Pub KS 1510 Sales Tax and Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared by the Kansas Department of 2020

Understanding the Kansas KS 1510 Sales Tax and Compensating Use Tax Booklet

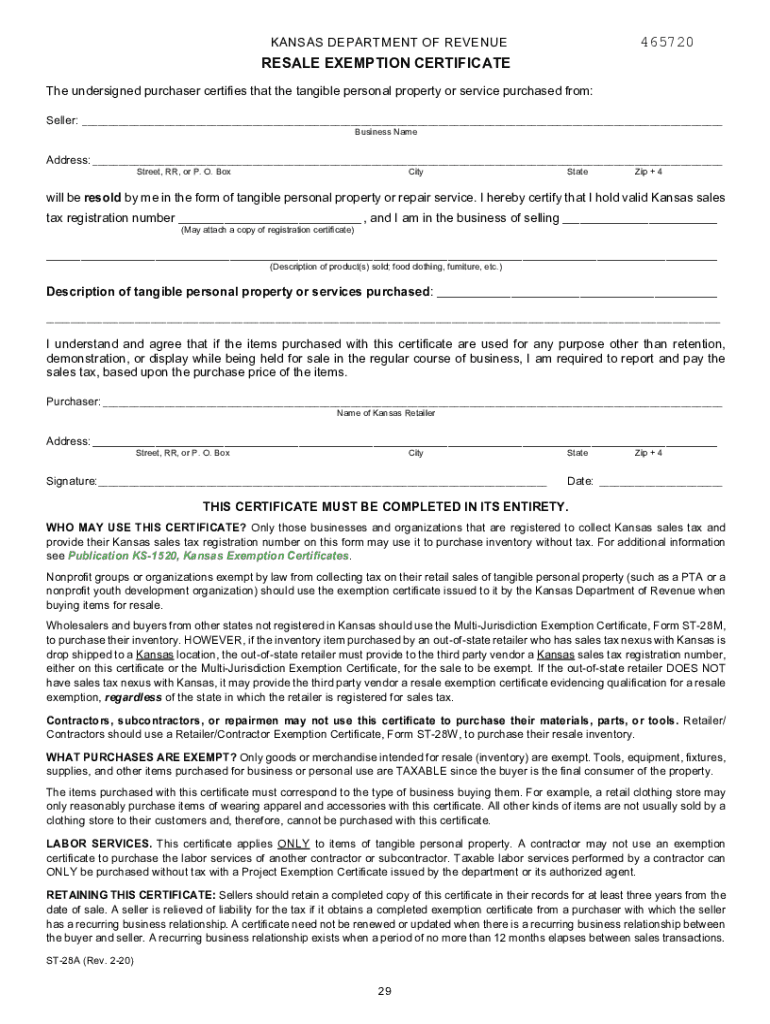

The Kansas KS 1510 Sales Tax and Compensating Use Tax Booklet, prepared by the Kansas Department of Revenue (KDOR), serves as a comprehensive guide for businesses operating within the state. This publication clarifies how the Kansas sales and use tax laws apply to various business operations. It includes essential information on tax rates, exemptions, and the types of transactions subject to taxation. Businesses can benefit from understanding these regulations to ensure compliance and avoid potential penalties.

Steps to Complete the Kansas KS 1510 Form

Completing the Kansas KS 1510 form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including sales records and purchase invoices.

- Determine the applicable sales tax rate for your transactions based on the location of the sale.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Kansas Department of Revenue by the specified deadline.

Key Elements of the Kansas KS 1510 Form

The Kansas KS 1510 form includes several key elements that are crucial for accurate tax reporting. These elements comprise:

- Taxpayer Information: Name, address, and identification number of the business.

- Sales and Use Tax Calculation: Detailed breakdown of taxable sales and the corresponding tax amounts.

- Exemptions: Documentation of any sales that qualify for tax exemptions.

- Signature: A declaration confirming the accuracy of the information provided.

Legal Use of the Kansas KS 1510 Form

The Kansas KS 1510 form is legally binding when completed and submitted in accordance with state regulations. Electronic submissions are accepted, and businesses must ensure compliance with the Kansas Department of Revenue's guidelines. Proper use of the form helps maintain accurate tax records and supports transparency in business operations. Failure to comply with the legal requirements can result in penalties, making it essential for businesses to understand their responsibilities.

Filing Deadlines for the Kansas KS 1510 Form

Timely submission of the Kansas KS 1510 form is critical to avoid penalties. The filing deadlines typically align with the end of each tax period, which may vary based on the business's tax classification. Businesses should stay informed about specific due dates to ensure compliance. Keeping a calendar of important tax deadlines can help in managing submissions effectively.

Examples of Using the Kansas KS 1510 Form

Businesses may encounter various scenarios when using the Kansas KS 1510 form. For instance:

- A retail store must report sales tax collected on merchandise sold within Kansas.

- A contractor providing services in multiple counties needs to calculate and report the appropriate sales tax based on the location of the service.

- A nonprofit organization may need to document exempt purchases to ensure compliance with tax regulations.

Understanding these examples can help businesses navigate their tax obligations more effectively.

Quick guide on how to complete pub ks 1510 sales tax and compensating use tax booklet rev 12 20 this publication has been prepared by the kansas department of

Complete Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling users to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of effortlessly

- Find Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight essential parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pub ks 1510 sales tax and compensating use tax booklet rev 12 20 this publication has been prepared by the kansas department of

Create this form in 5 minutes!

People also ask

-

What is Kansas KS 1510 in the context of airSlate SignNow?

Kansas KS 1510 refers to the unique features in airSlate SignNow that cater to businesses located in Kansas. This functionality enhances eSigning and document management, ensuring users in Kansas benefit from optimized workflow solutions.

-

How does airSlate SignNow pricing work in Kansas KS 1510?

AirSlate SignNow offers flexible pricing plans suitable for businesses in Kansas KS 1510. Each plan is designed to provide cost-effective solutions, allowing customers to choose the features they need without overspending.

-

What features does airSlate SignNow offer for Kansas KS 1510 users?

For users in Kansas KS 1510, airSlate SignNow delivers a range of features including configurable templates, real-time collaboration, and secure document storage. These features simplify document workflows to meet local business needs.

-

What are the benefits of using airSlate SignNow in Kansas KS 1510?

Businesses in Kansas KS 1510 can benefit from reduced turnaround times and improved document accuracy with airSlate SignNow. The platform enhances productivity by streamlining the eSigning process, making it a valuable tool for local organizations.

-

Can I integrate airSlate SignNow with other tools in Kansas KS 1510?

Absolutely! AirSlate SignNow supports various integrations with tools commonly used in Kansas KS 1510, such as CRMs and project management software. This seamless integration allows for a more cohesive workflow across different applications.

-

Is airSlate SignNow secure for businesses located in Kansas KS 1510?

Yes, airSlate SignNow prioritizes security for all users, including those in Kansas KS 1510. The platform employs advanced encryption and compliance with industry standards to ensure that all documents remain safe and confidential.

-

How can Kansas KS 1510 businesses get started with airSlate SignNow?

Kansas KS 1510 businesses can easily sign up for airSlate SignNow by visiting the website and choosing a plan that fits their needs. The user-friendly interface allows for quick onboarding, so users can start eSigning right away.

Get more for Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of

- 2020 form la ancillary certification application packet fill

- Ca std 268 2007 2021 fill and sign printable template form

- Oregons three tier system oregongov form

- Thank you for applying to the veterans home of california form

- Pdf business license application washington state department of form

- Revised 1017 form

- Well owners name form

- Petition for concurrent custody by extended family form

Find out other Pub KS 1510 Sales Tax And Compensating Use Tax Booklet Rev 12 20 This Publication Has Been Prepared By The Kansas Department Of

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself