedule C?

Absolutely! airSlate SignNow offers customizable templates specifically designed for the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. These templates simplify the process of preparing your documents and save precious time.

-

What benefits can I expect from using airSlate SignNow for my business?

By using airSlate SignNow, businesses can expect signNow benefits such as reduced turnaround time for document signing, improved compliance, and easier access to important documentation like the Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe Ca. This ultimately leads to enhanced productivity and profitability.

Get more for Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By

- 151 authorized representative declaration state of michigan form

- Disabled veterans exemption state of michigan form

- 3976 2009 electronic signature declaration for state of michigan michigan form

- Instructions for filling out the application for salesuse tax refund tax ohio form

- 2020 pa 40es individual pa department of revenue form

- Free utah bill of sale forms pdf eforms free fillable

- 2018 i 094 schedule ps wisconsin department of revenue form

- Idaho notice of hearing on name change minors form

Find out other Boe530 Schedule C Detailed Allocation By Suboutlet Of Combined State And Uniform Local Boe530 Schedule C Detailed Allocation By

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement