Ks Exemption 2015-2026

What is the Kansas Exemption?

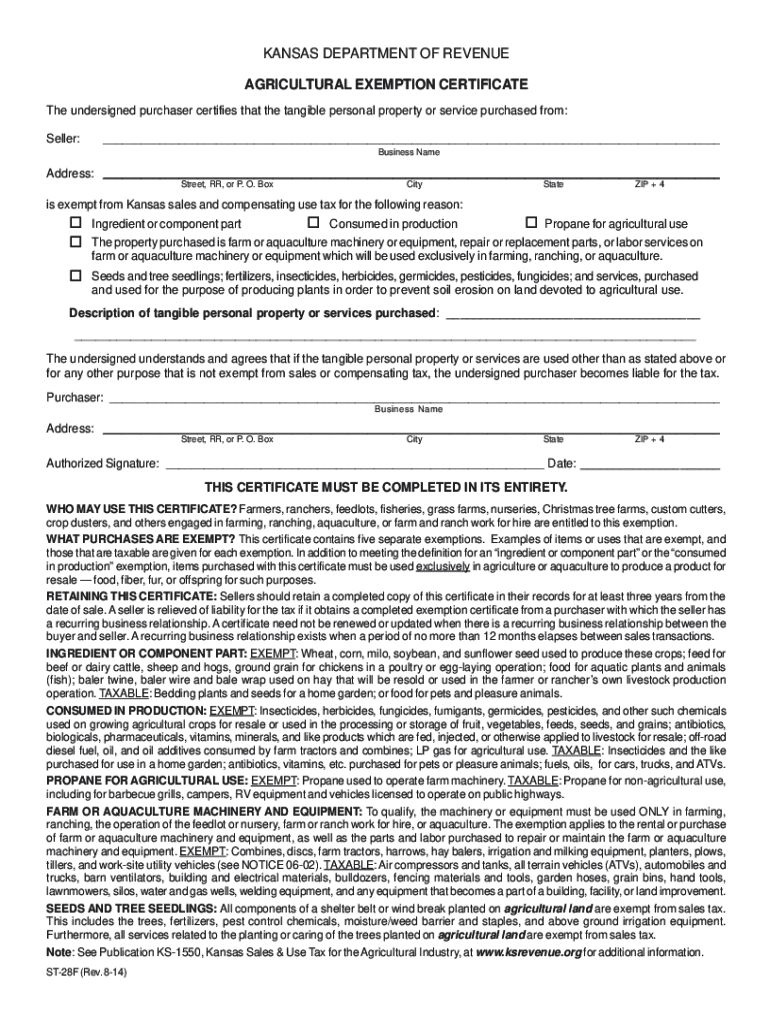

The Kansas exemption refers to specific tax exemptions available to individuals and businesses in the state of Kansas. These exemptions can reduce the amount of taxable income or eliminate certain taxes altogether. The most common form associated with this exemption is the KS-1520, which is used to claim exemption from sales and use tax on specific purchases. Understanding the Kansas exemption is crucial for taxpayers to ensure compliance and maximize their tax benefits.

How to Use the Kansas Exemption

To utilize the Kansas exemption, taxpayers must complete the KS-1520 form accurately. This form allows individuals or businesses to declare their eligibility for the exemption. It is essential to provide all required information, including the nature of the purchase and the reason for the exemption. Once completed, the form should be presented to the seller at the time of purchase to avoid sales tax charges. Keeping a copy of the form for personal records is advisable for future reference.

Steps to Complete the Kansas Exemption Form

Completing the KS-1520 form involves several key steps:

- Gather necessary information, including your name, address, and the nature of the exemption.

- Fill out the KS-1520 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form to validate your claim.

- Provide the completed form to the seller at the time of purchase.

Legal Use of the Kansas Exemption

The legal use of the Kansas exemption is governed by state tax laws. To be eligible, taxpayers must meet specific criteria outlined by the Kansas Department of Revenue. This includes understanding which purchases qualify for the exemption and ensuring that the KS-1520 form is used correctly. Misuse of the exemption can lead to penalties, so it is essential to adhere to the guidelines set forth by state authorities.

Eligibility Criteria for the Kansas Exemption

Eligibility for the Kansas exemption varies depending on the type of exemption being claimed. Generally, individuals and businesses must demonstrate that their purchases fall under specific categories, such as manufacturing or certain nonprofit activities. It is important to review the Kansas Department of Revenue's guidelines to ensure compliance with all eligibility requirements before submitting the KS-1520 form.

Required Documents for the Kansas Exemption

When claiming the Kansas exemption, certain documents may be required to support your application. These typically include:

- A completed KS-1520 form.

- Proof of eligibility, such as business registration documents or nonprofit status.

- Receipts or invoices for purchases made under the exemption.

Having these documents ready can streamline the process and help avoid any complications during the exemption claim.

Quick guide on how to complete ks exemption

Manage Ks Exemption effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools essential for creating, editing, and electronically signing your documents quickly and efficiently. Manage Ks Exemption on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Ks Exemption with ease

- Locate Ks Exemption and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Ks Exemption and ensure excellent communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ks exemption

Create this form in 5 minutes!

People also ask

-

What are Kansas exemption certificates and why are they important?

Kansas exemption certificates are documents that allow businesses to make tax-exempt purchases for specific goods and services. They are crucial for companies looking to save on sales tax expenses and ensure compliance with state regulations. Understanding how to properly utilize Kansas exemption certificates can enhance financial efficiency for businesses.

-

How can airSlate SignNow help with Kansas exemption certificates?

airSlate SignNow provides a streamlined process for managing and signing Kansas exemption certificates electronically. Our platform ensures that documents are signed quickly and securely, reducing the time spent on paperwork. Plus, the easy template creation feature allows for efficient management of multiple exemption certificates.

-

Are there any fees associated with using airSlate SignNow for Kansas exemption certificates?

airSlate SignNow offers competitive pricing tailored to different business needs, including options for managing Kansas exemption certificates. Our subscription plans include all the features necessary to create, send, and store exemption certificates at an affordable rate. Users can explore free trials to evaluate the platform before committing to a plan.

-

Can I integrate airSlate SignNow with other software for managing Kansas exemption certificates?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses commonly use. This functionality allows for efficient data sharing and management of Kansas exemption certificates alongside existing workflows. Popular integrations include CRM systems, accounting software, and other document management platforms.

-

How does electronic signing of Kansas exemption certificates work?

With airSlate SignNow, electronic signing of Kansas exemption certificates is facilitated through a secure online platform. Users can upload their documents, send them for signature, and track their status all in one place. This process not only enhances efficiency but also ensures that records are securely stored and easily accessible.

-

What benefits do businesses gain from using airSlate SignNow for Kansas exemption certificates?

Using airSlate SignNow for Kansas exemption certificates offers numerous benefits, including increased efficiency, reduced administrative burden, and greater cost savings. Businesses can easily manage their documents without the hassle of printing and mailing. Additionally, the improved compliance with tax regulations adds peace of mind to business owners.

-

Are there templates available for Kansas exemption certificates in airSlate SignNow?

Yes, airSlate SignNow provides customizable templates specifically for Kansas exemption certificates. This feature allows users to save time by reusing documents with common information pre-filled. Customizable templates help ensure that all necessary details are included and properly formatted.

Get more for Ks Exemption

- The medicaid pharmacy prior authorization form colorado

- Pharmacy prior authorization form connecticut medical

- Dhs 952 statement of operation policies department of form

- Fillable online mybillofrights government copy form short

- Medication prior authorization request meridian health plan form

- Nevada hipaa release form

- Application for financial assistance ohio form

- Ohio pharmacy services ohiomhas ohiogov form

Find out other Ks Exemption

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed