STEC CC Rev 1114 Tax Ohio Gov Sales and Use Tax Form

Understanding the STEC CC Rev 1114 Tax in Ohio

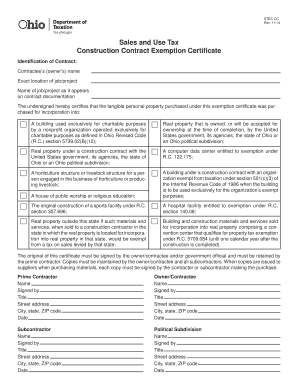

The STEC CC Rev 1114 form is essential for businesses in Ohio seeking a sales tax exemption for construction contracts. This form allows contractors to purchase materials without paying sales tax, provided the materials are used in the construction of real property. The exemption is particularly relevant for those involved in large construction projects, as it can lead to significant cost savings. Understanding the legal framework surrounding this exemption is crucial for compliance and effective financial planning.

Steps to Complete the STEC CC Rev 1114 Tax Form

Completing the STEC CC Rev 1114 form requires careful attention to detail. Here are the key steps:

- Obtain the form from the Ohio Department of Taxation website or through your tax advisor.

- Fill in the required information, including the contractor's name, address, and tax identification number.

- Specify the type of construction project and the materials being purchased.

- Ensure that all sections are completed accurately to avoid delays in processing.

- Sign and date the form before submission.

Legal Use of the STEC CC Rev 1114 Tax Form

The legal use of the STEC CC Rev 1114 form is governed by Ohio sales tax laws. To qualify for the exemption, the form must be used strictly for purchases related to construction contracts. Misuse of the form, such as using it for personal purchases or unrelated business expenses, can result in penalties and the requirement to pay back taxes. It is essential to maintain accurate records of all transactions made under this exemption to ensure compliance with state regulations.

Eligibility Criteria for the STEC CC Rev 1114 Tax Form

Eligibility for using the STEC CC Rev 1114 form is primarily determined by the nature of the construction project. Contractors must be engaged in a project that involves the construction of real property. Additionally, the materials purchased must be directly used in the construction process. Businesses must also be registered with the Ohio Department of Taxation and possess a valid tax identification number to qualify for the exemption.

Required Documents for the STEC CC Rev 1114 Tax Form

When completing the STEC CC Rev 1114 form, certain documents may be required to support your application. These include:

- A copy of the construction contract.

- Proof of registration with the Ohio Department of Taxation.

- Any additional documentation that verifies the nature of the construction project.

Having these documents on hand can expedite the process and ensure that your exemption request is processed smoothly.

Penalties for Non-Compliance with the STEC CC Rev 1114 Tax Form

Failure to comply with the regulations surrounding the STEC CC Rev 1114 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the Ohio Department of Taxation. It is crucial for businesses to understand their obligations and ensure that they use the form correctly to avoid these consequences. Regular training and updates on tax laws can help mitigate risks associated with non-compliance.

Quick guide on how to complete stec cc rev 1114 taxohiogov sales and use tax

Prepare STEC CC Rev 1114 Tax ohio gov Sales And Use Tax effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without complications. Manage STEC CC Rev 1114 Tax ohio gov Sales And Use Tax on any device through the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to modify and electronically sign STEC CC Rev 1114 Tax ohio gov Sales And Use Tax seamlessly

- Locate STEC CC Rev 1114 Tax ohio gov Sales And Use Tax and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize critical parts of the documents or obscure confidential information using the specific tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign STEC CC Rev 1114 Tax ohio gov Sales And Use Tax to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Ohio tax exempt form?

An Ohio tax exempt form is a document that allows certain buyers to purchase goods or services without paying sales tax. This form is crucial for non-profit organizations, governmental entities, and other tax-exempt groups operating in Ohio. By using this form, eligible organizations can save on costs associated with taxable purchases.

-

How can I fill out the Ohio tax exempt form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the Ohio tax exempt form digitally. Simply upload the form, fill in the required fields, and use eSignature capabilities for signing. This streamlined process saves time and ensures your form is accurately completed and legally binding.

-

Is airSlate SignNow compliant with Ohio tax regulations for eSigning?

Yes, airSlate SignNow complies with all necessary Ohio tax regulations, meaning you can confidently use our service for eSigning your Ohio tax exempt form. Our platform ensures that your electronically signed documents meet legal standards, providing you with peace of mind in your tax-exempt transactions.

-

What are the benefits of using airSlate SignNow for Ohio tax exempt forms?

Using airSlate SignNow for your Ohio tax exempt forms offers numerous benefits, including reduced paperwork and faster processing times. Our eSigning technology allows you to complete forms from anywhere, ensuring you stay efficient and organized. Plus, the platform helps to maintain compliance with Ohio tax laws effortlessly.

-

Are there any costs associated with using airSlate SignNow for Ohio tax exempt forms?

airSlate SignNow provides a cost-effective solution for managing your Ohio tax exempt forms. Pricing packages cater to businesses of all sizes, allowing you to choose a plan that fits your budget. Enjoy a comprehensive toolkit for document management without the hefty price tag.

-

Can airSlate SignNow integrate with accounting software for Ohio tax exempt forms?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to facilitate the management of your Ohio tax exempt forms. Integrations with platforms like QuickBooks or Xero ensure that your financial records remain up-to-date and can help simplify tax reporting processes. This connectivity enhances overall efficiency.

-

How secure is the airSlate SignNow platform for Ohio tax exempt form processing?

Security is a priority at airSlate SignNow, especially when processing documents like the Ohio tax exempt form. Our platform uses advanced encryption and security protocols to safeguard your data, ensuring that sensitive information remains protected during transmission and storage. You can rely on us for safe eSigning and document management.

Get more for STEC CC Rev 1114 Tax ohio gov Sales And Use Tax

- Information entered into the application while viewing it in a browser window cannot

- Checkout procedure example for laptops form

- This is a legal and binding agreement which when form

- Fillable outsourcing security assessment questionnaire form

- Veteran children and spouse tuition waiver form

- Pennsburysd form

- Medical reports are necessary for your case form

- Accommodation plan form

Find out other STEC CC Rev 1114 Tax ohio gov Sales And Use Tax

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form