Filing a Petroleum Tax Refund ClaimMinnesota Department 2018

What is the Filing A Petroleum Tax Refund Claim Minnesota Department?

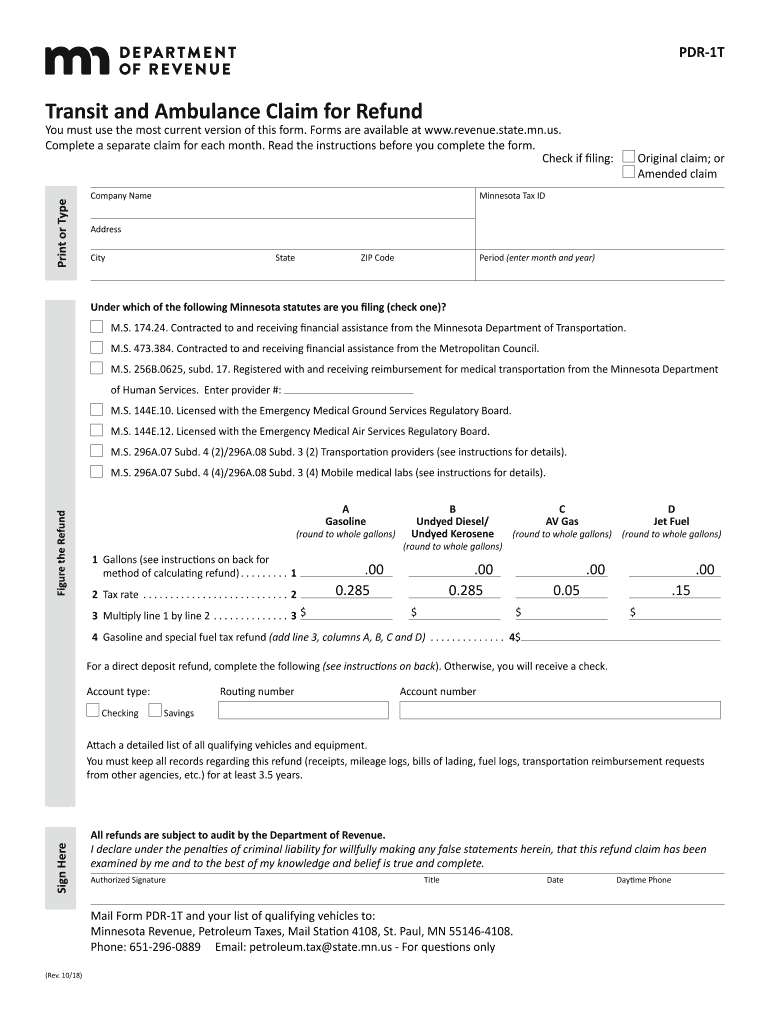

The Filing A Petroleum Tax Refund Claim is a specific form used by businesses and individuals in Minnesota to request a refund for taxes paid on petroleum products. This form is particularly relevant for those who have incurred taxes on fuel used for specific purposes, such as agricultural or commercial activities. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for receiving potential refunds.

Steps to Complete the Filing A Petroleum Tax Refund Claim Minnesota Department

Completing the Filing A Petroleum Tax Refund Claim involves several key steps to ensure accuracy and compliance:

- Gather all necessary documentation, including receipts and proof of tax payments.

- Fill out the form accurately, providing all required information such as your name, address, and details of the petroleum products purchased.

- Attach any supporting documents that validate your claim, such as invoices or purchase orders.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents

To successfully file the Petroleum Tax Refund Claim, certain documents are necessary. These include:

- Proof of purchase for petroleum products, such as receipts or invoices.

- Documentation showing the amount of tax paid on those products.

- Any additional forms or schedules required by the Minnesota Department of Revenue.

Eligibility Criteria

Eligibility for filing the Petroleum Tax Refund Claim typically includes specific conditions that must be met. Generally, applicants must demonstrate that the petroleum products were used for qualifying purposes, such as:

- Fuel used in agricultural production.

- Fuel consumed in certain exempt activities, like non-highway use.

It is essential to review the eligibility requirements set forth by the Minnesota Department of Revenue to ensure compliance.

Legal Use of the Filing A Petroleum Tax Refund Claim Minnesota Department

The legal use of the Filing A Petroleum Tax Refund Claim is governed by state tax laws. To ensure that your claim is valid, it is important to adhere to the following:

- Ensure that all information provided is accurate and truthful.

- Maintain copies of all submitted documents for your records.

- Be aware of the deadlines for filing claims to avoid penalties or disqualification.

Form Submission Methods

The Filing A Petroleum Tax Refund Claim can be submitted through various methods, allowing flexibility for applicants. These methods include:

- Online submission via the Minnesota Department of Revenue's website.

- Mailing the completed form to the appropriate department address.

- In-person submission at designated state offices.

Choosing the right submission method can help expedite the processing of your claim.

Quick guide on how to complete filing a petroleum tax refund claimminnesota department

Complete Filing A Petroleum Tax Refund ClaimMinnesota Department effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Filing A Petroleum Tax Refund ClaimMinnesota Department on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Filing A Petroleum Tax Refund ClaimMinnesota Department effortlessly

- Locate Filing A Petroleum Tax Refund ClaimMinnesota Department and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Filing A Petroleum Tax Refund ClaimMinnesota Department to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing a petroleum tax refund claimminnesota department

Create this form in 5 minutes!

People also ask

-

What is mn pdr and how does it relate to airSlate SignNow?

MN PDR stands for Minnesota Professional Development Requirements. AirSlate SignNow helps professionals meet these requirements by offering a user-friendly platform for sending and eSigning documents efficiently, ensuring compliance with necessary regulations.

-

How much does airSlate SignNow cost for mn pdr documentation?

AirSlate SignNow offers competitive pricing for professionals needing mn pdr documentation. Plans start at an affordable monthly rate, which includes essential features such as unlimited eSigning and document storage, designed to fit various organization sizes and budgets.

-

What features does airSlate SignNow offer for handling mn pdr requirements?

AirSlate SignNow provides features specifically designed to streamline the signing process for mn pdr documents. Users can access templates, use advanced signature authentication, and track document statuses in real-time, making it easier to manage compliance efficiently.

-

Can airSlate SignNow integrate with other tools for mn pdr?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and Microsoft applications. This functionality allows users to manage their mn pdr documentation alongside other essential business tools, enhancing productivity.

-

Is airSlate SignNow user-friendly for those unfamiliar with mn pdr?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate, even those unfamiliar with mn pdr. The intuitive interface ensures that users can quickly send and sign documents without any steep learning curve.

-

What are the benefits of using airSlate SignNow for mn pdr?

Using airSlate SignNow for mn pdr offers signNow benefits, including enhanced efficiency in document processing and reduced turnaround times for signatures. Additionally, the platform's compliance tracking helps ensure that all documentation meets necessary requirements.

-

How does airSlate SignNow ensure the security of mn pdr documents?

AirSlate SignNow prioritizes document security with advanced encryption measures and secure storage solutions. This not only protects your mn pdr documents but also ensures that all sensitive data remains confidential and compliant with industry standards.

Get more for Filing A Petroleum Tax Refund ClaimMinnesota Department

Find out other Filing A Petroleum Tax Refund ClaimMinnesota Department

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure